In our kick-off episode, Ben, Matt and Jack talk about why we’re here – to break open the news reported by mainstream media to reveal the Nudging language of Narrative and story that drives us.

We focus on the reporting of inflation as a perfect example of what we call Fiat News.

Recession – like beauty – is in the eye of the beholder. Unlike beauty, though, our economic perceptions are far more likely to fall into the self-imposed traps of cynicism and nihilism.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

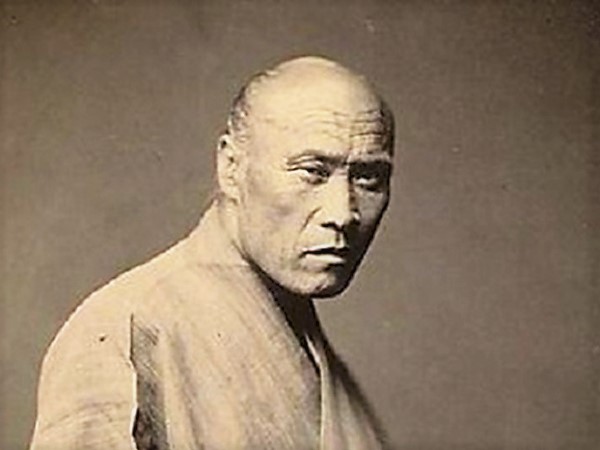

This is the Way.

Not just for the samurai but for the trader.

A revamped Cursed Knowledge is back! In this brand new episode, Ben joins Harper in the studio to talk about the all too common trope of killing off female characters to motivate male characters. Trust me, you’ve seen it. It’s everywhere and can tell us a lot about how hard it is to capture and maintain an audiences attention.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

Well, it’s been about three weeks since my “feel it in my bones” email describing why I think the next investable (+/- 7% or so) move in equity markets is down rather than up.

I still think that’s the case.

Recent major media stories that feel to us like they’re part of a larger Narrative campaign.

Physical viruses sometimes jump from one species to another.

Narrative viruses sometimes jump from one culture to another.

All it takes is the right virus and a susceptible host.

Narrative viruses are not immune to events in reality world – especially when we have made those narratives part of our identity.

And when a narrative becomes part of our identity, it changes what we need to be true.