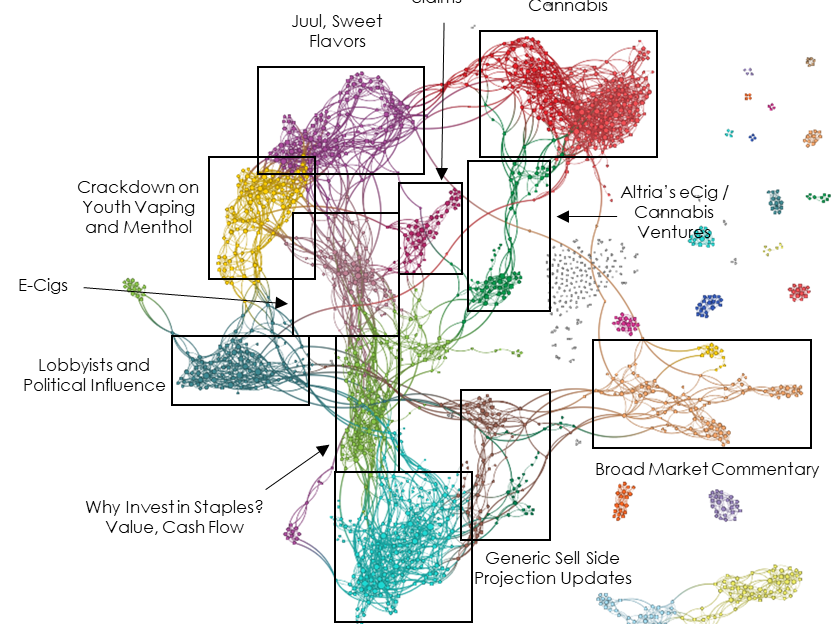

Summary on most narrative-linked news of one announcing US company and this week’s December non-farm payrolls and unemployment updates.

We’ve been doing it wrong with AI for too long. Time to do it right.

We can’t SOLVE for the future of complex social systems like markets or politics with algorithms. But we can CALCULATE the future of these systems with AI.

The problem for markets today is not the Fed.

The problem for markets today is the guy in the White House and his game of Chicken with the world.

All of the heartfelt prayers to the Fed gods went unanswered last week. Or rather, the answer was “No.” And without a Fed backstop to US-China negotiations (where the narrative continues to worsen), we are immersed in technical uncertainty.

With limited markets-related events next week, we instead highlight some of the most representative (and unique) reviews of 2018.

We would usually tell you that all information is information. There is no good or bad. No right or wrong. But some things aren’t even information. Knowing what you can ignore is worthwhile.

With increasing attention to trade and tariff narratives and falling attention to inflation and growth narratives in the U.S., we believe that investors may benefit from focus on sectors on which the latter narratives have weighed heavily in 2018. Of particular interest? Brand-oriented consumer stocks, especially many staples that have been left for dead.

When our processes of inquiry lack challenge, doubt and obsession with falsifying our best ideas, the result is inevitable. Our conclusions cease to be science and become something else entirely. That something else is a thing sensitive to narrative, vulnerable to priors and bias. That something else is scientism.

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.

The Street is beating the recession narrative drums, culminating in Friday’s sharp sell-off in US markets. But there’s a chance for Powell to save the day, by shifting the Fed narrative to provide a market backstop to US-China trade disputes.