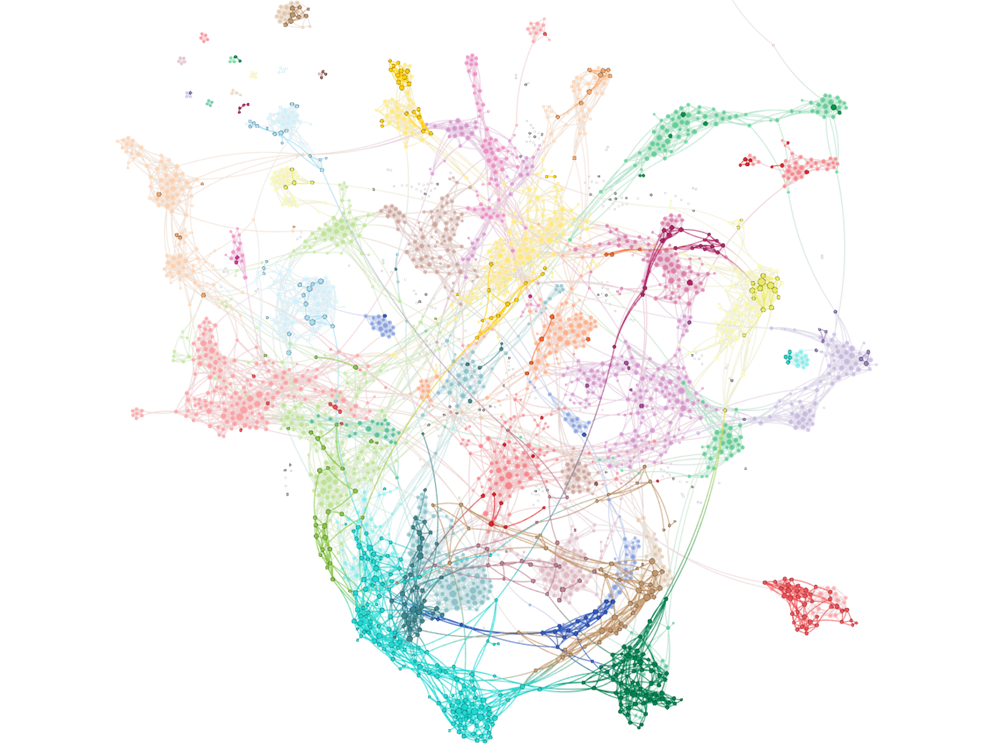

For fund managers and asset management executives, the fundraising question is often the most important and most inscrutable. Understanding how narratives and career risk factors interact with decision-making processes is critically important.

Ladies and gentlemen, your narrative-world assault words du jour … “sponsored content”, “democratic justifications”, “fishing expeditions”, “diversification”, “value investing”, and “growth of $1”.

The ET Zeitgeist, because if you don’t know who the sucker is at the poker table … it’s you.

Kashkari on Brexit, Cramer on Tesla, Breitbart on China, and “shorting unethical stocks” … all in a day’s work for The Zeitgeist!

Every morning, we run the Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

ET contributor Neville Crawley is simply one of the wisest people I know, and he outdoes himself in this killer Rabbit Hole note.

Come for the Amazon anecdote. Stay for the book recommendations.

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Fiat News and narrative construction galore in today’s set of the most on-narrative financial media articles.

What links them all? Dopamine is a helluva drug.