Two distinct market narratives that came into sharper focus last week – Global Growth Slowdown! and Democratic Socialism!. The first was pushed by the usual market Missionaries – the WSJ and the FT and the talking heads on CNBC – and the latter was pushed by the usual political Missionaries – Trump and AOC and Bernie and the rest of the 2020 presidential crowd.

But only one of these narratives makes a long-term difference for your portfolio.

Why VC loves fintech for some reason, populist messages, “optimism over trade talks” take 25, and more popullsm.

We’re all passengers in the backseat of the State-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.

What the rise and fall of baseball cards can and can’t tell us about bubbles and the turning of markets into utilities.

Fawning Tesla press, coming storms, ESG and data, striking a balance between tasteful display of art collections and pay cuts at banks, and post-Yorkshire pudding walks.

Today’s specials: Megadevelopments in Chicago, online grocery shopping, slowdowns at Apple, vagueness at Alphabet and Canadian weed.

Your mother was a hamster and your father smelt of elderberries … the pricing power found in intellectual property. It’s not as easy as it looks.

In today’s edition, it’s captain obvious takes on the ECB, is there anything active funds CAN do?, more Brexit and dead-cat bounces.

Trust in media is being debased from without and within. The Clear Eyed, Full-Hearted answer? Don’t pick and choose. Set yourself against both threats.

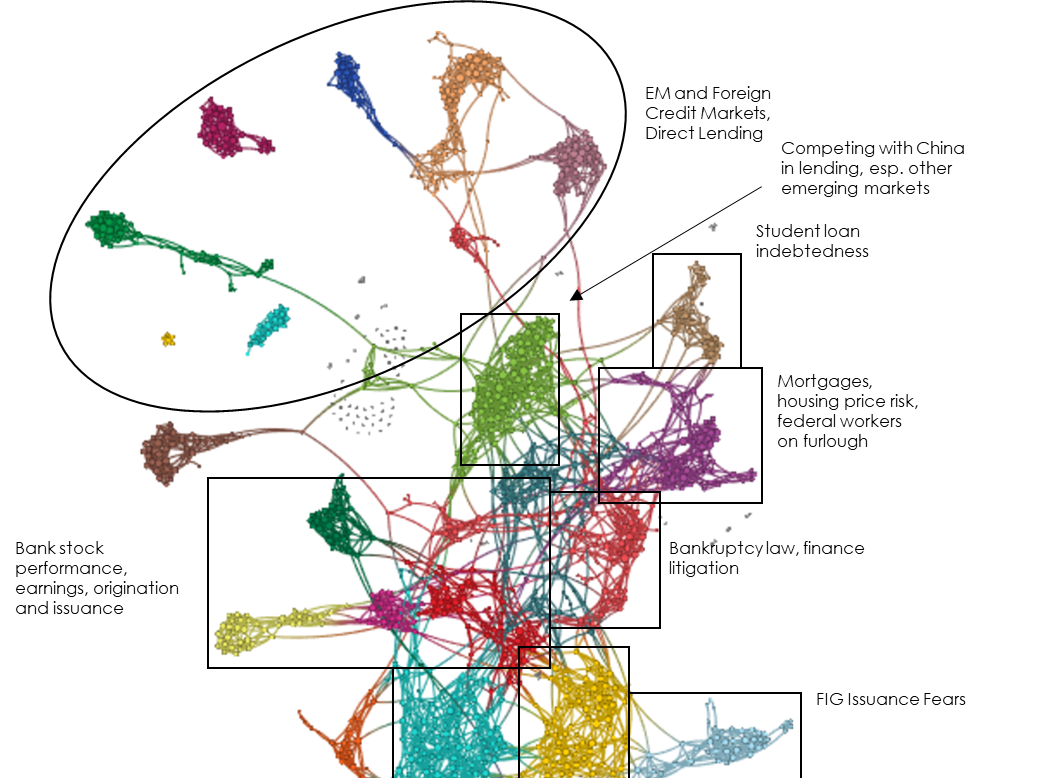

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. The attention on credit and credit cycles has increased slightly, but most of…