Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying…

Fiat News and Narrative construction galore in today’s set of the most on-narrative financial media articles.

What links them all? Dopamine is a helluva drug.

It’s not impossible for market volatility to spike massively through some deflationary shock to the financial system like a China-driven credit crisis or an Italy-driven euro crisis. What’s impossible is TO GET PAID for taking out an insurance policy against the last war.

The new Zeitgeist is here! Now with all the snippets and twice the snark.

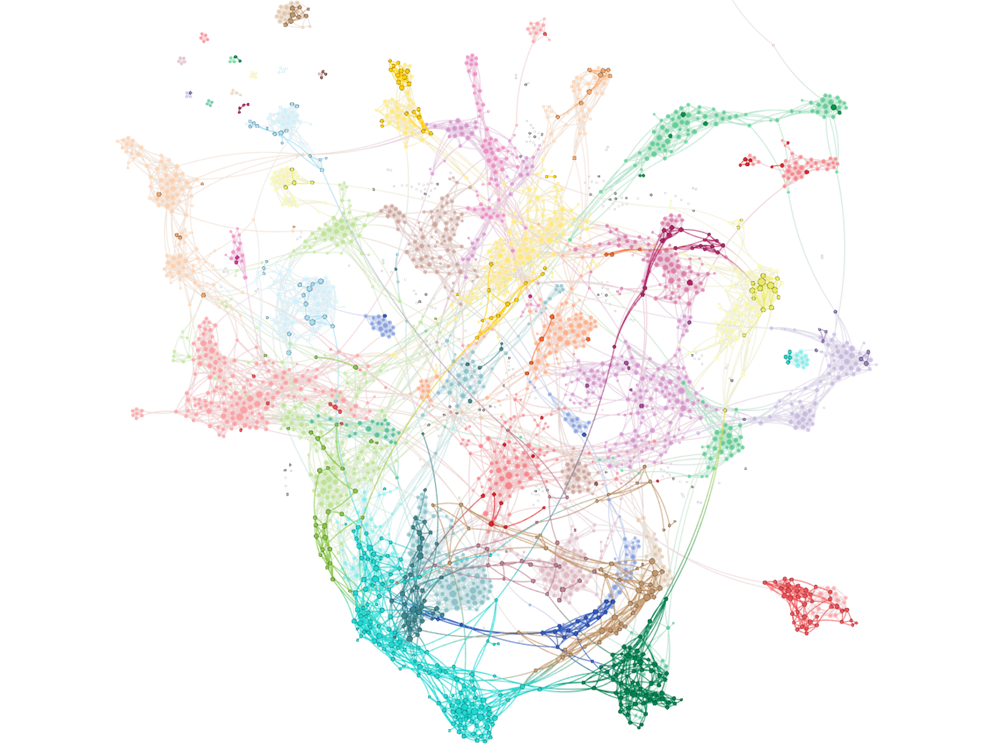

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

Why are institutional investors in trouble with the new Zeitgeist of capital markets transformed into a political utility?

Because everything you think you know about portfolio diversification will fail. Because emerging markets are going to be crushed before this is over. Because everyone’s inflation-investing muscles have atrophied to the point of helplessness. Because you think long-vol and crisis-alpha are things.

BATs vs. FAANGs, trading against institutions, trading with institutions, why Americans buy cars and a shocking J.C. Penney news bulletin.