Oil falls, gas bounces, banks are buoyed. It’s apparently a weird gravity metaphor grab-bag on a Monday Zeitgeist.

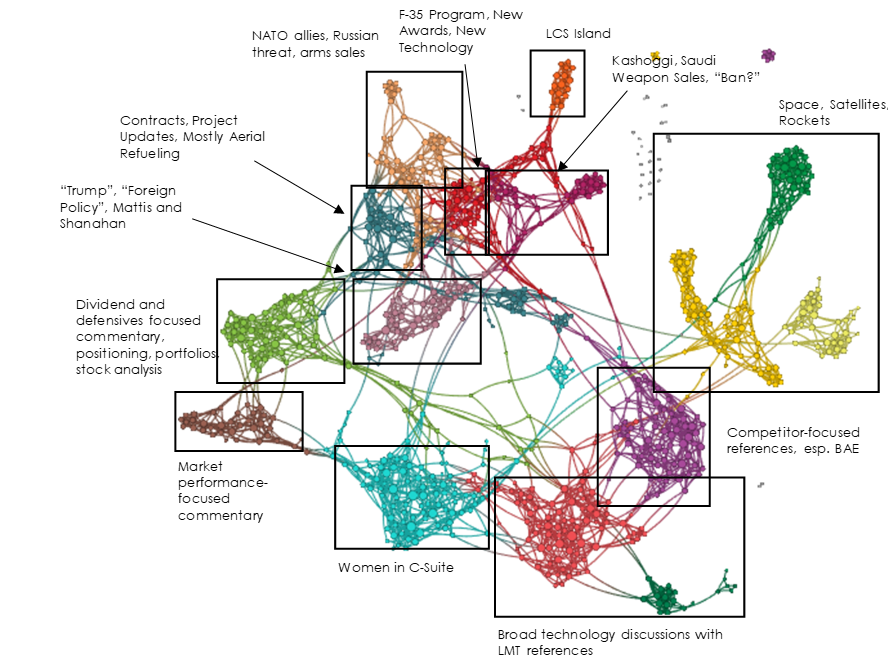

With aerospace and defense in the spotlight, we turn our own spotlight to the sector. We find a generally weak narrative structure with a lot of vulnerability to positive and negative events. We also find some interesting shift in project-specific narratives for Lockheed Martin (LMT).

When an inflation regime shifts, the only question that really matters for your investments and your business model is this: do you have pricing power?

Pt. 1 of a three-fer Brief series … why the worst place to be in any services industry is on the product side.

Billionaire penthouses, vertical integration in cannabis, non-musical music power, and a shifting tone in tech.

Time to resurrect an old Epsilon Theory feature and make it a regular thing. Because the ET pack has a voice that’s worth hearing.

An American mutual fund gatekeeper does PR for China, DNC gunning for Wall Street, multiple missionaries live from the pulpit in Davos.

Talking ourselves into a recession, trusting our employers, and a fine example of government shutdown Fiat News.

Welcome back, folks. Today, it’s all about cloud and blockchain, but no cannabis. Also: tech earnings, Trump can’t make a deal, and corporate debt.

A generation of investors has Paul Volcker to thank for almost 40-years of slowly falling rates. He handed countless baby-boomers a free 100 points of investing IQ, for which most never thanked him. It was as good as it gets.

More than ever I can hear the approaching hoofbeats of the Fourth Horseman – a regime change in inflation expectations. The hooves are still distant, and you’ll have more bites at the portfolio-preparation apple as global growth concerns in China and Europe persist. But prepare you should.