News Flash: People Like Free.

Free is a good price.

It’s how we got Fortnite, and Radio, and a terrible internet. People hate paying for things.

That’s what Fidelity was counting on when some beancounter in their custody division decided to make a stink about 9 ETF issuers (most of whom nobody outside the industry has ever heard of) not signing their revenue sharing deal. And they’ll win. They always win.

If you missed the story, it’s very simple:

- Before 2019, in general, if you wanted to buy or sell an ETF (either as a rando or as an advisor) you paid some commission. At Schwab, it was $4.95, or more for large trades.

- In Jan 2019, Fidelity kicked off the “no-commission-ETF” thing announcing a deal iwht Blackrock.

- By the Pandemic, we had Robbinhood and E-Toro and everyone other than interactive brokers all racing to zero as fast as possible.

- Fido makes this announcement, and FinTwit looses it’s collective mind, and a handful of stories get written about it in the usual places (BB, FT, industry sites.)

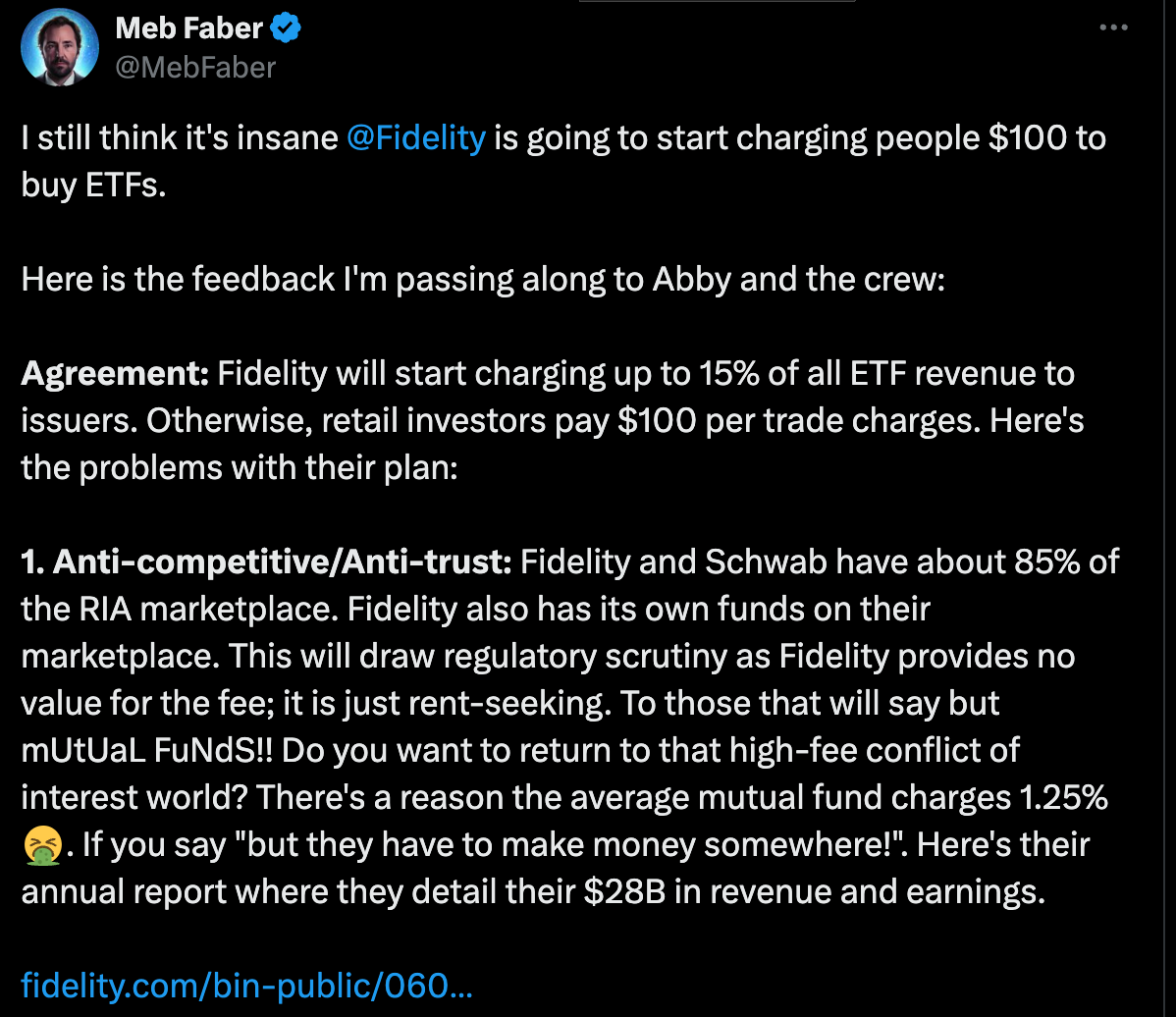

A good summary tweet comes from my friend Meb Faber at Cambria:

With lots of comments that echo Bob Elliot here:

To which my response is:

Companies are Not Your Friends

The weird irony of the ETF, Financial Advice and Retail Investing market is that its dominated by three companies with RADICALLY different ownership structures and approaches to transparency.

On the one hand, we have Fidelity, which is completely privately owned. It’s a family business, the same way Cargill is. While various corners of their business are regulated and thus have to produce minimal documentation, they can do, essentially, whatever they like within the bounds of legality.

All the way at the other extreme is Vanguard, the worlds only Mutually-owned pure asset manager (and broker, and advisor, and marketing agent, etc…) While “owned by the funds” it actually makes it less transparent than you might think. Teasing out something like “exactly how much did Vanguard spend on TV ads last year?” or “how does executive compensation get handled” isn’t precisely impossible, but it’s hardly simple. Their approach has generally been to tell folks what they think they should know … so for example, they still dont publish actual daily holdings on their ETFs, because they’re share classes of the mutual funds, and Bogle always wanted to discourage trading or some other excuse.

In the middle is Schwab, a pretty straightforward public company I have been tracking for decades, that produces more-than-required levels of transparency not just on their businesses, but on their clients.

And these three companies have very different motives:

Fidelity is run by Abby Johnson, not Abby Joseph Cohen. The latter is a former star analyst at Goldman (and now Columbia B school prof).

This note reminded me of what I consider to be a classic from @rguinn

My fault as the editor for not catching that. Thanks, James!

I hate Fidelity. I don’t use their products…with one caveat: they have a money market fund that pays better than the other options out there and it’s my duty to get my clients the best yield I can, when all other things are equal.

I hate Fidelity and so do most of the people with whom I work. But we need the eggs.

DY, Vanguard Government MMF is 35-40 bps higher in yield than Fidelity

We used to have everyone in that fund, but then Vanguard stopped covering the back office expenses for a bunch of wirehouses so it vanished off of our menu. Nobody was happy about that.

Fund Manager Alpha may come from Retail Investors.