It’s the Friday Zeitgeist, in which people who will never buy a company learn how to do it, Powell delivers a belly-rub and takes away a child’s cookie jar simultaneously, Swiss francs climb the Zeitgeist ladder, a local bank makes it up on volume, and we all declare together that an OK faux-hamburger is more than just a faux-hamburger.

Content placement by asset managers is like the elaborate red pouch of the male frigate bird. It is SO wasteful and extravagant that – in an economically perverse way – it demonstrates your evolutionary fitness.

Ditto for why the sell-side still cares about II ratings and “who’s the ax?” and all that stuff that hasn’t mattered for 20 years.

It’s plumage.

At some point, all Fed Chairs learn that their primary function is just to wave their hands. Jay Powell has learned this sooner than most.

ET contributor Pete Cecchini goes way off the Wall Street reservation with this: the bullish Narrative for U.S. equity risk makes sense only if one accepts a narrative that the Fed will proactively move to prevent a U.S. slowdown before it happens.

Don’t believe it.

Berkshire Hathaway’s financing for Occidental is in the Zeitgeist today.

What is shadow banking? THIS.

Not that there’s anything wrong with it. Hey, this is Uncle Warren’s true face, and I’m a fan of authenticity in all its forms and ways. But if you think poorly of a guy like, say, Ken Griffin because you think Citadel was “bailed out by the US taxpayer”, and you don’t think EXACTLY the same about Warren Buffett and Berkshire Hathaway … then you’ve been played.

It’s the Tuesday Zeitgeist, in which we explore how you could go with this (or you could go with that), the power of AS, my respect for you, IPOs aplenty and the trade/rotation of choice.

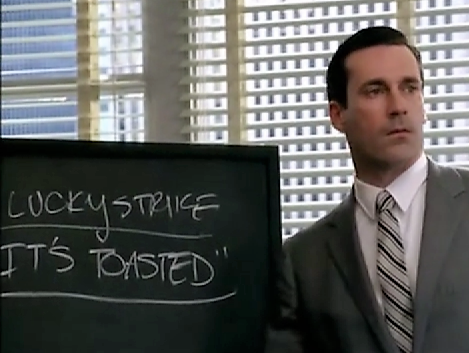

When Donald Trump tells you that there’s no inflation, that up is down and black is white, that monetary policy … It’s toasted! … you’ve gotta believe him, right? Right?

Actually, for investment purposes, you do. When everyone knows that everyone knows that inflation is dead, that IS the Common Knowledge. And the common knowledge must be respected.

The student loan crisis is a Big Deal. And it is only a part of a Bigger Deal: the Myth of College.

This issue will be front-and-center in the upcoming elections. We will all be handed our very own ‘Yay, College’ signs to raise high. More often than not, we will be asked to raise them in service of market-distorting policies which will make our problems worse.

Our lead article today is about Uber (driving-as-a-service) and Amazon (shopping-as-a-service). It’s the triumph of on-demand everything, that makes both production and consumption an experience.

What do you get out experiential consumption and production?

You get to hold up a card that says, “Yay, swineherding!”

It’s the Weekend Zeitgeist, which means we leave the world of finance behind us to delve into bipartisan distrust of government, local opinion writers’ opinions on packaging materials, Yoopers, F-35 sales to completely trustworthy foreign partners, Fiat Features and the worst thing I ever saw.

Yeah, we’re at that point in the cycle where you will be told about all the wonderful opportunities provided by levered private REITS.

For your IRA.

Because of all this craaaazy volatility in the stock market.

That and the President’s Cheif Economic Advisur tells us why “Dow 36,000” is just the tip of the iceberg.