ET Intro

Of all the notes we've written, these are some of our favorites. These are the notes that we (and our readers) keep coming back to and have created the foundation of Epsilon Theory.

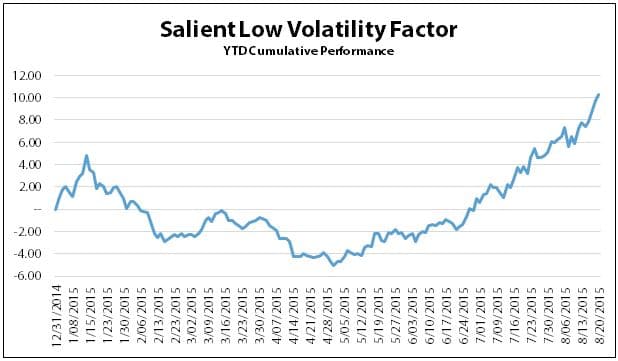

Our times require an investment and risk management perspective that is fluent in econometrics but is equally grounded in game theory, history, and behavioral analysis. Epsilon Theory is my attempt to lay the foundation for such a perspective.

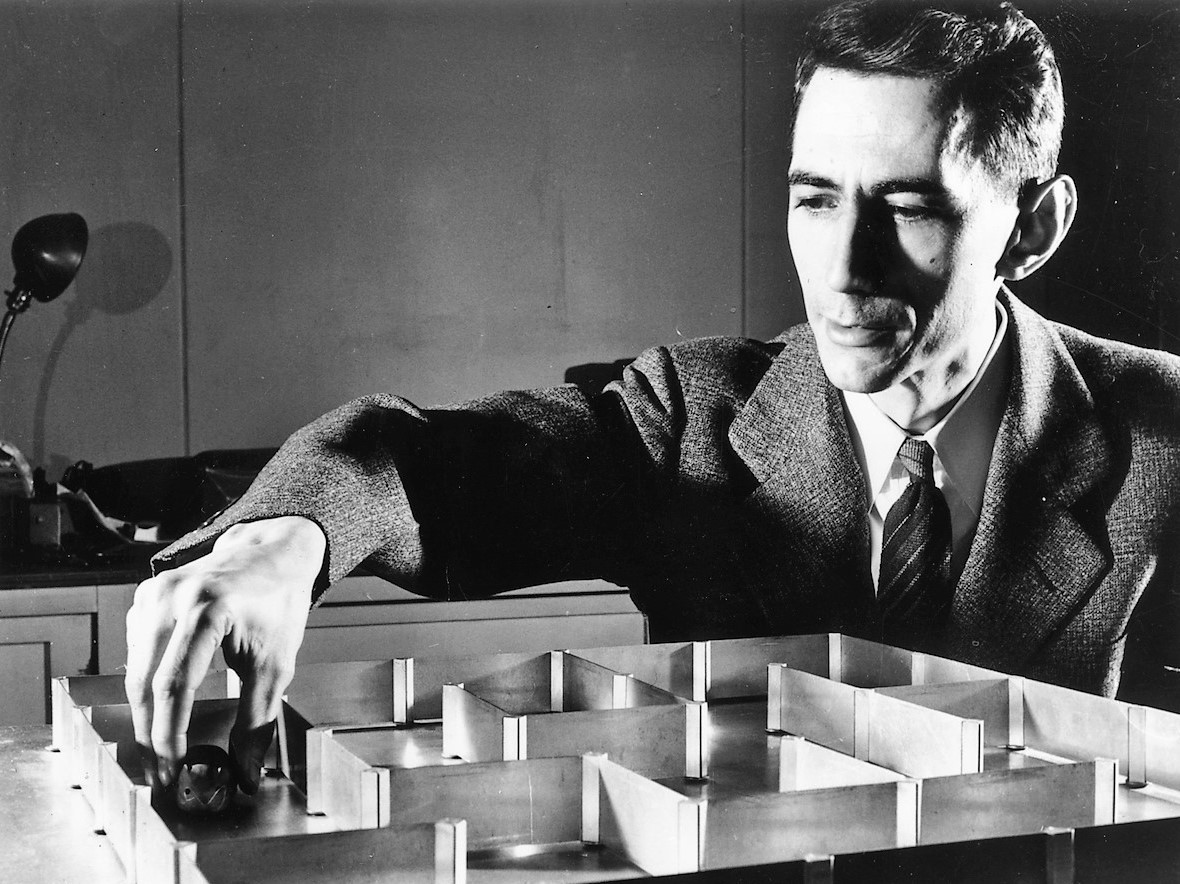

The first ET note focused on Information Theory.

“Tattaglia is a pimp. He never could have outfought Santino. But I didn’t know until this day that it was Barzini all along.” – Don Vito Corleone

Same with Emerging Market growth narratives. It was Developed Market monetary policy all along.

The Three Types of Fear: The Gross-out: the sight of a severed head tumbling down a flight of stairs. It’s when the lights go out…

“So, in the interests of survival, they trained themselves to be agreeing machines instead of thinking machines. All their minds had to do was to discover what other people were thinking, and then they thought that, too.” – Kurt Vonnegut

If there’s a better description of modern markets, I have yet to find it. We have become agreeing machines.

The problem with magical thinking run amok and its perpetuation of a fantasy world is that sooner or later the dream of the delusional king becomes a real world nightmare for real world people. It’s time to wake up.

Don’t get me wrong. I’m thoroughly despondent about the calcification, mendacity, and venal corruption that I think four years of Clinton™ will impose. Trump, on the other hand … I think he breaks us. Maybe he already has. He breaks us because he transforms every game we play as a country — from our domestic social games to our international security games — from a Coordination Game to a Competition Game.

The inevitable result of financial innovation gone awry, which it ALWAYS does, is that it ALWAYS ends up empowering the State. When too clever by half people misplay the meta-game, that’s all the excuse the State needs to come swooping in and crush them, just as they are with Bitcoin today they did with Bear and Lehman in 2008. Installment #10 from Notes from the Field.

Part 1 of a three-part series on what it means to have a polarized electorate and a monolithic market. Today’s note: the Age of Ridiculousness and the decline and fall of the American Empire.

The Long Now is everything we pull into the present from our future selves and our children.

We are told that the economic stimulus and the political fear of the Long Now are costless, when in fact they cost us … everything.

Tick-tock.

This is not a chronicle of errors and mistakes made during COVID-19.

This is the story about the inevitable, simultaneous failure of each of the institutions designed to operate in our interest.

It is the story of how we respond to fragility with resilience.

The American Medical Association is not a charitable organization.

The American Medical Association is not an educational organization.

The American Medical Association is a tax-exempt hedge fund and licensing corporation, designed from the ground up to enrich its executives and serve its own bureaucratic interests.

Burn. It. The. Fuck. Down.

You have been told that the odds are ever in your favor. You have been told this for your entire life. More and more, you suspect this is a lie.

You have been told a new story. A brave story. That by banding together and acting as one, you can “democratize” the stock market. Today, as you see the collapsing stock prices of the companies you supported, you suspect that this was a lie, as well.

I want to change the language of crypto from mining to growing. I do not mean this in a metaphorical sense. I mean a proof-of-plant method for literally growing cryptocurrency tokens as a representation of the value stored in the human cultivation of plants.