What’s the most valuable commodity Gordon Gekko knows? Information.

How valuable is Wall Street research? How much information does Wall Street research have? LOL.

MIFID II is making the jump from Europe to the US. Time to polish those sell-side research resumes. As if you weren’t already.

Bernie Sanders isn’t leading in the polls. He may also be the most polarizing candidate – again. But don’t tell the political media, whose Sanders content thus far in the primary process has the strongest, most positive narrative of any candidate. And it’s not close.

There’s a point in any human activity – investing, politics, religion, or business – where a thing we do together becomes a thing in-itself. It’s a point that changes our thinking and the moral questions we are forced to answer. Knowing where this point lies is in all our activities is important.

The need to control and influence Common Knowledge knows no boundaries. And I mean literally no boundaries.

There are two narrative structures that have grown to a size and a level of cohesion that makes them impossible to be politically ignored.

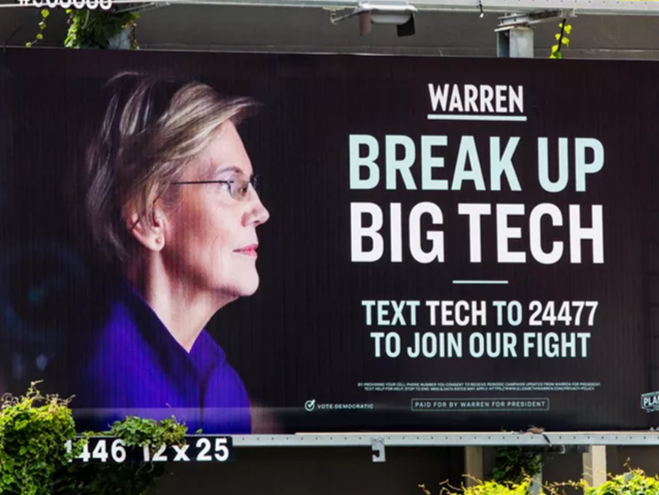

One is the student loan “crisis”. The other is the Big Tech “monopoly”.

And yes, I’m putting those words in air-quotes, because the first isn’t really a crisis and the second isn’t really a monopoly. But since when did that matter in narrative-world?

Vanguard just announced a joint venture with Ant Financial in Shanghai. They’re not waiting around for a trade “deal”, and they’re not clutching their pearls about Chinese IP “theft”.

No, Vanguard is going to do what they always do … they’re going to obliterate their competition with the pricing power that comes from government collaboration.

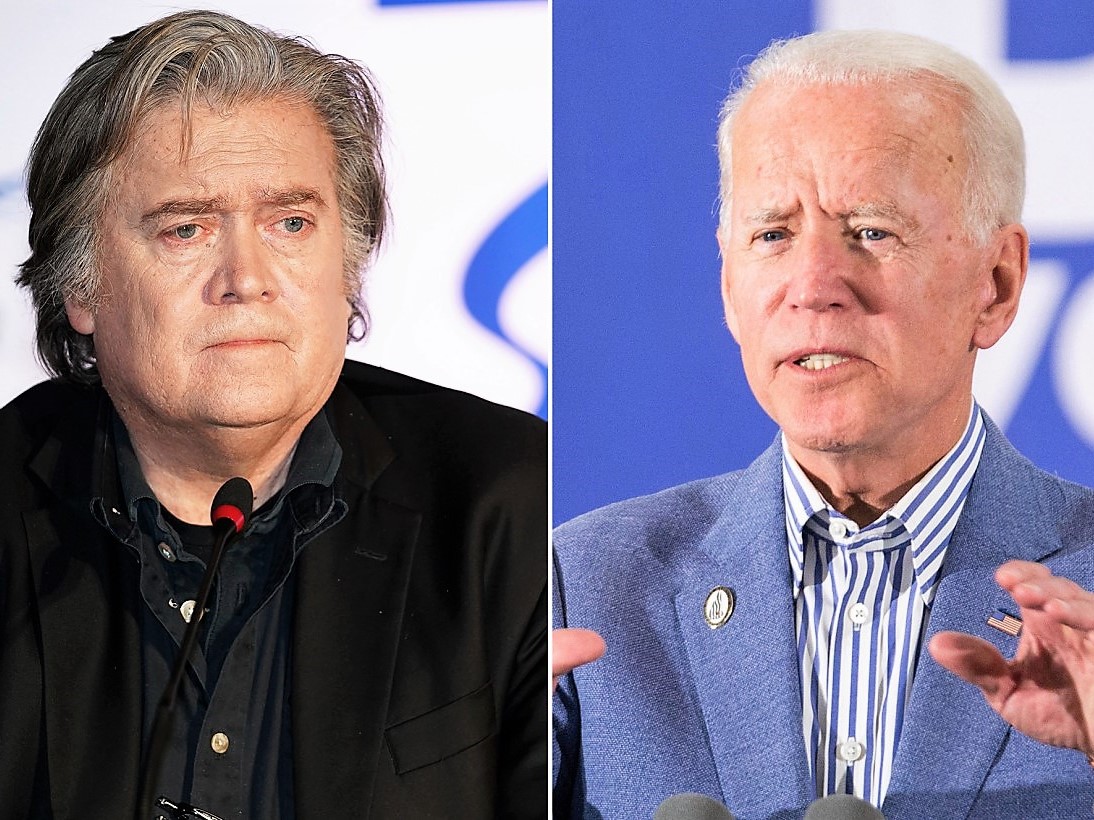

Some few months into primary season, Joe Biden is the Democratic front-runner. But his narrative isn’t – it remains distinct from the issues that appear to be defining the written and spoken dialogue about the election. Above all, it remains distinctly negative. Will the left-pivot gambit pay off?

Bannon and the rest of the America First brigade (which includes a LOT of bedfellows you see all the time on CNBC, like Kyle Bass) are going full-McCarthy. They’re going to have a “list”. They’re going to accuse anyone and everyone of “treason”.

It’s part and parcel of the China narrative transformation that Rusty and I have been talking about for a month now: the US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.

Certificate programs like “Impact Investing for the Next Generation”, a course offered by Harvard’s Kennedy School and the World Economic Forum (yes, the Davos guys), are a great way to fleece the suckers. And by suckers I mean rich Asians.

I know of which I speak. Because I used to do the fleecing.

It’s the Weekend Zeitgeist, in which a lovely sentiment is enough to convince us to include a soccer piece, a thoughtful observation on symbols is enough to convince us to include a Gawker piece, and language colors what we treat as acceptable political views.