In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.

In the 8th or extra innings (what about the 9th?), allocations to alternatives, fixed income ETFs, offensive hacking and “markets up on trade deal hopes” (again).

ET contributor Neville Crawley is back from time well spent at an amazing library, with thoughts on no-end state architecture, marketing alpha, DOD AI, wonderfully goofy blogs, and a new addition to the Rumsfeld canon: unknown knowns.

Maine cashes in, investors cash out, stocks get a lift from trade hopes (version 28), the Brexit pantomime and a shadow over strawberry fields.

If you view the world through Clear Eyes, and hold loosely to your convictions, you’ll have an easier time adapting to a dramatic shift in the market regime than your competitors who’ve been lulled into a Narrative-induced fugue state. You’ll make up your own damn mind. You, your clients, and your business will all be better off for it.

Soft drinks, REITs, midstream companies, CROs and video games round out the start to the second half of earnings season.

Two distinct market narratives that came into sharper focus last week – Global Growth Slowdown! and Democratic Socialism!. The first was pushed by the usual market Missionaries – the WSJ and the FT and the talking heads on CNBC – and the latter was pushed by the usual political Missionaries – Trump and AOC and Bernie and the rest of the 2020 presidential crowd.

But only one of these narratives makes a long-term difference for your portfolio.

Why VC loves fintech for some reason, populist messages, “optimism over trade talks” take 25, and more popullsm.

We’re all passengers in the backseat of the State-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.

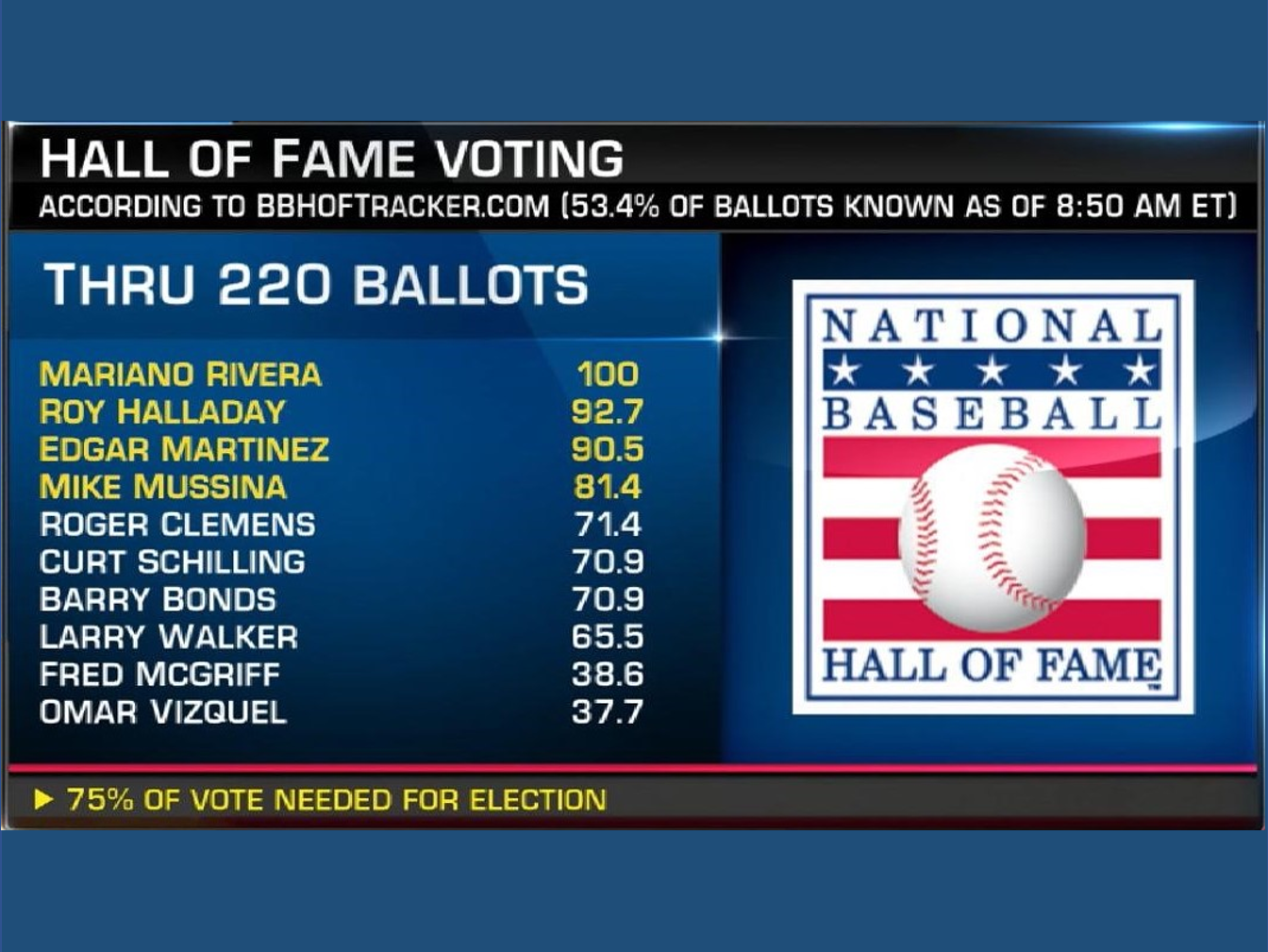

What the rise and fall of baseball cards can and can’t tell us about bubbles and the turning of markets into utilities.