In today’s edition, it’s captain obvious takes on the ECB, is there anything active funds CAN do?, more Brexit and dead-cat bounces.

Trust in media is being debased from without and within. The Clear Eyed, Full-Hearted answer? Don’t pick and choose. Set yourself against both threats.

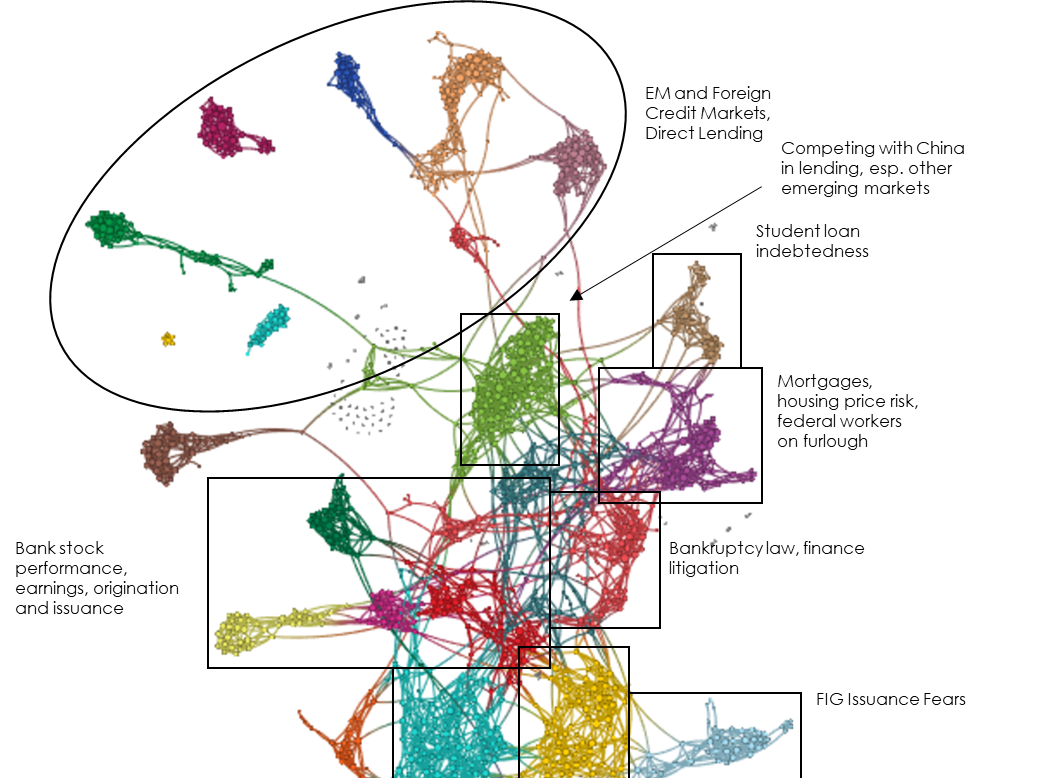

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. The attention on credit and credit cycles has increased slightly, but most of…

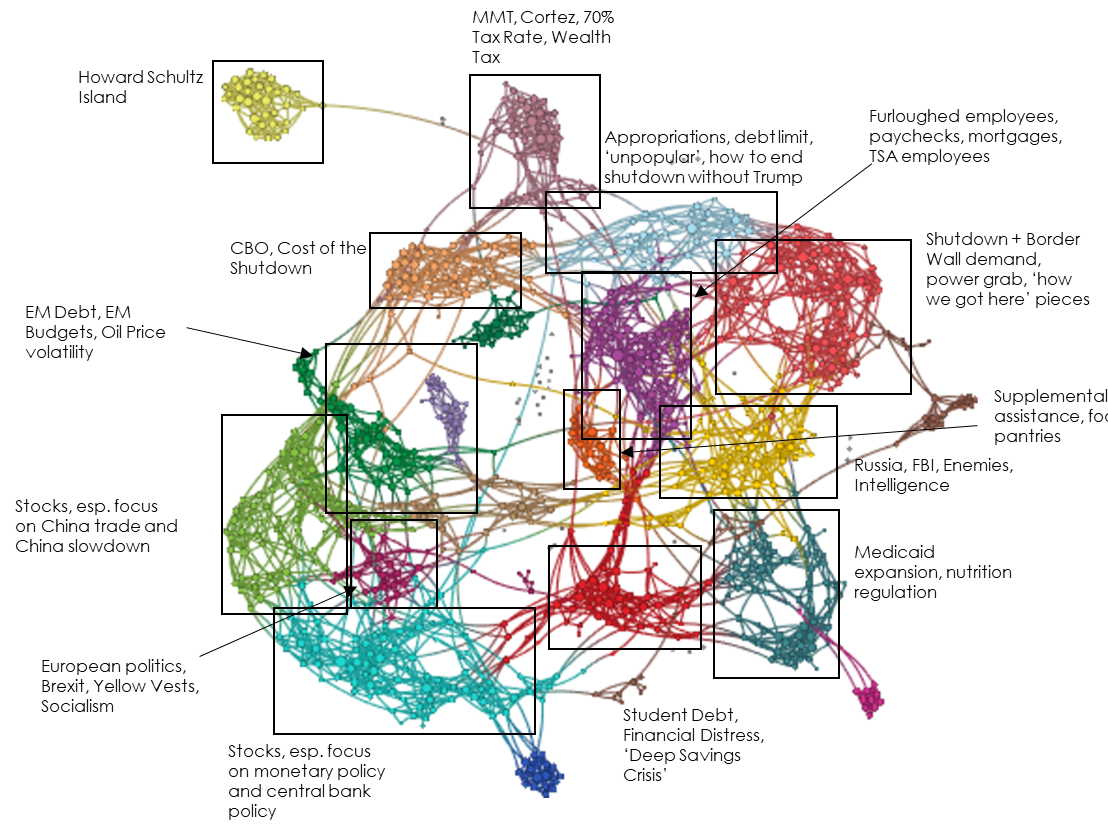

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to fiscal policy narratives has dramatically increased in January. The shutdown (and…

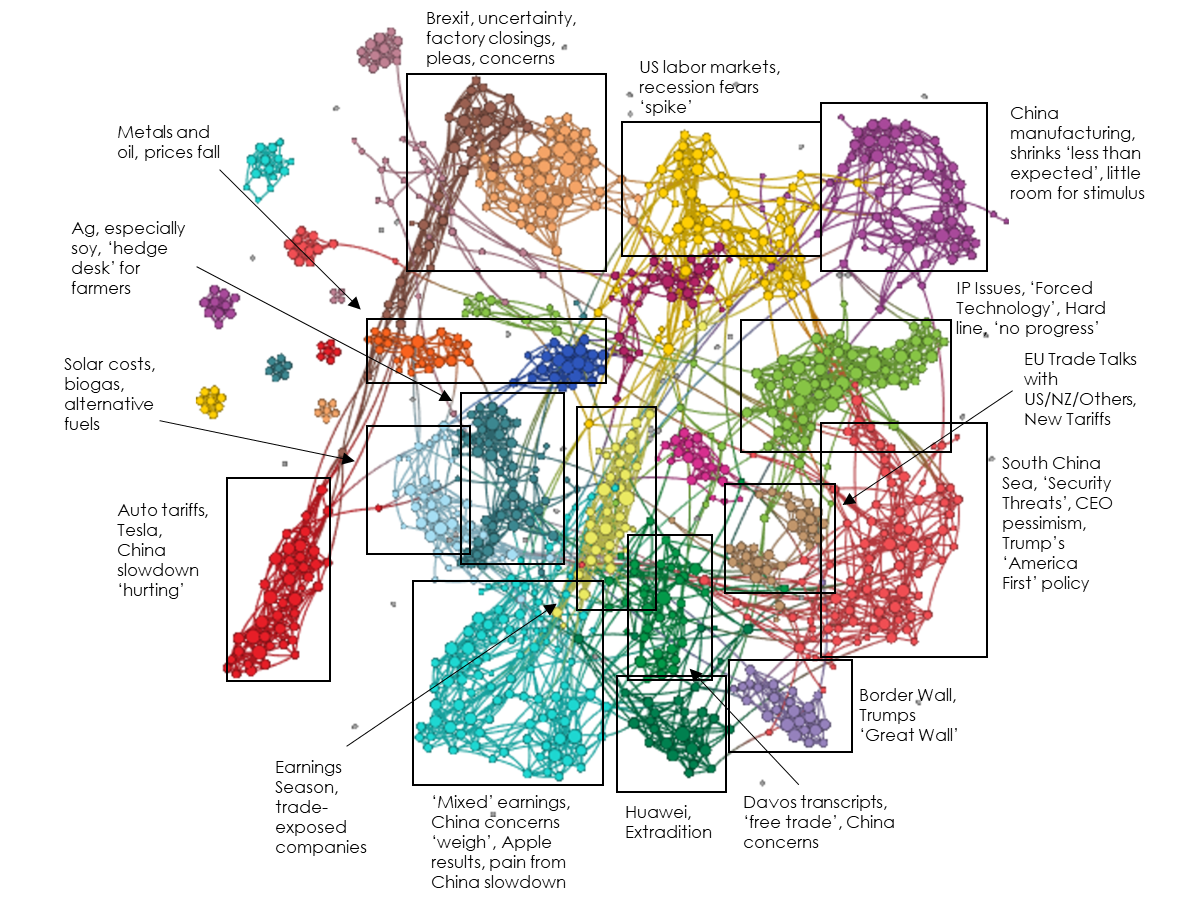

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention on Trade and Tariffs is now as high as we have measured…

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to central bank narratives continued to rise in January, to nearly the…

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Our attention measure for Inflation narratives rose somewhat in January, probably the result…

In which we hear the term, ‘megadeal hunger’, contemplate a Larry Fink v. Ken Fisher celebrity steel cage match, and boggle at the unironic advocacy of regulation as the solution for lack of trust in blockchain applications.

For every historical Narrative there is a counter-narrative, and every time history repeats itself, the main narrative gets weaker and the counter-narrative gets stronger.

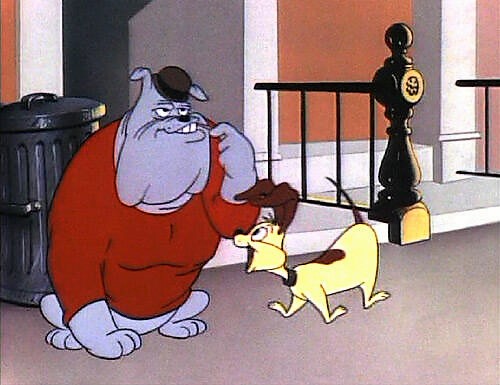

That’s a problem for Jay Powell, as the counter-narrative of Central Banker Lapdog is getting stronger.

The near-term focus of financial markets coverage seems squarely on M&A in the U.S. Elsewhere, Lord Fink (!) roasts Corbyn and Australian housing has become a media obsession.