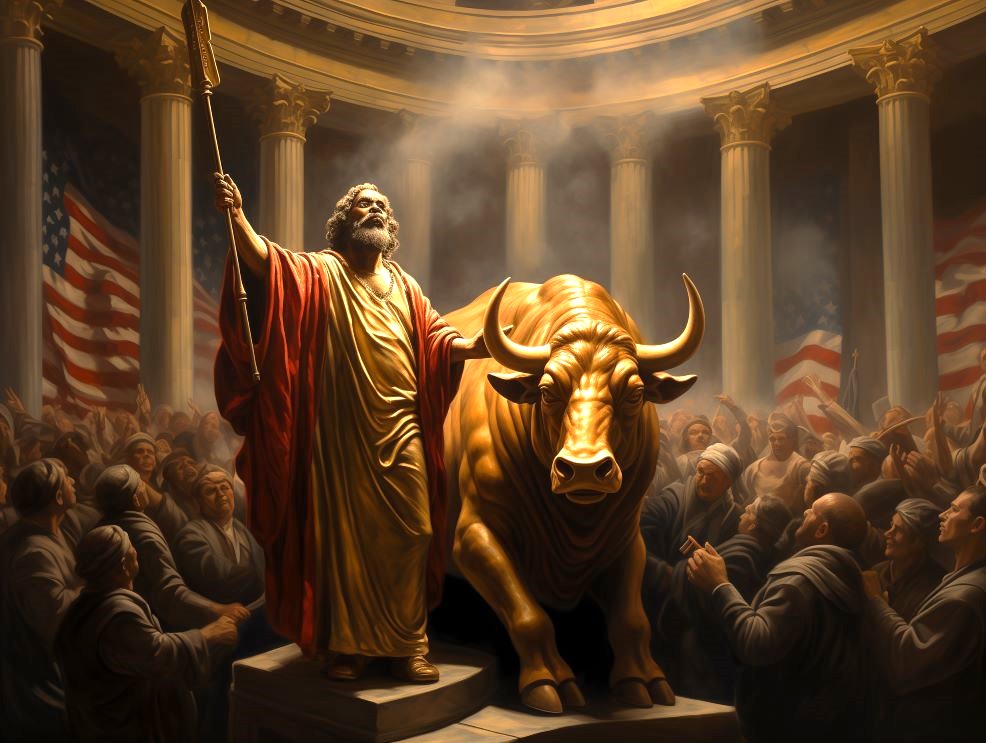

The ‘monomyth’ or Hero’s Journey isn’t just a script for movies. It’s also the script of our society and our individual lives.

If we let it.

In this episode of The Intentional Investor, host Matt Ziegler interviews Howard Lindzon, the founder and CEO of StockTwits. Lindzon shares his journey from aspiring comedian to stockbroker, entrepreneur, and investor, highlighting the importance of mentorship, tight networks, and adaptability in the ever-changing landscape of business and technology. The conversation covers Lindzon’s early investments in companies like Robinhood and eToro, the evolution of social media platforms like Twitter and YouTube, and the lessons he’s learned from navigating bull and bear markets.

My spidey-sense is no longer tingling like crazy about the overall rise in scale and scope of private credit. It’s a profound shift in the core social function of credit provision to the real economy, but I think it moves systemic risk around rather than creating new systemic risk.

The associated transformation of the insurance industry, on the other hand …

Free is a good price. It’s how we got Fortnite, and Radio, and a terrible internet. People hate paying for things.

That’s what Fidelity was counting on when they decided to make a stink about 9 ETF issuers not signing their revenue sharing deal.

And they’ll win. They always win.

In this episode of Breaking News, we examine the recent situation with NPR and how it relates to the concept of Fiat News. We also delve into the current state of tensions between Iran and Israel and why we may see a ‘phony war” in the coming months. Additionally, we examine the underwhelming sales of Tesla’s Cybertruck and the broader decline of the EV Narrative. We also have a dumb question about expansion of NATO and a Cultish Corner on Conan O’Brien’s masterful appearance on the show “Hot Ones”.

In this episode of the Intentional Investor, Matt Zeigler and Justin Castelli explore the intersection of life and investing, discussing the importance of aligning your financial plan with your personal values and vision. Justin shares his unique perspective on setting goals versus having a vision, emphasizing the significance of investing in experiences, relationships, and intellectual property rather than solely focusing on traditional financial metrics. The two discuss the role of financial advisors in helping clients live authentically and the potential for an abundance mindset within the financial system. Justin also touches on his aspirations to support others through creative ventures and the generational wisdom he hopes to pass down to his children.

Gambling is a big deal. And everyone’s got an opinion one way or another. It’s had a pretty insane increase over the last few years. But what happens when Gambling becomes gambling? When it stops being a grand event and is instead a much more insidious and, well, casual thing. Spoiler Alert. Nothing good. It’s now showing up everywhere. From sports, to finance, to politics, to videogames. It’s rarely obvious gambling, and that’s what we need to be worried about.

It doesn’t happen often, but every few years there’s a real-world shock that leaves the old narrative structures standing but eliminates all the people who believe strongly in them. These events are like neutron bombs for narrative-world, and that’s how I’d describe Iran’s attack on Israel this weekend.

In this episode of The Intentional Investor, Matt Ziegler has a wide-ranging conversation with Ben Hunt, discussing Ben’s journey from academia to finance and the pivotal moments that shaped his career. Ben shares his lifelong fascination with games, puzzles, and cracking codes, which eventually led him to the world of investing. They delve into Ben’s experiences in academia, the lessons he learned from starting a software company, and his realization that fundamentals and value in investing are ultimately driven by narratives and game theory. Ben also discusses the genesis of Epsilon Theory, and his ongoing quest to find structure in unstructured data and stories. Throughout the conversation, they explore the interconnectedness of human, intellectual, social, and financial capital in shaping one’s life and career.

If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.