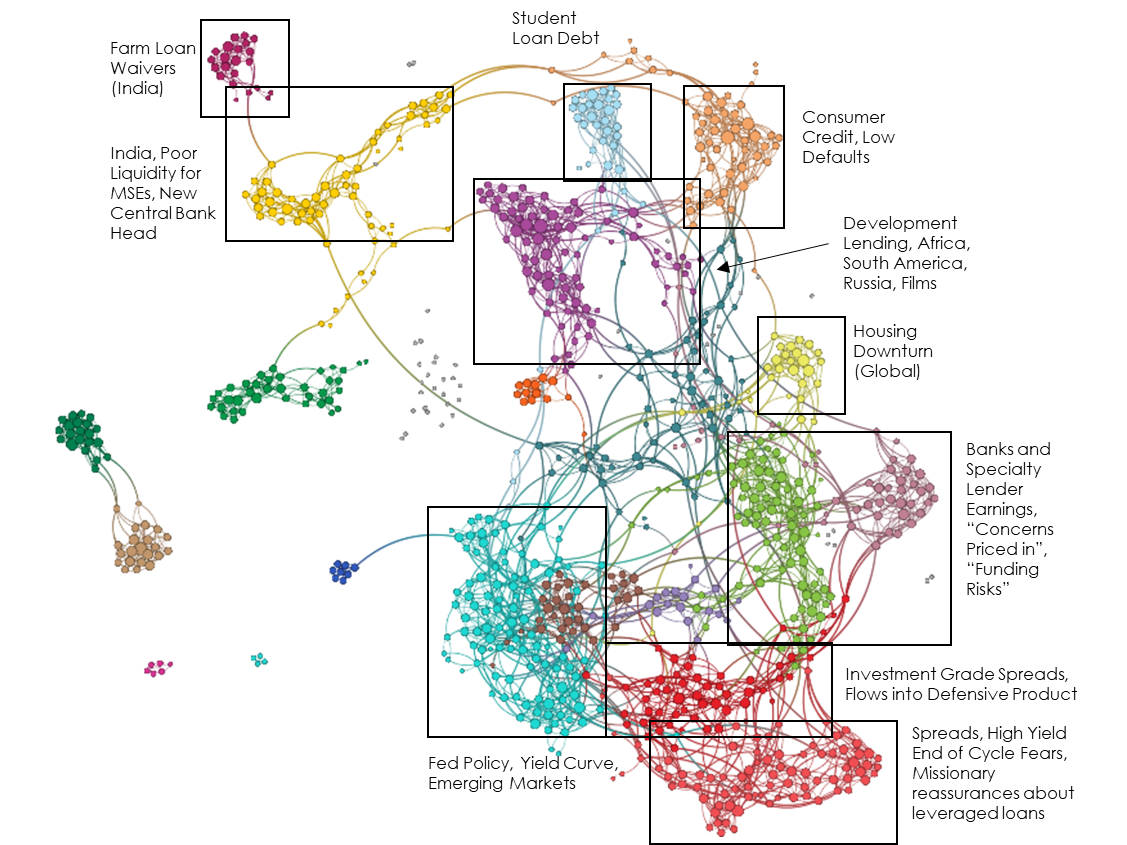

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. As we noted in November, missionaries in force were a leading indicator for…

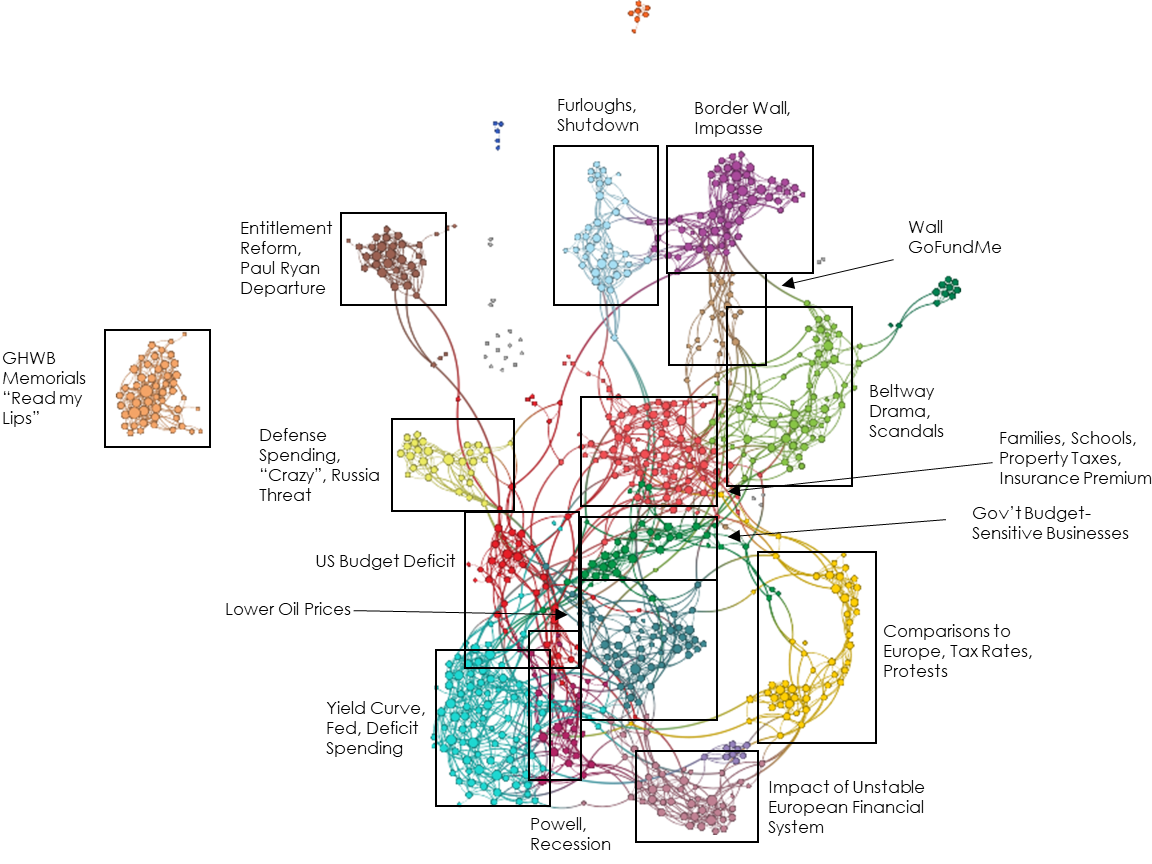

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Fiscal policy in the US remains a largely low-attention topic with little in…

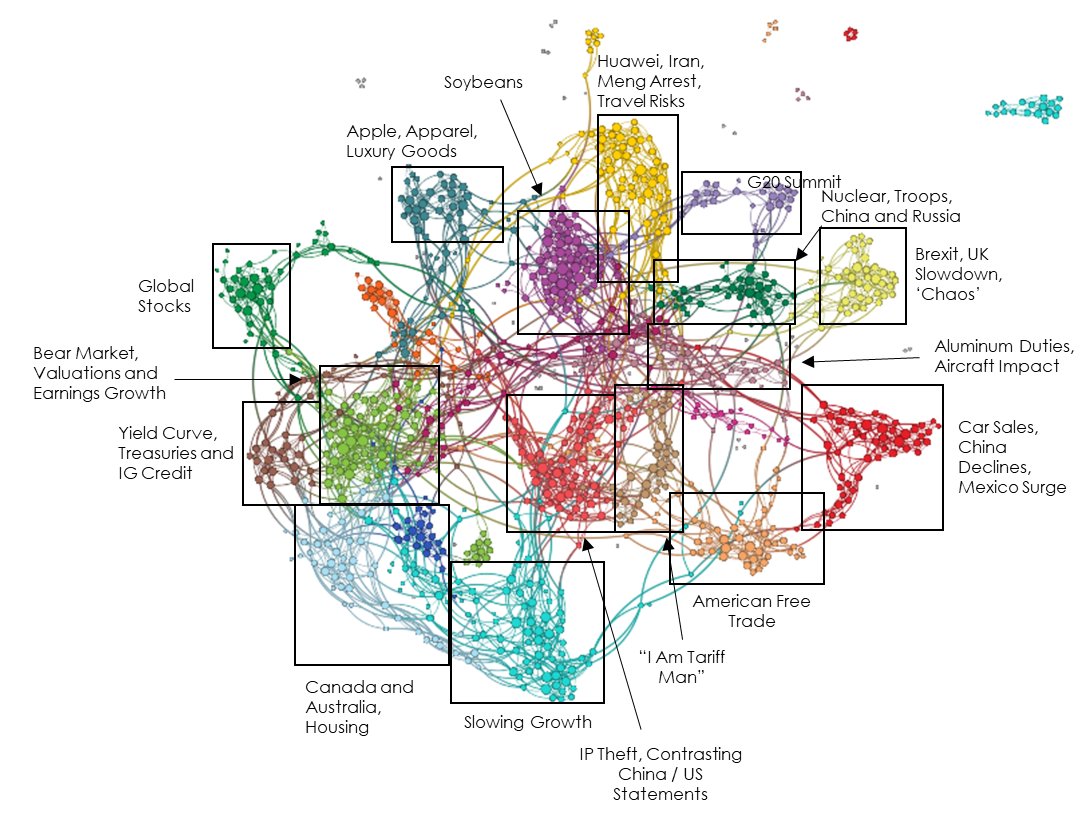

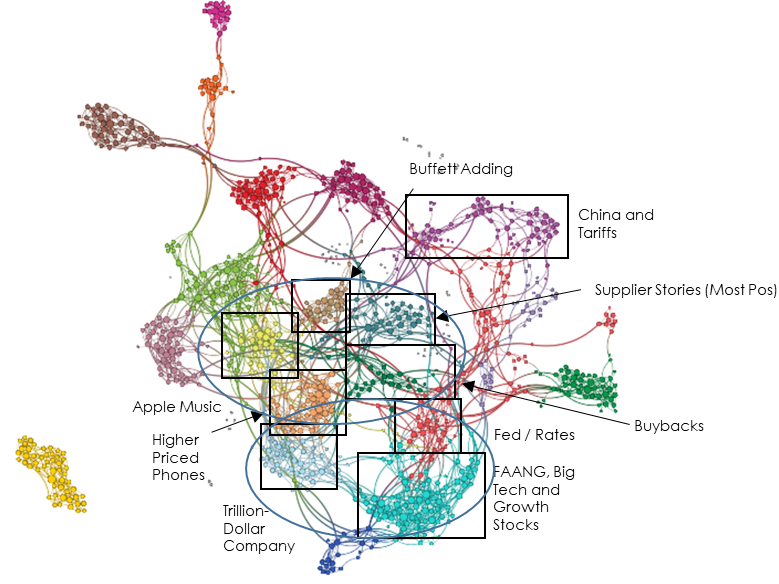

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. The focus on a China Trade War narratives accelerated even further in December.…

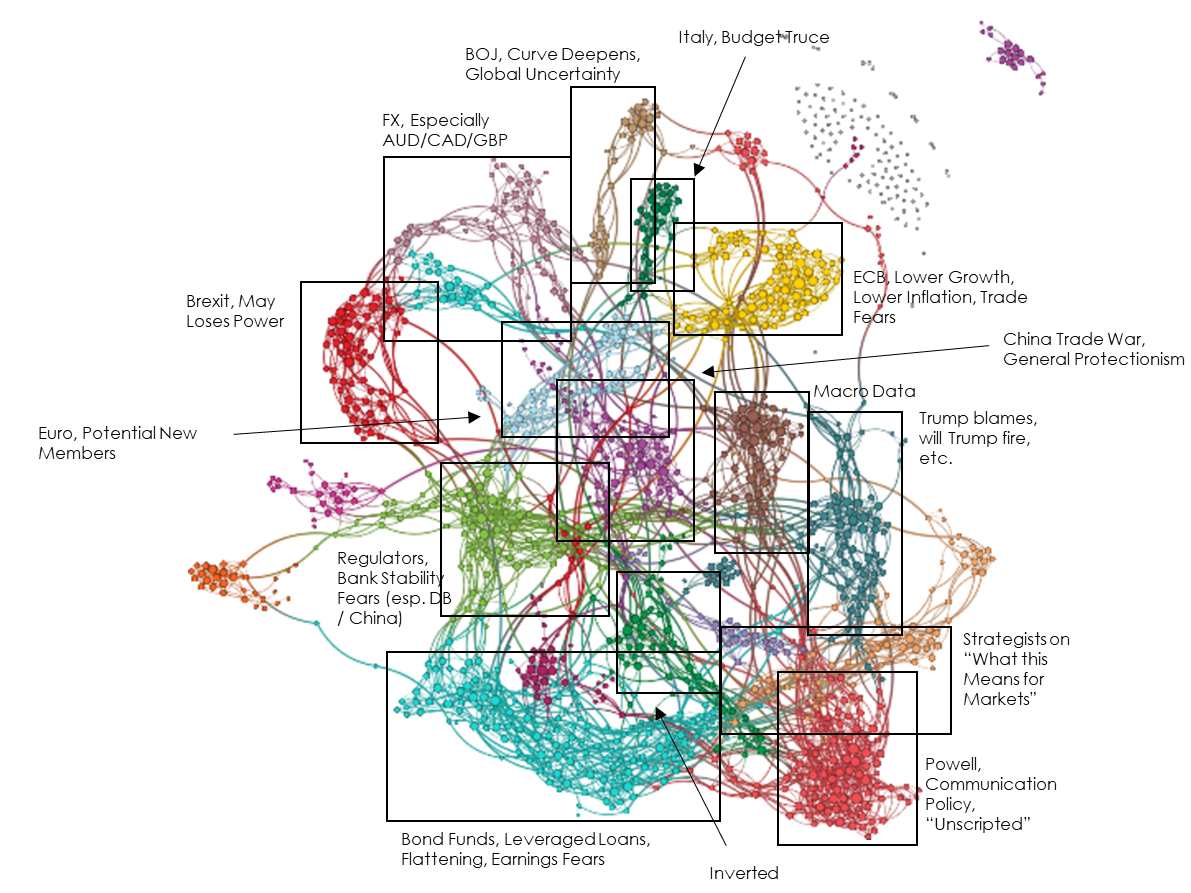

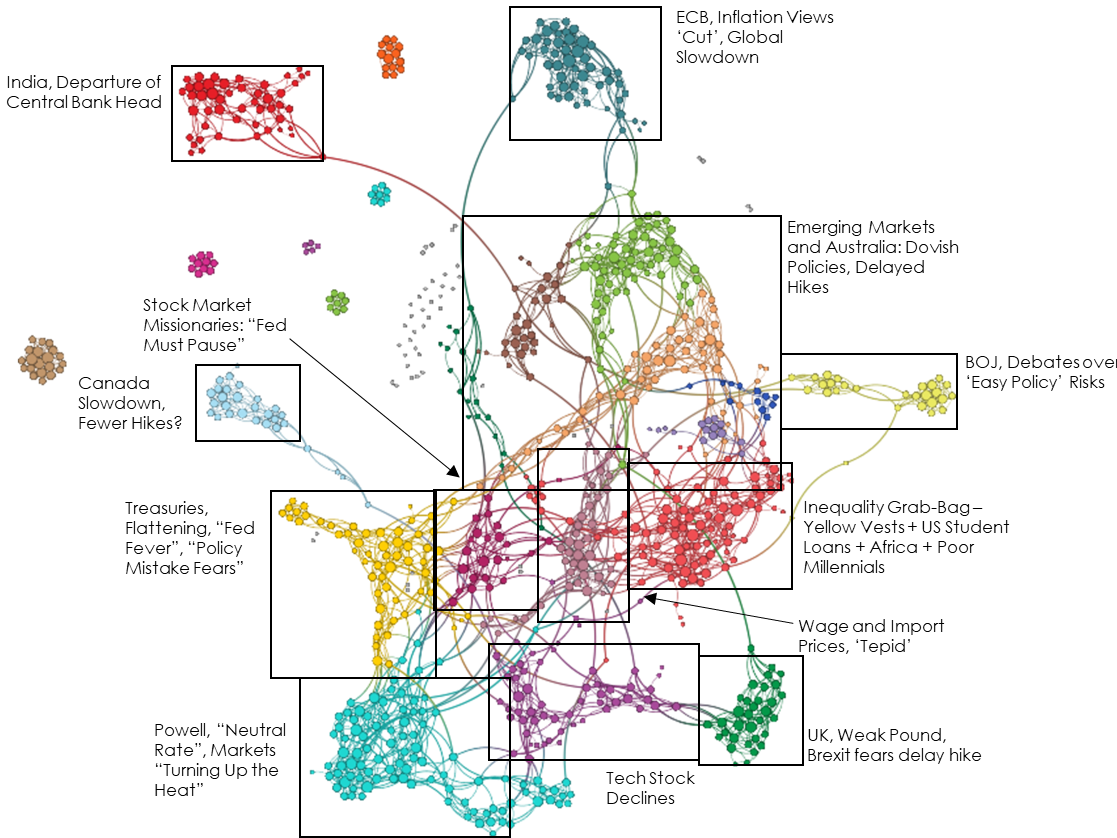

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Attention to central bank narratives rose sharply in December, with a renewed attention…

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. For yet another month, stock market declines refocused investor narratives – especially concerning…

I found this photo from Friday’s presser, when Jay Powell was asked to describe how much credibility he has now.

JK. But also, LOL.

Three reporting companies this week. The most-connected articles include an odd weed obsession among media and analysts, and a…rather unfortunate Delta experience.

When it comes to politics and social media, making up straw men about our enemies to make them look ridiculous seems like good entertainment. But beware embracing amusing-but-wrong cartoons in zero sum games.

Introducing the Epsilon Theory Discovery Map – a novel way to navigate the Epsilon Theory archives, not based on chronology or author, but based on connectivity, similarity and consistency in the underlying narratives.

We examine how Apple found both of the ways to lose on Narrative in less than two months’ time, and outline how that might change the playbook for the near-, medium- and long-term for different investor types.