We’ve moved on to a motley crew on the back end of earnings season, with a couple noteworthy larger names: Walmart and Berkshire Hathaway.

We’re back with a third edition of ET Live! On the docket for this session: MMT and the Zeitgeist that brought it to the forefront of our political and economic discussions.

In which we learn about new voices in the hospital, we pile on the Fed, and we exult in stocks “edging up” on trade talk progress (I’ve forgotten what take we’re on).

The hardest job for any financial adviser is knowing when a fiduciary mindset should guide us to take a stand, and when it should guide us to adopting flexibility. If we claim to have a process, we have to have an answer for this.

Every investor who wants to understand narrative and its impact on markets should read “The Alchemy of Finance”, by George Soros.

ET contributor Demonetized rediscovers the joys of Soros. It’s all reflexivity, all the time.

We introduce a new narrative measure and then put major global equity markets under the narrative microscope in Q1 2019.

Lots of ‘playing’, ditching New York, and a piece of hard-hitting analysis demonstrating that sitting at the crossroads of government and business can be personally profitable.

We don’t have to treat it like a cardinal sin any time an author, politician, consultant, adviser or expert tries to make us feel a certain way. Just don’t be the only one at the table who doesn’t realize what’s happening.

Today’s Zeitgeist poses a riddle: what is noxious, may not be a catalyst, extends a rally and awaits cues all at the exact same time?

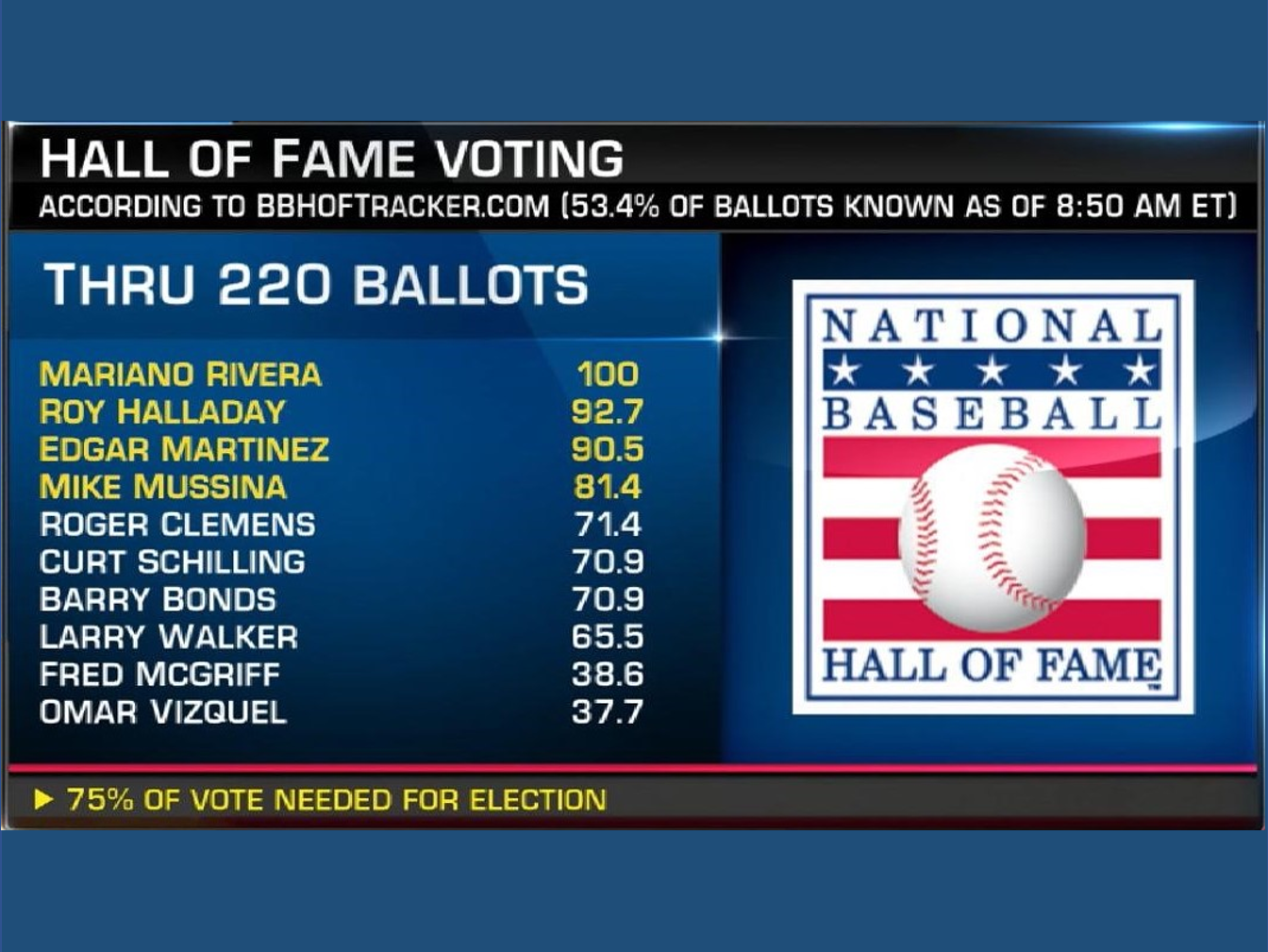

In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.