If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Things Fall Apart

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Hunger Games

Recent Notes

Wall Street’s Not-So-Golden Rule

We are in the early stages of a bank run on the United States and the US dollar, and everyone on Wall Street is heading for the exits, including domestic investors who will exit not because they want to but because they know the Not-So-Golden Rule.

We’ve Tried Nothing and We’re All Out of Ideas

When you’re defending the indefensible, you have to create a symbol powerful enough to keep the masses in line.

“I voted for this” is one of the few capable of sustaining support for policy this extreme.

The Intentional Investor #27: Daryl Fairweather

Join Matt Zeigler on The Intentional Investor podcast as he interviews Daryl Fairweather, Chief Economist at Redfin and author of the new book “Hate the Game: Economic Cheat Codes for Life, Love, and Work.” In this engaging conversation, Daryl shares her journey from MIT to the University of Chicago, her experiences navigating corporate America, and how she applies economic principles to everyday life decisions. With her unique background spanning academia, tech, and real estate, Daryl offers fascinating insights on using economic frameworks to understand human behavior and make better decisions.

Scoreboard

We live in a world awash with narrative.

It’s worth celebrating those rare moments where a man gets to thumb his nose at those narratives, point to the sky, and say “Scoreboard.”

I Broke the Dam

Some want us to believe that the narratives that shape belief are universally promoted from the top down.

That hasn’t been true for a long time.

Crashing the Car of Pax Americana

I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants as a replacement is not a stable system that is possible as a replacement.

Narrative Shopping

The Trump administration has flipped between a half dozen distinct narratives telling us what these tariffs are really about.

Why? Because they needed to wrap the truth in a better story. Time to go Narrative Shopping.

The Intentional Investor #26: Danika Waddell

Join host Matt Zeigler as he interviews Danika Waddell, founder of Xena Financial Planning, in this engaging conversation about career pivots, financial independence, and creating a more inclusive financial services industry. Danika shares her journey from accounting to launching her own financial planning firm during the pandemic, and how her personal experiences shaped her mission to help women in tech achieve financial independence.

The Intentional Investor #25: Cullen Roche

In this episode of The Intentional Investor, host Matt Zeigler sits down with Cullen Roche, an economist, writer, and financial maverick who has carved out a unique space in the world of finance through his independent thinking and unconventional approach. From his large Irish Catholic family to his journey through finance, Cullen shares an intimate look at how curiosity, non-conformity, and a commitment to understanding complex systems have shaped his professional and personal life.

The Goldstein Machine

A threat built on a shred of truth, an existential fear, and our utter inability to stop it is the perfect tool for psychological control at scale.

It is a Goldstein Machine.

The Intentional Investor #24: Ben Hunt

In this profound follow-up conversation, Matt Zeigler welcomes back Ben Hunt to explore the evolution of Hunt’s writing and worldview. Beginning with reflections on their childhood relationships with religion and storytelling, the discussion moves into Hunt’s journey with Epsilon Theory – from its market-focused origins to his current philosophical crossroads.

The Intentional Investor #23: Kevin Muir

Kevin Muir, author of the Macro Tourist newsletter and a seasoned trader, joins The Intentional Investor for a fascinating conversation that weaves together trading, life lessons, and Canadian culture. From his early days mastering Monopoly statistics to pioneering computer-driven trading strategies at RBC in the 1990s, Kevin shares candid stories about finding his path in finance.

Kevin discusses growing up as the older brother of a professional hockey player, his journey from discount brokerage manager to institutional trading desk, and how becoming a father changed his perspective on risk and career. He offers unique insights into market psychology, friendship, and the importance of finding work you genuinely love.

It Was Never Going To Be Me

The Road to Serfdom is not an endless road, but its path and duration, what I call the Great Ravine, is not up to us to choose. While we walk this road the only thing we can save is our souls, and we do it with one simple sentence: It was never going to be me.

The Intentional Investor #22: Eric Markowitz

In this engaging episode of The Intentional Investor, host Matt Ziegler interviews Eric Markowitz, exploring his fascinating journey from investigative journalism to investment research. The conversation weaves through Eric’s formative years, professional evolution, and life-changing experiences, offering valuable insights into the intersection of media, investing, and personal growth.

DeepFreak

In seven days, a narrative about AI tech technology became a narrative about what it meant for chip manufacturers, which because a narrative about national security.

The Intentional Investor #21: Corey Hoffstein

Join Matt Zeigler as he sits down with Corey Hoffstein, a successful entrepreneur and financial innovator, for a candid conversation about his remarkable journey from video game programmer to financial pioneer. In this wide-ranging discussion, Corey shares the story of his career trajectory – from teaching himself programming at age 12 to founding Newfound Research and developing groundbreaking investment strategies.

A Death in the Family

Today I know that the meaning of the American Presidency is dead, and like the loss of a beloved family matriarch it’s a loss I’ll never get over. I know that I have to accept it, but I’ll never get over it. And right now I’m still pretty angry at ALL of them.

The Intentional Investor #20: Dr. Preston Cherry

Join host Matt Zeigler as he sits down with Dr. Preston Cherry, founder and CEO of Concurrent Wealth Management and author of “Wealth in the Key of Life.” From his father’s treasured vinyl collection to transformative “fog years,” Dr. Cherry shares his journey of discovering the deep connections between music, money, and meaning.

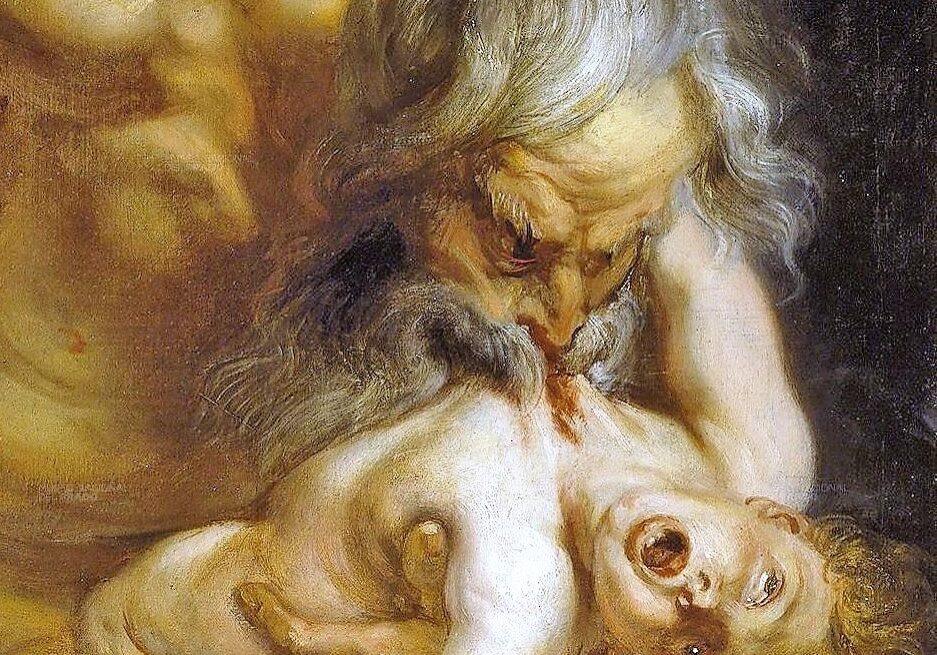

The Four Horsemen of the Great Ravine, Part 1

Every so often, things fall apart.

In the words of those who lived it, here are the vibes and the semantic signatures of the twentieth century’s most devastating social collapses.

From the meaning in their words, wisdom for our future emerges.

Data Engineer I

We’re looking for a Data Engineer to help build and maintain the data pipelines that power our AI-and NLP-driven narrative analysis platform. You’ll work with everything from structured financial data to unstructured news and social media content.