I’d like to tell you that our Narrative Monitors are not as bearish for May as they were for April.

Yep, I’d really like to tell you that.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

The big global risk today is not that the banks are undercapitalized. No, the big global risk today is that banks are unwilling to provide long-term financing for anything. The big global risk today is that we are only in the early innings of a profound deleveraging cycle.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

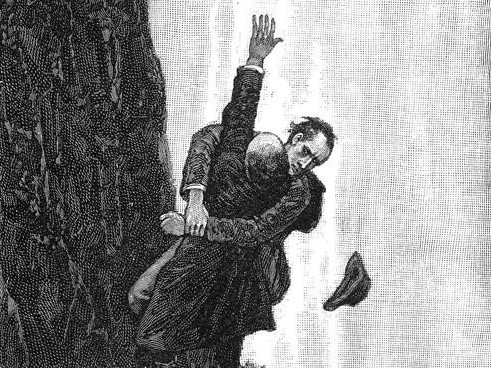

We’ve all fallen victim to a bad retcon at some point in our lives. It’s Sherlock Holmes coming back from the dead. It’s the reveal that an entire season of Dallas was only a dream. It’s the author changing their mind and trying to convince you that it’s all part of the plan. I don’t buy it. And neither should you.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

The Fed’s rate hikes to curb inflation?

Not gonna make it.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

The narrative puts and takes of March (and the resulting market rollercoaster) have coalesced into no puts and all takes. This is about as bearish a set of narrative signals for risk assets as we’ve had in a long time.

What does your money/happiness curve look like? Is it curved or linear? Does it flatline somewhere? If so, where?

There’s the game of trading and the metagame of life. To win the latter, you have to Know Thyself.