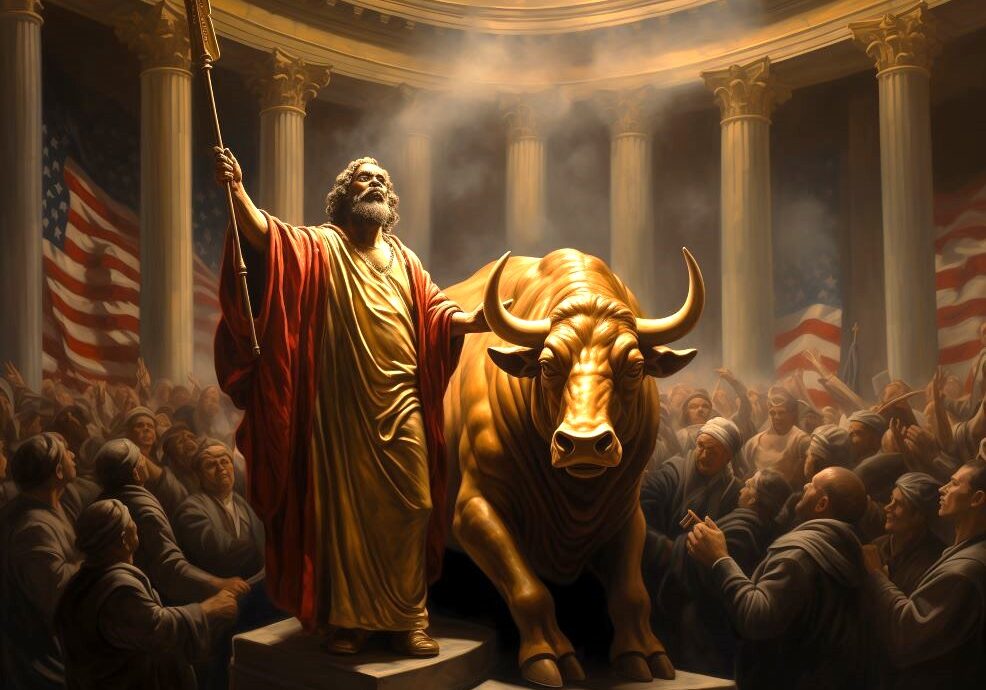

You have been told that investing in the stock market is like betting on a sports game.

You have been told that you are a SPECTATOR in the game of markets, that you are WATCHING a game being played out in front of you by lots of different companies.

You have been told that you should make 'bets' on those companies based on how well you think those companies can play the game that you are watching. The companies will play the game and they will keep score by 'beating' or 'missing' on revenues and earnings and the like, and then that score will determine whether or not your bets pay off.

You have been told that the better you are at 'analyzing' the teams playing this game, the more 'due diligence' you put into studying the teams playing this game, the more money you will make with your bets.

You have been told that everyone can win with their bets, that this is how you, too, can achieve the wealth that you deserve.

You have been told that the odds are ever in your favor.

Bingo. Thank you.

Yet another reminder— follow the money. You may think you are the customer but you are not. You ARE the product. And you (your eyeballs, tweets, posts, stock orders, search history, viewing history, emails, etc) are being sold to the highest bidder.

SOYLENT GREEN IS PEOPLE! https://www.youtube.com/watch?v=8Sp-VFBbjpE

Well done

Did Dr. Ben just publish his long-awaited book???

Wishful thinking: Eliminate Citizens United, bar anyone from being able to accept a speaking fee or related activity from holding public office, charge a dime a share and stiffen the Fair Doctrine laws while including social media. Not very small d but I think we’re are too far down the tube to extract ourselves without a painful clasp of our behind.

I feel as if I’ve said this a few times over the last six months, but it continues to be true: Ben, this may be your greatest note yet.

Thank you! This one was from the heart, and it gave me a chance to weave together so many threads from the past 8 years!

BINGO !!

terrific piece.

One quibble (as a Pats fan !!), the anlogy doesn’t quite work, because GME went BACK to $400 the following day after RH shut down. (The media won’t talk about this - just watch, i.e., small investors had a chance to sell the next day - but didn’t.)

So it would be like the Jets not being able to play offense for the 3rd Q, but then getting the ball back in the 4th, and going ahead again, only to lose in the end.

and as we can see with GME<70 as I write this - the House always wins.

Let’s call it the Pick 6 exception!