Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

In one of our most-read notes ever – Too Clever By Half – Ben gave a succinct definition of financial innovation:

Financial innovation is always and in all ways one of two things — a new way of securitizing something or a new way of leveraging something.

We are now securitizing wokeness. Behold:

Beyond Meat investment frenzy paves way for Wall Street’s first vegan ETF [CBS News]

The U.S. Vegan Climate ETF, which is expected to launch next month, will likely be the first that investors are served up.

OK, so maybe that’s not a precise definition of what’s happening – although in fairness, I’m still not sure I know what a “Vegan Climate” is. Still, it follows a pretty common pattern for the pop-up thematic funds. Jam some buzzwords into a fund name (check), push it to market as quickly as possible (check), and find a way to get some media attention from an outlet that has no earthly idea how many funds like this are born, live and die in a single week (check).

If you’re feeling like this is creeping into the zeitgeist, well, you’re right. That’s why it’s in our Zeitgeist feature: The language in this article was among the most highly connected to that of all financial news published in the last few days. You probably remember a couple days ago when the Times and some other outlets picked up the Business Roundtable’s meta-game positive announcement about ‘stakeholders.’ I’ll withhold the snark. Read the thing and make up your own mind.

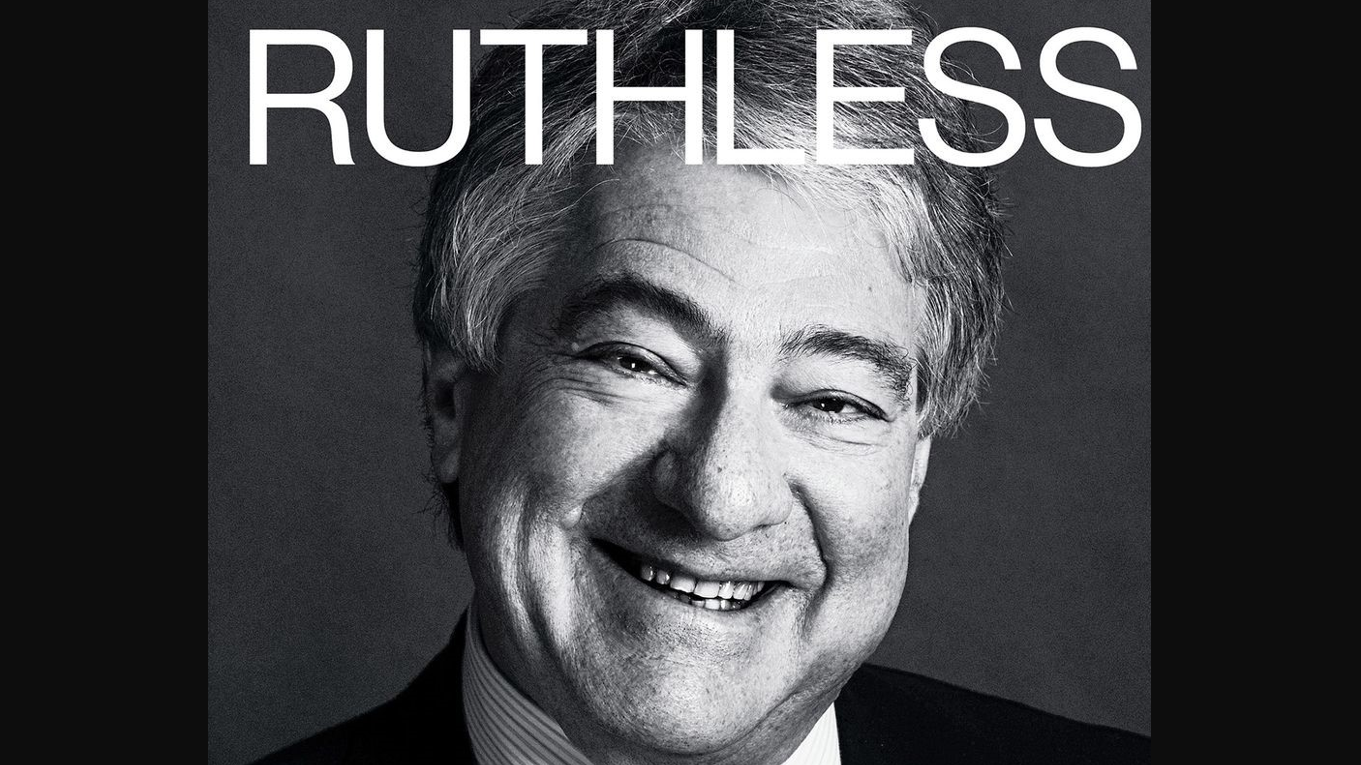

OK, maybe a little Fiat News-related snark: have you ever seen a piece about Big Corporate CEOs in which these were the pictures selected? The cool, soothing backdrop? These are not your father’s Rich, Evil, Old Dudes. These are Wise, Confident, Trustworthy, Responsible Executives. Well, everybody except for Larry, I guess. Can’t a guy catch a break?

Still, whether it’s metagame playing by CEOs vying to not get their birthday parties taken away by the next (or incumbent) administration, or strike-while-the-iron’s-hot launches of nominally thematic funds which end up just holding Apple and Microsoft anyway, the social and political perceptions of Wall Street and financial markets are very much in the Zeitgeist. In our parlance, ‘we’re going to do something about corporate responsibility’ is a cohesive narrative with moderate-to-high attention.

But like most ‘financial innovation’, SRI – oops, ESG – oops, ‘impact investing’ comes and goes from the zeitgeist with some regularity. Part of its coming and going are the inevitable claims by those involved that it will be different this time. People are finally ready! Y’all, I worked on M&A processes which included two of the bigger SRI shops in the US back in the mid-2000s. I’ve seen the CIMs, the internal and external marketing plans before. Same language.

But as we’ve highlighted in detail for our ET Pro subscribers, the rise and fall of these narratives is entirely pro-cyclical. When markets have been lulled into complacency by supportive policy and good long-term returns with no major drawdowns, this is the friendly form that financial innovation takes. When a shock to equity markets or the economy punches everyone in the mouth, boardrooms and investment committees alike go from woke-to-S-R-what in about five seconds flat.

None of that means this or anything else is a bad product or that it shouldn’t exist. I have no idea, and as long as it isn’t being sold with some mythical alpha argument, I have zero problem with a clear-eyed vegan climatologist buying a financial product to express something about themselves. I have zero problem with the person on the other end of that making a buck from it. Or for feeling good about it, for that matter.

But for FAs and others wondering if this is a forever thing, if we’re reaching a new normal on these issues, I wouldn’t pay attention to the ebbs and flows of financial narratives. I’d be laser focused on political narratives, and the extent to which wealth inequality politics are brought front-and-center. That’s where you’ll see this zeitgeist manifest in changes that really may influence your business and your day-to-day processes for working with families and individuals.

Too cool for school! Drinking the Kool-Aid IS the not-so-secret to ‘success’; responsible-ness-ish is the exception to the rule! I know a thing or two about that. (Aarrgghh!!??!!)

I love ET’s weaving of specific nuance understanding around themes. Here’s my point of view from 2013: "The truth is that food is not always what you think it is. Its physical transformation into a food product belies a much darker reality. Food undergoes the equivalent of a leveraged recapitalization designed to suit the financial goals of its creator. Consumption of junk food (for example a Twinkie or a sugary drink) is akin to a financial exchange where short-term gains are privatized and long-term costs are socialized in the form of horrific health outcomes. The metabolic donkeys - consumers - pay relatively little money and turn a blind eye to the health consequences of their food choices – instead hoisting the fantastic profits of companies like Monster and opting for a shortened, diseased life. https://www.lbs.co/blog/sodastream-vs-monsterbeverage

I think Michael Pollan who wrote The Omnivore’s Dilemma and other major works described the layout of most supermarkets. The outside ring is food. Everything on the shelves in between are “food-like substances” just like Bud Lite is a “Beer-like substance.” The darker truth is that many of these substances are physically addicting, engineered to be that way. It costs less to eat fast food than real food, because of the subsidies granted to the sugar, corn, and other interests. Iowa needs ethanol because that’s an early election state, but as usual I digress because your writing just starts me throwing off all of these thoughts. Back on topic; it’s amazing that the “Investment-like” products have taken so long to mature. Oh sure MO has been a stud for 35+ years…Kraft, Heinz, Bud, not so much. Next will be an index based on the current occupant’s tweets, derived from regression analysis of his tweets and their direction and or correlation to moves in the market. Now, correlation does not imply causation or does it? https://xkcd.com/552/

I’m reminded how for nearly 30 years of my career…“Frontier Markets” were trotted out at market near tops as the next new thing/diversifier only to tank worse than anything else. Frontier Markets of old = ESG of today. Love how companies are all tripping all over themselves to be ESG…and MOST IMPORTANLY get included on some ESG Index ETF.

“Next will be an index based on the current occupant’s tweets, derived from regression analysis of his tweets and their direction and or correlation to moves in the market.” Too late - I think that’s called the VIX./s