If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

Rock, Paper, Scissors

We’ve been doing it wrong with AI for too long. Time to do it right.

We can’t SOLVE for the future of complex social systems like markets or politics with algorithms. But we can CALCULATE the future of these systems with AI.

Lord Make Me Chaste … But Not Yet

The problem for markets today is not the Fed.

The problem for markets today is the guy in the White House and his game of Chicken with the world.

In the News | Week of 12.24.2018

With limited markets-related events next week, we instead highlight some of the most representative (and unique) reviews of 2018.

The Prediction Polka

We would usually tell you that all information is information. There is no good or bad. No right or wrong. But some things aren’t even information. Knowing what you can ignore is worthwhile.

Twilight of the (Consumer) Goods?

With increasing attention to trade and tariff narratives and falling attention to inflation and growth narratives in the U.S., we believe that investors may benefit from focus on sectors on which the latter narratives have weighed heavily in 2018. Of particular interest? Brand-oriented consumer stocks, especially many staples that have been left for dead.

The Road to Tannu Tuva, Pt. 1

When our processes of inquiry lack challenge, doubt and obsession with falsifying our best ideas, the result is inevitable. Our conclusions cease to be science and become something else entirely. That something else is a thing sensitive to Narrative, vulnerable to priors and bias. That something else is scientism.

We Had The Same Crazy Idea

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.

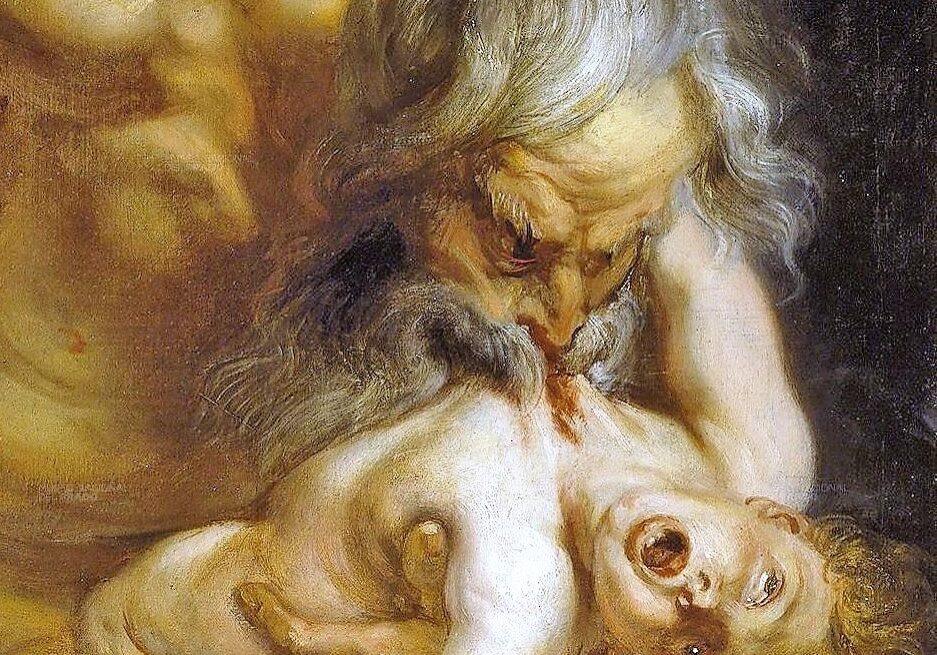

Sin Boldly

There is very little that an investor can do to more easily become a better investor than to better understand his behavior. But the investor who relies on awareness, discipline and self-control remains susceptible to a world that seeks to influence his standard for correct behavior.

Notes from the Diamond #5: Wannabes Beware

Imitation is not only the sincerest form of flattery, it’s also the engine behind so much of what we do in both professional baseball and professional investing. The trick, of course, is not to get beaned in the process!

In the News | Week of 12.17.2018

Key articles for companies reporting the week of December 17, 2018, as well as the upcoming meeting of the FOMC.

Common Knowledge or Fortune?

Common knowledge effects, credentialing and missionaries are everywhere. You may differ in your view of their importance, but if your framework doesn’t acknowledge their role in price-setting, you’re not seeing the full picture.

In the Trenches: Bridge Out?

ET contributor Pete Cecchini, better known as Cantor Fitzgerald’s Chief Market Strategist, is back with the December installment of his series, In the Trenches. For ET readers who want a less philosophical but no less smart take on markets, Pete’s your guy.

Basically a Snake Don’t Have Parts

No matter how much you try to make mama tell you what part of the snake you’re eating, and no matter how much the answer might comfort you, it’s important to know that neither you nor she is telling the truth.

Topical Trends from Corporate Earnings Calls (12/2018)

As we’ve written a fair bit recently, the source of Narrative can often be as important as the stories being told themselves. By narrowing the…

Office Hours – 12.11.2018

Our December 11 edition of Office Hours has concluded, but subscribers can still catch the replay here.

Introduction to ET Professional

We are pleased to announce the launch of Epsilon Theory Professional, or ET Pro. It is a service designed to leverage our narrative research more directly for investors and asset owners. Learn more about the types of content and research we’re doing here.

You Don’t Have to Dance Every Dance

Discretionary investment always and in all ways boils down to two things: edge and odds. In the US-China trade war game of Chicken, you have no edge. And you don’t know the odds. Time to sit this dance out.

ET Live @ 2PM ET 12.11.2018

We will be live at 2PM on Tuesday, December 11, 2018. Click here to get more information about ET Live, how to subscribe and how to get your questions in for the day.

The ET Interviews: Banking the Unbankable

It’s possible to do good AND to do well. ET’s Neville Crawley interviews Lev Plaves, Senior Investment Manager at Kiva, on banking the unbankable – refugees and internally displaced populations.

In the News | Week of 12.10.2018

Key articles for companies reporting the week of December 10, 2018