If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

Gell-Mann Gravity

It’s the Monday Zeitgeist, including all known lanthanides and actinides.

Notes from the Diamond #8: Room For Doubt

In both baseball and in investing, we need an all-purpose test of excellence, not just for identifying MVPs like Mike Trout, but for seeing how all of us mere mortals stack up.

ET contributor David Salem makes the case for an investing corollary to baseball’s Wins Above Replacement (WAR). It’s a defense of value investing, but with a twist.

LEEROY JENKINS!!!

There are four non-exclusive Occam’s-razorish explanations for Bill Dudley’s recent article inciting the Fed to get involved in the 2020 election:

A) Bill Dudley is a technocratic fascist.

B) Bill Dudley has lost his mind. In a sad clinical sense.

C) Bill Dudley is a MAGA sleeper agent.

D) Bill Dudley is Leeroy Jenkins.

When Non-News Becomes Fiat News

IT’S A DISASTER. IT’S A CATASTROPHE. IT’S A PERFECT STORM. It’s today’s Zeitgeist.

Office Hours – 8.27.2019

It’s the August 27th edition of Office Hours! In which political, economic and markets nihilism are the order of the day.

You Can’t Take It Back

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central)…

My Dinner with Neel

I haven’t been very nice to Neel Kashkari.

But he was nice enough to engage in a twitter exchange with me the other day. Well, sort of.

Here’s a record of that exchange. I’ll leave it to you to decide who’s the prisoner and who’s the guard.

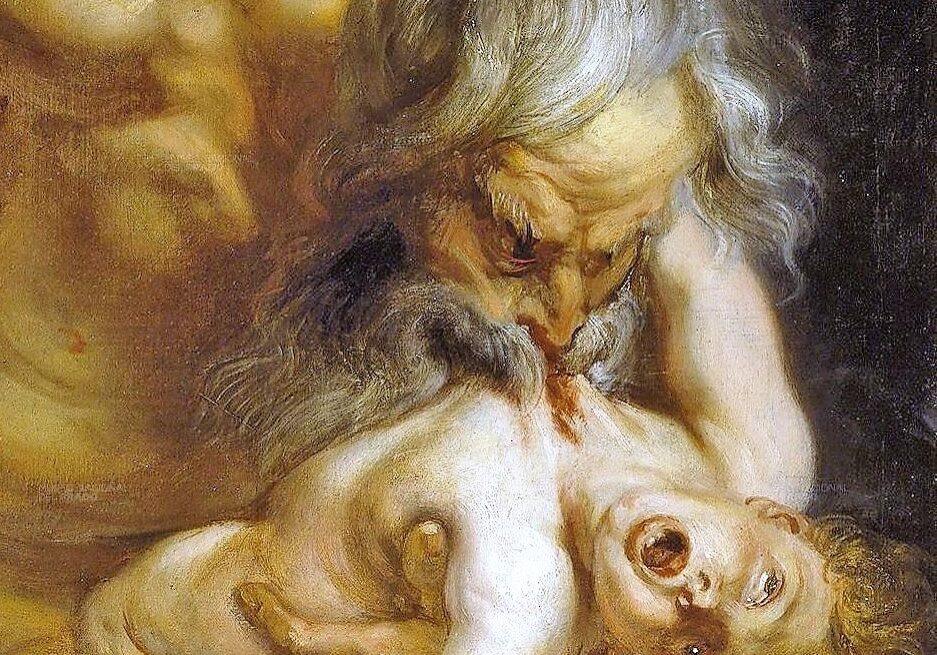

Nuke ‘Em From Orbit. It’s the Only Way To Be Sure.

Nuke the site from orbit. It’s the only way to be sure.

It’s the best line from a movie full of them.

I couldn’t help but think about nuking inhuman monsters from orbit, when I read the PR releases from Prince Andrew and Les Wexner about their “relationship” with Jeffrey Epstein.

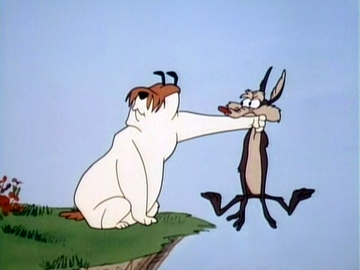

License to Kill Gophers

The desire of central banks to forestall recession at all costs reminds us of the war that groundskeeper Carl Spackler had with the gopher in Caddyshack.

Sure, you can defeat the gopher. But you’ve gotta blow up the golf course with dynamite to do it.

Food Innovation Meets Financial Innovation

Markets are boring. Hey, what if we securitized wokeness?

The World ‘Twixt Ought To and Is

Honest investing means finding a balance between approaches which imply we know everything and those which imply we can’t know anything. It means humility.

We think there are three – and only three – paths to finding this balance. One is the heart of what we are trying to achieve with Epsilon Theory.

Frauds and Traitors

Throwing words like “Fraud!” and “Traitor!” around so casually … it doesn’t reveal the true frauds and the true traitors.

It makes it easier for them to hide.

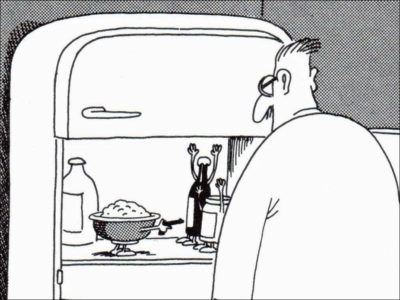

When Potato Salad Goes Bad

On Tuesday, the Macy’s narrative was “I think they can make their comps.”

On Wednesday, the Macy’s narrative was “I think they can cover their dividend.”

This is what it means for a narrative to go bad. This is what it means for a story to break.

And when a story breaks, so does the stock. Not just for a little while, but for a loooong time.

Just ask GE.

ET Election Index: July 31, 2019

This is the fourth installment of Epsilon Theory’s Election Index. Our aim with the feature is to lay as bare as possible the popular narratives…

Does It Make a Sound?

Wherever self-determination and resistance to the encroaching power of the state and oligarchical institutions find expression, there should our Full Hearts be also.

And our full voices.

I’m a Superstitious Man

“I’m a superstitious man, and if some unlucky accident should befall him — if he should get shot in the head by a police officer, or if he should hang himself in his jail cell, or if he’s struck by a bolt of lightning — then I’m going to blame some of the people in this room.” – Vito Corleone

Same.

The Nudging State and the Nudging Oligarchy cannot be defeated on a single point of failure like Jeffrey Epstein’s testimony at trial. Or like the bankruptcy of AIG.

But a million effin’ points of failure? A refusal to vote for ridiculous candidates and buy ridiculous securities? A refusal AT SCALE?

Yeah, that can work.

The Country HOA and other Control Stories

There are some stories that we will want to believe no matter how much contrary evidence we find, and no matter how much we know that the story is bogus. And when these stories convey a sense of control? All bets are off.

A Cartoon in Three Parts

Cartoons are not evil. And yet they are the engine behind the Long Now, and very much at the center of our financial Zeitgeist. What is a clear eyed, full-hearted investor and citizen to do?

The Last Chance

You want scarcity? Access to the upper echelons of high society? Well, say no more. It’s your very last chance to buy this most special, most fantastical, most legendary, most unattainable of whiskies.

What You Call Love

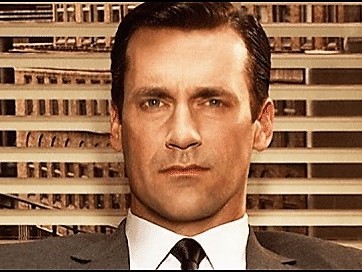

“What you call love was invented by guys like me. To sell Nylons.”

Every missionary has his own version of the Don Draper quote.

Politician: What you call values were invented by guys like me. To win power.

Fancy Asset Manager: What you call ESG was invented by guys like me. To gather assets.

The Sell-Side: What you call a rotation trade was invented by guys like me. To earn commissions.