If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

The Summer Reading List (by Jeremy Radcliffe)

In which Jeremy Radcliffe recommends Bob Lefsetz, Scott Galloway, Scott Belsky,Tim Urban and the gang at Hoisington.

Tell My Horse

So yeah, I’m overweight and I need to get more sleep. I’m not happy about the market, and I’m anxious about living up to my obligations to my partners and clients. But I wake up every morning thinking independent thoughts about idiosyncratic risks. I’ve got a Tribe. I’m nobody’s horse. And that’s about as good as it gets here in the Hollow Market.

Chili P is My Signature: Things that Don’t Matter #5

The second moral license from a wise emphasis on passive investing is spending inordinate amounts of time on tilts, trades and tactical ideas that will never influence our portfolio results.

Quantum Supremacy, Correlating Unemployment, and Buddhists with Attitude (by Silly Rabbit)

What web searches correlate to unemployment, verbal and nonverbal behaviors, and methodologies with a fragility problem.

Complex Systems, Multiscale Information and Strange Loops (by Silly Rabbit)

Complex systems, machine learning software creating machine learning software, one-shot imitation and the power of the platform.

She Screams, He Kidnaps (by Silly Rabbit)

Proximity of verbs to gender, wiki-memory, fool me once (and twice), and a veritable zoo of machine learning techniques.

And They Did Live by Watchfires: Things that Don’t Matter #4

For the bored (read: profitable) investor, the bias to action is a constant threat. As we become more passive in our strategies, the moral license to ‘do something’ is exaggerated, and must be curtailed.

Mo’ Compute Mo’ Problems (by Silly Rabbit)

On hard problems, lazy XKCD references, the myth of superhuman AI, and valley grammar.

Westworld

If political parties in Western democracies were stocks, we’d be talking today about the structural bear market that has gripped that sector. Show me any country that’s had an election in the past 24 months, and I’ll show you at least one formerly big-time status quo political party that has been crushed.

1999 v2.0

On episode 21 of the Epsilon Theory podcast, Dr. Ben Hunt is joined by Brad McMillan, CFA, CAIA, the chief investment officer at Commonwealth Financial Network®. Brad graciously hosts us at Commonwealth’s headquarters in Waltham, Massachusetts. Ben and Brad talk about their mutual love for Terry Pratchett, Narrative causality, the French elections, and how technology is changing the financial advisory business.

Future Flash Crashes, Digital Darwinism & the Resurgence of Hardware (by Silly Rabbit)

My view is that we are heading into a far more ‘interesting’ era of flash crashes of confused, or deliberately misled, algorithms.

Alibaba’s AI, JP Morgan’s Risky Language & the Nurture of Reality (by Silly Rabbit)

Starcraft mastery from AI, risky language, and the map of physics. Also Zen vs. Tantra, because why not?

Break the Wheel: Things that Don’t Matter #3

Almost as much as we love stock discussions, we love talking about our favorite fund managers. These discussions are unfortunately almost always a complete waste of time.

AI Hedge Funds, Corporate Inequality & Microdosing LSD (by Silly Rabbit)

On DARPA explainer videos, Burning Man invocations, and the impact of bad weather and high taxes on AI talent pools.

Change is in the Air

By the time we got to episode 20 of the Epsilon Theory podcast, change was bound to happen. Coming to you from our New York office, Dr. Ben Hunt and producer Michael Corrao talk about changes to the Epsilon Theory website, Ben’s role, and the entire political system.

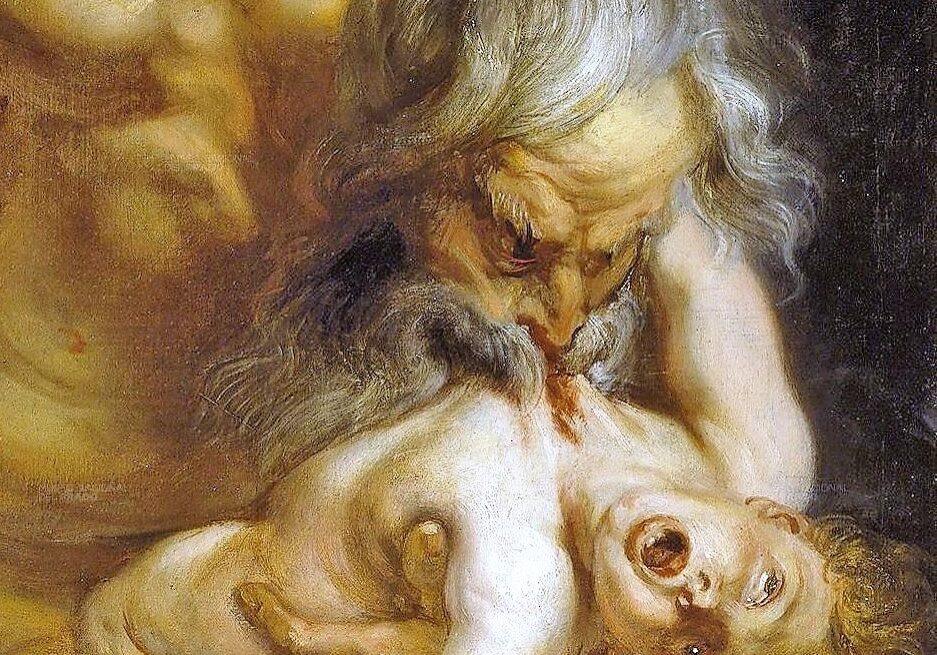

The Horse in Motion

Many of the gaps in our knowledge are the result of our insistence on accepting our priors and using technology to answer questions we see as new. But what if we could develop techniques to challenge those priors with new questions?

What a Good-Looking Question: Things that Don’t Matter #2

We meet with our fund managers and financial advisers with a goal in mind. But we always end up talking stocks. If you insist on buying the tank, they’ll sell you a tank, folks.

Information, Please.

On episode 19 of the Epsilon Theory podcast, Dr. Ben Hunt is joined by Rusty Guinn, Salient’s executive vice president of asset management. Picking up from their last conversation on fake news, Ben and Rusty consider the kinds of information that we have at our disposal and if we are asking the right questions in our analysis — or just searching for the answers we want.

Salient and Other Just-So Origin Stories (by Jeremy Radcliffe)

An introduction to Jeremy Radcliffe, the Rabbit Hole and why it seems like the best asset management executives would be far happier as general managers of sports teams.

The Rabbit Hole: The War on Bad Science (by Jeremy Radcliffe)

If questioning everything you ever thought you knew about science sends you into a downward spiral of crippling anxiety, this may not be the Rabbit Hole for you.