If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

In Praise of Work

The problem isn’t that we derive too much of our worth and value from work. The problem is that our jobs are becoming increasingly abstracted from work. Friends: Your work is holy.

The Zeitgeist | 2.28.2019

Lots of Blockchain, UK house prices subdued, trade talks weigh, idol worship perilous, a rich kid buys gold and why Nintendo goes back to Pokemon.

They’re Not Even Pretending Anymore

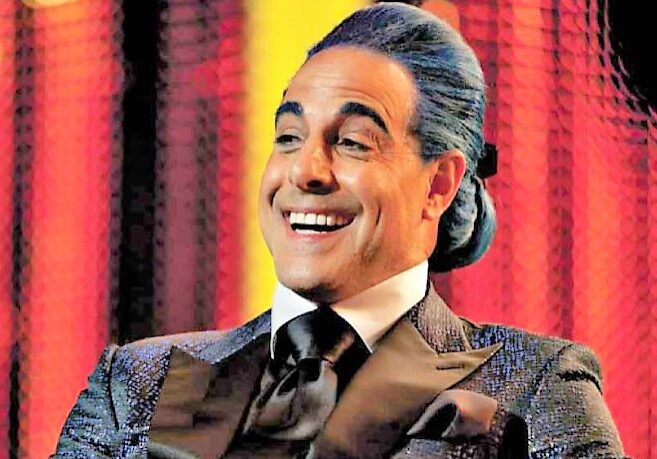

Now that Jay Powell’s semi-annual Congressional testimony has finished up, it’s time for a brief walk down Memory Lane.

As with everything else in our Washington clown show, nothing really changes. This has all happened before.

The Zeitgeist | 2.27.2019

A World Full of Elons, the unrevolutionary foldable era, the fastest strike in history and more arbitrary causal links in financial media.

The Zeitgeist | 2.26.2019

Markets ‘seek clarity’ on China/US trade, fire engine manufacturers, drug price hearings, and lowball hostile bids.

The Seed Delusion

The hobbyist farmer can afford to spread wildflower seeds to the wind and the elements. The professional farmer, on the other hand, doesn’t have this luxury. Neither do any of us as investors.

In the News | Week of 2.25.2019

Home improvement, midstream energy, travel and leisure, and the heart attack that wasn’t caused by energy drinks.

The Zeitgeist | 2.25.2019

A tariff three-fer, subsidizing orphans like it’s a bad thing, Buffett buffetted, and MMT/GND propaganda shifts into a new gear.

Pricing Power (pt. 3) – Government Collaboration

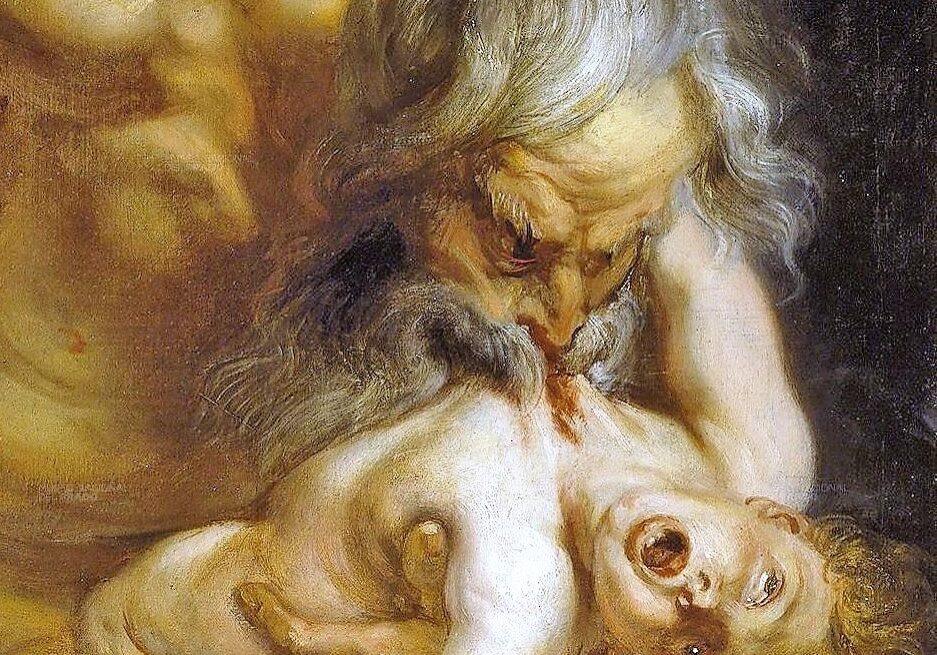

What killing active investment management? It’s not some monster hiding behind the rabbit. No, it IS the little white bunny. It’s the Zeitgeist of capital markets transformed into a political utility, innocuous on the surface … but with killer teeth.

How do you defeat the Zeitgeist? You don’t. The smart move, in fact, is to help the killer rabbit.

But there IS another way.

The Zeitgeist | 2.22.2019

Highs on trade hopes, mixed on trade talks, creepy refrigerators, CRM for Main Street and Insurance Love Stories.

Gravity Sucks

Usually we draw attention to narratives not because we like them, but because we believe investors can’t afford to ignore them. But the intense gravity of a directionless Narrative is a different matter altogether.

The Zeitgeist | 2.21.2019

In which we focus on struggles and changes at asset managers, Soc Gen misses the boat, and markets ‘move’, ‘inch’ and ‘advance’ on trade optimism.

The Zeitgeist | 2.20.2019

Pesky stock analysts, an earnings season focus on power and energy, and a late run on descriptive terms for the China Trade negotiations.

In the News | Week of 2.19.2019

We’ve moved on to a motley crew on the back end of earnings season, with a couple noteworthy larger names: Walmart and Berkshire Hathaway.

ET Live – 2.19.19

We’re back with a third edition of ET Live! On the docket for this session: MMT and the Zeitgeist that brought it to the forefront of our political and economic discussions.

The Zeitgeist | 2.19.2019

In which we learn about new voices in the hospital, we pile on the Fed, and we exult in stocks “edging up” on trade talk progress (I’ve forgotten what take we’re on).

C.A.F.

The hardest job for any financial adviser is knowing when a fiduciary mindset should guide us to take a stand, and when it should guide us to adopting flexibility. If we claim to have a process, we have to have an answer for this.

The Alchemy of Narrative

Every investor who wants to understand narrative and its impact on markets should read “The Alchemy of Finance”, by George Soros.

ET contributor Demonetized rediscovers the joys of Soros. It’s all reflexivity, all the time.

The Zeitgeist | 2.15.2019

Lots of ‘playing’, ditching New York, and a piece of hard-hitting analysis demonstrating that sitting at the crossroads of government and business can be personally profitable.

Duck and Cover

We don’t have to treat it like a cardinal sin any time an author, politician, consultant, adviser or expert tries to make us feel a certain way. Just don’t be the only one at the table who doesn’t realize what’s happening.