There are two narrative structures that have grown to a size and a level of cohesion that makes them impossible to be politically ignored.

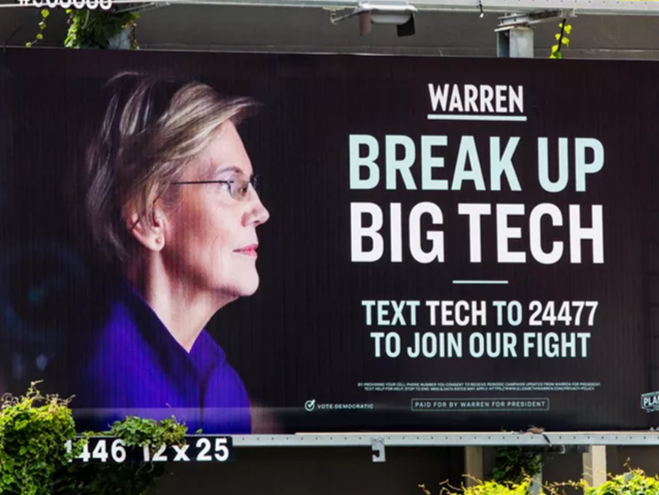

One is the student loan “crisis”. The other is the Big Tech “monopoly”.

And yes, I’m putting those words in air-quotes, because the first isn’t really a crisis and the second isn’t really a monopoly. But since when did that matter in narrative-world?

Vanguard just announced a joint venture with Ant Financial in Shanghai. They’re not waiting around for a trade “deal”, and they’re not clutching their pearls about Chinese IP “theft”.

No, Vanguard is going to do what they always do … they’re going to obliterate their competition with the pricing power that comes from government collaboration.

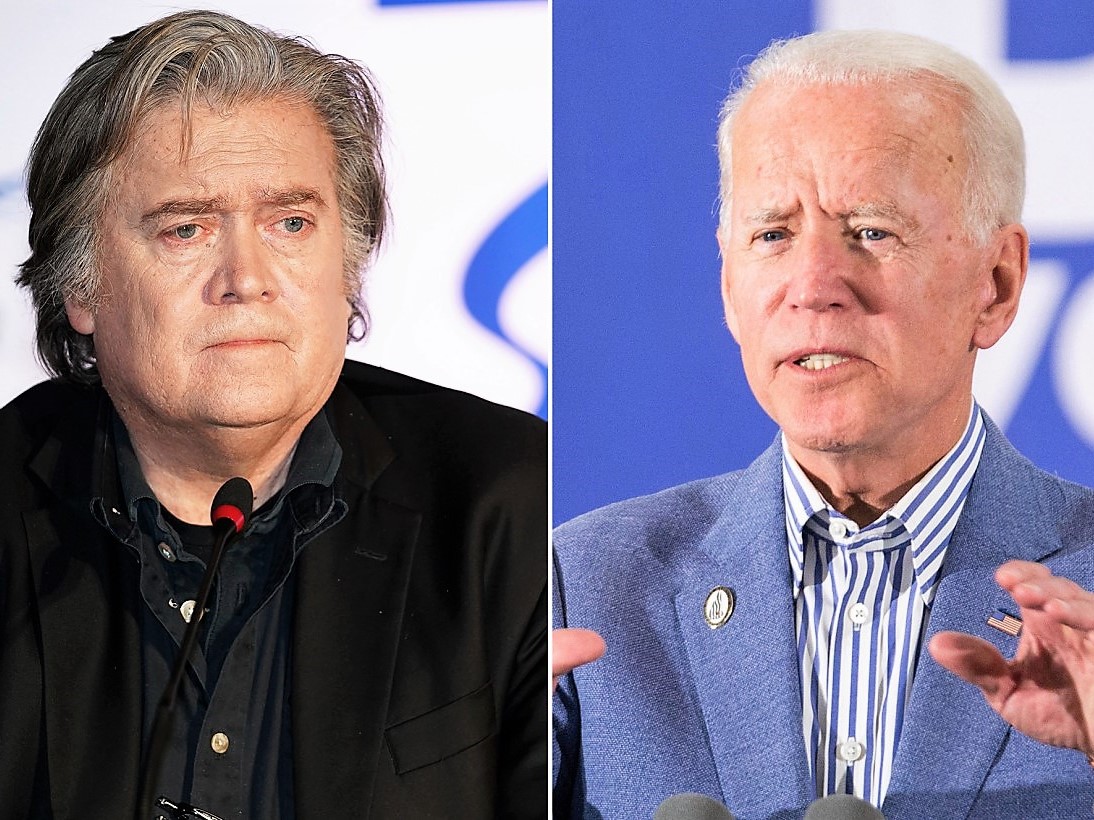

Some few months into primary season, Joe Biden is the Democratic front-runner. But his narrative isn’t – it remains distinct from the issues that appear to be defining the written and spoken dialogue about the election. Above all, it remains distinctly negative. Will the left-pivot gambit pay off?

Bannon and the rest of the America First brigade (which includes a LOT of bedfellows you see all the time on CNBC, like Kyle Bass) are going full-McCarthy. They’re going to have a “list”. They’re going to accuse anyone and everyone of “treason”.

It’s part and parcel of the China narrative transformation that Rusty and I have been talking about for a month now: the US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.

Certificate programs like “Impact Investing for the Next Generation”, a course offered by Harvard’s Kennedy School and the World Economic Forum (yes, the Davos guys), are a great way to fleece the suckers. And by suckers I mean rich Asians.

I know of which I speak. Because I used to do the fleecing.

It’s the Weekend Zeitgeist, in which a lovely sentiment is enough to convince us to include a soccer piece, a thoughtful observation on symbols is enough to convince us to include a Gawker piece, and language colors what we treat as acceptable political views.

Any shift in the Trade narrative away from economic issues and toward national security issues is highly problematic for a market-friendly resolution in US-China negotiations. Why? Because the political stakes are much higher for both Trump and Xi in a national security game of Chicken than they are in an economic game of Chicken. It is much easier to be “the chicken” in an economic game and claim some sort of face-saving feature than in an national security game, so the latter is almost always a protracted affair of brinksmanship and high stress.

It’s happening.

Nancy Pelosi’s chief of staff is now Facebook’s chief lobbyist. Big Tech just gave the Internet Freedom Award to Ivanka Trump. The head of the antitrust division of the Justice Dept. is a former Google lobbyist.

They’re. Not. Even. Pretending. Anymore.

Great Truths can be important engines for social unity and shared identity. In the hands of some, however, they can become tools for obscuring actual truth – facts – in service of cynical use of the emotional memes attached to those Truths.

The narratives of Central Bank Omnipotence and Trade & Tariffs have merged into a superstorm.

We are tracking its movement across the map of narrative-world, and as you might expect … it packs a punch.