The next stops in our discovery of the process of discovery? A town of 1,282 people and the mind of a German physicist named Arnold Sommerfeld.

Like it or not, the 2020 election season has begun. But I’ve got good news for you: someone has The Answer for the political center, and he’d very much like to discuss it with you.

Tech, telecom, pharma and defense report. Plus some…er…highlights, from Davos.

Last Halloween the hipsters over at Salesforce.com turned their new San Francisco building into a giant Eye of Sauron. I keep waiting for someone to try this with the Federal Reserve’s Eccles Building, but that would be too on-the-nose.

Oil falls, gas bounces, banks are buoyed. It’s apparently a weird gravity metaphor grab-bag on a Monday Zeitgeist.

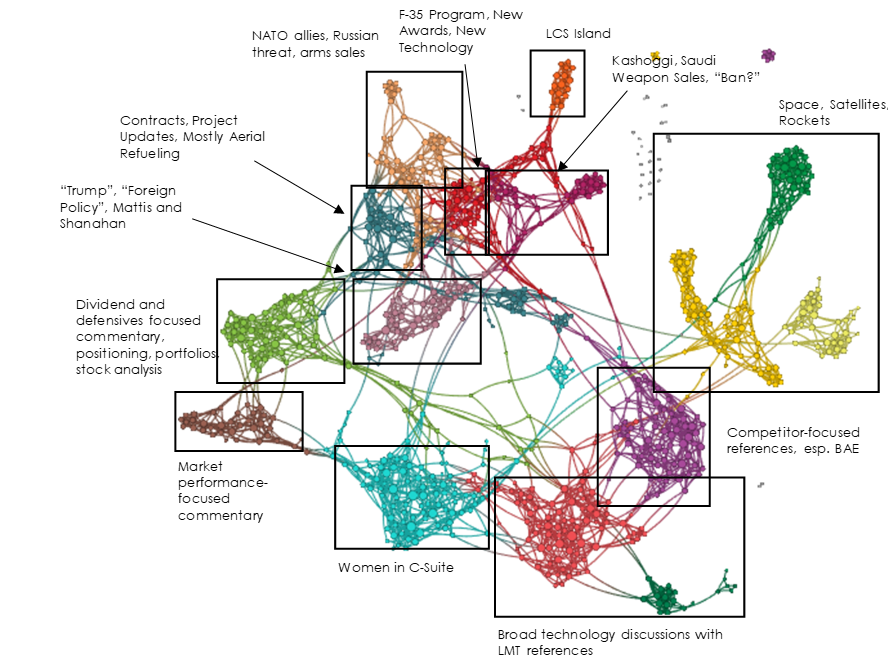

With aerospace and defense in the spotlight, we turn our own spotlight to the sector. We find a generally weak narrative structure with a lot of vulnerability to positive and negative events. We also find some interesting shift in project-specific narratives for Lockheed Martin (LMT).

When an inflation regime shifts, the only question that really matters for your investments and your business model is this: do you have pricing power?

Pt. 1 of a three-fer Brief series … why the worst place to be in any services industry is on the product side.

Billionaire penthouses, vertical integration in cannabis, non-musical music power, and a shifting tone in tech.

Time to resurrect an old Epsilon Theory feature and make it a regular thing. Because the ET pack has a voice that’s worth hearing.

An American mutual fund gatekeeper does PR for China, DNC gunning for Wall Street, multiple missionaries live from the pulpit in Davos.