Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

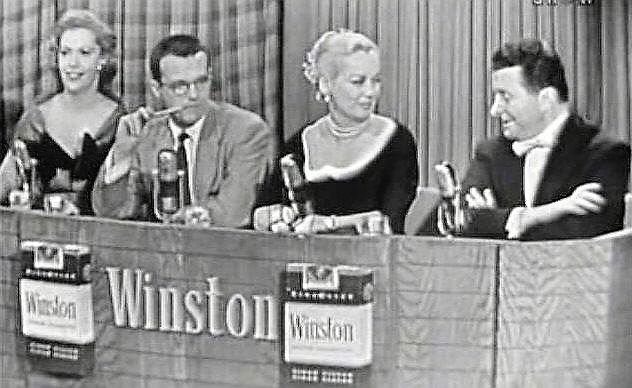

I’ve Got a Secret was a TV game show that aired from 1952 to 1967, where debonair white people would smoke cigarettes, sport bow ties and ermine stoles, and crack wise as they quizzed “contestants” about their secret pastime or accomplishment. My god, how I miss Kitty Carlisle.

Anyway, I thought a lot about I’ve Got a Secret when I saw the recent financial media brouhaha over Michael Burry and passive investing. But probably not for the reasons you think.

The Big Short’s Michael Burry Sees a Bubble in Passive Investing [Bloomberg]

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,”

The Big Short’s Michael Burry Explains Why Index Funds Are Like Subprime CDOs [Bloomberg]

“Central banks and Basel III have more or less removed price discovery from the credit markets, meaning risk does not have an accurate pricing mechanism in interest rates anymore. And now passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies — these do not require the security-level analysis that is required for true price discovery.”

Okay. Whatever. The whole index-funds-are-like-subprime-CDOs thing is silly, but that’s the headline writer setting this article up for clicks. Burry – like every small cap value investor since the dawn of time – is saying that the market doesn’t appreciate the information he’s uncovered about his small cap value stocks, and that there are structural reasons why the market doesn’t appreciate that information. Not exactly fighting words.

But judging from the reaction on Fintwit and elsewhere in the financial blogosphere, you would have thought that Michael Burry had run over someone’s dog.

It’s the reaction to the Michael-Burry-says-passive-investing-is-a-bubble stories that made me think of I’ve Got a Secret.

I mean, you had celebrated former-alpha-guy-turned-asset-gatherer Cliff Asness leap to Twitter to call Burry a “monkey who typed Hamlet” (but don’t worry, it’s okay to say this because it was done in a self-deprecating way), “histrionic”, and full of “inarticulate nonsense.” I lost count of all of the urgent “debunking” blog posts to the Michael-Burry-says-passive-investing-is-a-bubble story.

It’s just weird.

To be fair, it’s also weird how passive investing becomes the scaffolding for any number of Grumpy Grandpa strawman positions, most notably the “this will blow up ANY DAY NOW” argument, the “those darn computers!” argument, and the “in praise of index-hugging active managers and their … [checks notes] … price discovery” argument. I claim zero association with those positions in what I’m about to say, so don’t @ me.

There IS a bubble here. It’s a behavioral bubble I’ll call ABB.

Always. Be. Buying.

And the Common Knowledge surrounding passive investing – what everyone knows that everyone knows about passive investing – is what blows this bubble.

Everyone knows that everyone knows that passive investing beats active investing.

Everyone knows that everyone knows that stocks as an asset class ALWAYS go up over time.

And if that’s the case, then why in the world would you pay more for someone to use their discretion in picking this stock or that stock? No, no … just harvest the inevitable returns that stocks in a general sense ALWAYS provide by putting your money in an inexpensive, systematic buying program. If you think yourself particularly clever, then by all means express this systematic buying program in terms of “factors” or “betas” instead of this index or that index, but the important thing is to ABB.

Always. Be. Buying.

Index funds and any other passive investment vehicles are really important, excellent things for investors. I get that. I am not railing against their existence.

But you cannot separate the Always. Be. Buying. impulse from index vehicles and pretend that they are just the intellectually simple, straightforward expression of market exposure that they are in theory. They are loaded with “be long” MEANING for everyone.

THAT’S THE BUBBLE.

Now I know this will come to a shock for many, but there was a time when this was not the accepted faith of markets.

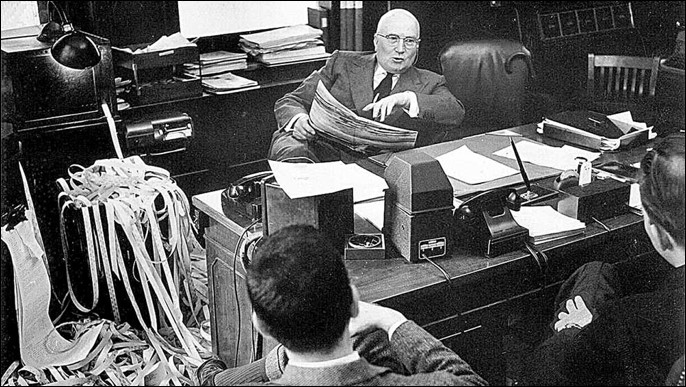

This is a picture of Gerald Loeb, who co-founded E.F. Hutton and was Warren Buffett-level famous back in the 1950s and 1960s … back when I’ve Got a Secret was in its heyday. And this was The Secret about markets that Gerald Loeb thought he knew:

Buy and hold is for chumps.

In the 1950s and 1960s, everyone knew that everyone knew that Gerald Loeb was right. This was the investment Common Knowledge of the day. This was the gospel and the MEANING of the business of Wall Street.

No one remembers Gerald Loeb today.

Which is a shame. But not surprising.

Did Gerald Loeb know The Secret to markets? Of course not. But did Gerald Loeb know A Secret to markets? Yes, he did. And did his secret WORK for the markets of his day? Absolutely. Would his secret work TODAY in a different Common Knowledge environment? Not a chance.

Do YOU know The Secret to markets, that stocks as an asset class ALWAYS go up over time?

Or do you know A Secret to markets, one that works because it is the Common Knowledge of the day?

I think it’s the latter. Which means it will work until it doesn’t. Which means it will work until the Common Knowledge changes.

That’s my Secret about markets. It’s far from Common Knowledge. But pass it along and let’s see what happens.

PS – We’ve written a lot about passive investing and indexing. And by we, I mostly mean Rusty, who has some great notes on the subject. Like these:

Is Burry tilting at windmills? A Cassandra?

Is it possible Burry is a big enough of a Missionary to change the narrative (After all he was played Christian Bale in a movie)?

In a markets as a political utility world, isn’t ABB the “right” strategy; Limited downside/unlimited upside?

One more piece of evidence in support of ABB is the distaste asset allocators have for cash holdings in recommended portfolios.

So not only is cash not to be held on it’s own, but since the movement from active to passive has occurred, there is even less cash holdings in portfolios ( active managers carry cash that passive do not) . And even that has changed from the 10% cash active managers carried 20-30 years ago to the 2-5% now.

I currently see that sitting on a Finance Comm of a non-profit endowment .

IMHO, this ABB Common Knowledge will only change until there is a long, sustained period where passive underperforms active.

And that only happens in a sustained bear market

Or a sustained volatile sideways market

That lasts for years.

It will take a 1929 or Japan-1989 thing to remind a generation that ABB can become a formula for, oh I don’t know, loss of money for a long time.

The wealth management industry has to sell something and that something is certainty (with small print disclaimers - to that certainty - everyone is numb to owing to their repetition - as in, “side effects may cause dry mouth…”). Oddly, for retail clients, in particular, certainty is more important than alpha - heck, a good FA can wave their hands to easily get past the alpha part of the client conversation.

But certainty - “you can take 4% out every year based on this model [‘Yay, models!’] and you won’t run out of money” [said with calming conviction] or “yes, the stock market goes up and down, but [to the sound of angels singing] stocks always go up over the long run -” is what the FA is really selling and the p̵a̵t̵e̵n̵t̵-̵m̵e̵d̵i̵c̵e̵ ̵b̵u̵y̵e̵r̵ client is buying.

An early ET note (“How Gold Lost its Luster…”) used (paraphrasing) “home prices never decline nationally” and “sovereigns never default” as examples of common knowledge that were so strong they were never questioned or even thought about - they just were / like the sun rising in the east. ABB feels about the same to me and, my guess, will have the same outcome as, as Ben puts it perfectly succinctly: “it will work until it doesn’t.”

The market is staying irrational longer than I can afford the opportunity costs. In the long run we will be right, albeit dead.

Mark-As an FA it’s been tough these past few years when you look at allocating among what I call: Risk (anything long that goes up and down in price), Non-Risk (cash, Cds, T-bills, etc), and Anti-Risk (go up when risk/stocks go down…shorts, carry trade currencies, etc) assets. Client memories are short, forgetting their being down 15% in a down 40% market. It’s been like putting my hand in a paper shredder to be risk centric in a perceived NO risk market these past few years. Either I’ll get some vindication…or will remain awaiting “The Bib-Pumpkin” until I retire…toes up.

Peter, I don’t do a good enough job in my comments of noting that there are a lot of good FAs out there who want to do the right thing by their clients - period, full stop.

I tend to focus on the negative behaviors/bad FAs - my bad, I should try to be more balanced as there are many good FAs, like, I’m sure, you are.

The challenges are, at least two fold. One, many FAs are in it for themselves or only kinda, sorta in it for the client - so the industry and the clients have that to deal with.

But as you note, the good FAs - the ones trying to do the right thing - have to deal with clients that judge them not on the long-term risk-balanced and diversified value the good FA bring to portfolio construction aligned to each client’s particular goals, personality and situation, but on some ex-post-facto standard of “I could have made more if…”

I’ve sat in too many of those meetings for one lifetime.

Ben I’m curious about the Recession! narrative, which I think has become Common Knowledge at this point. At least all the people in my circles are all talking about it anyway. Every decent FA, “smart” investor, real estate guys, gold bugs, and family office people I know are trying to raise cash allocations and talking about the business cycle right now. None of them however mentioned raising cash to preserve wealth. Every single one is hoping to buy assets on the cheap. To me that sounds like a lot of bulls trying to buy back in at a lower price.

I’m not at all disagreeing with the theory that the end to the longest bull run ever is surely coming. Quite the contrary actually. What I’m interested in is not a potential looming recession. I’m interested in learning more about the narrative surrounding the Recession! I cut my teeth in the last one, and by that I mean I got my teeth kicked in by the last one. Well, I guess a lot of people did.

The point is that nobody saw those 1,000+ point down days coming. Everyone was buying, right up until the music stopped. When the music stopped those 1,000+ down days came several days a week, for what seemed like weeks on end. It was a big one. My point is that nobody was building cash allocations in advance of that. Not the decent FAs, the “smart investors”, the real estate guys, gold bugs, or family office people. Everyone saw something far off in the distance but nobody in my circles were trying to raise serious cash allocations that I can recall. I’m curious what you think of this narrative.