Ben and Rusty discuss games of chicken and multi-level games, and where we think the previously complacent trade and tariffs Narrative has gone in early May.

Each month we update our five narrative Monitors and summarize the main findings from each.

The big reveal for May? There’s a tremendous amount of narrative complacency out there, particularly on Trade and Tariffs, which means this market has a long way down if the narrative focuses on negotiation failure. It’s not focusing there yet, but that’s what you want to watch for.

Cheer up, farmers! Sure, you f’d up by trusting our current frat house leadership, but I’m sure that the crack team at USDA has a great plan in the works to buy up all your soybeans and corn and give it away to the poors.

Will that work?

Hey, it’s gotta work better than the truth.

It’s the Weekend Zeitgeist, where we leave the world of finance for a day, in which high costs of credit and criminal justice remain top-of-mind concerns, Bulgaria stems the tide of its brain-drain, Reuters publishes straight opinions as news, Stephen Moore goes on Glassdoor, and we all succumb to the collective solipsism of nostalgic reverie.

It’s the Friday Zeitgeist! In which we explore new ecological niches, dust off our not-so-dusty trade war battle plans, announce the latest winner of “Who’s Going to Blame Risk Parity First”, and talk fairness and Fair Isaac.

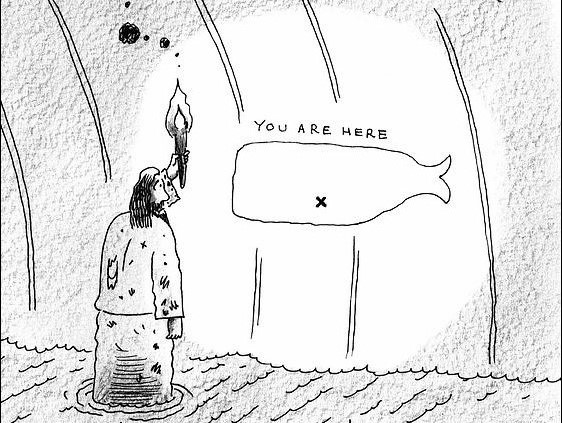

Hyper-awareness of narrative, memes and cartoons can become paralyzing. Once we see them, we see them everywhere. But much of that paralysis comes because the demands of Clear Eyes are less than the demands of Full Hearts. And it’s the latter – identity – that truly matters.

Process stories (what’s happening behind the scenes at the campaign / the White House / the locker room / the negotiations) are the original Fiat News. They are designed to make you angry and further the aims of whoever sourced the “news”.

Who benefits from making you angry at China and their “reneging” on a deal that never existed in the first place?

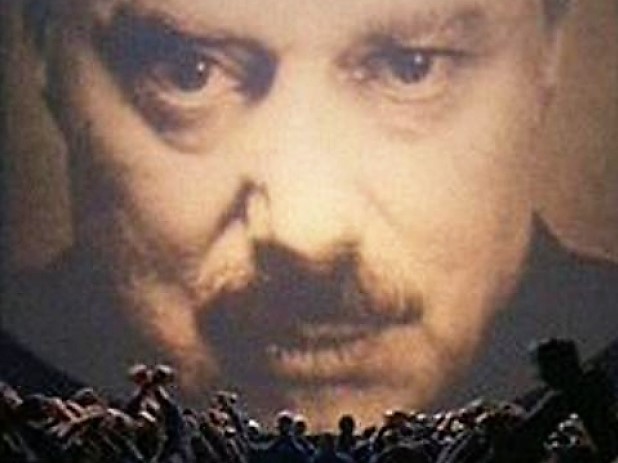

Oceania has always been at war with Eastasia. Or was it Eurasia? I don’t seem to remember so well these days.

It’s the Wednesday Zeitgeist, in which we get the updated odds on the China Trade War, the updated ways to play the odds on the China Trade War, two quasi-sovereign oil & gas operators’ investments in blockchain-as-a-service, financialization again, and a reminder that what is dead may never die.

Ever wonder why you don’t ever get hit with a year-end taxable gain from ETFs like you do with mutual funds? They use a legal (for now) pseudo-wash trade with in-kind redemptions.

Now Vanguard is doing the same thing with their mutual funds. And get this … they’ve filed a patent on this.

So amazing that I’m not even mad.

Wage stagnation in 2016 was actually much worse than you were told. Did this make a difference in the Midwestern states that swung the election, in that actual labor conditions were worse than everyone thought they were? I think yes.

Wage growth in 2018 was actually much better than you were told. Did this make a difference in the current Fed/Wall Street/White House narrative that inflation is dead and the easy money punchbowl can be maintained without consequence? I think yes.

For a few days, we’re making this ET Professional note available to everyone to review. We think the ET Pro service is something that every portfolio allocation, wealth management and active investment team can find useful, particularly for risk management.