Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

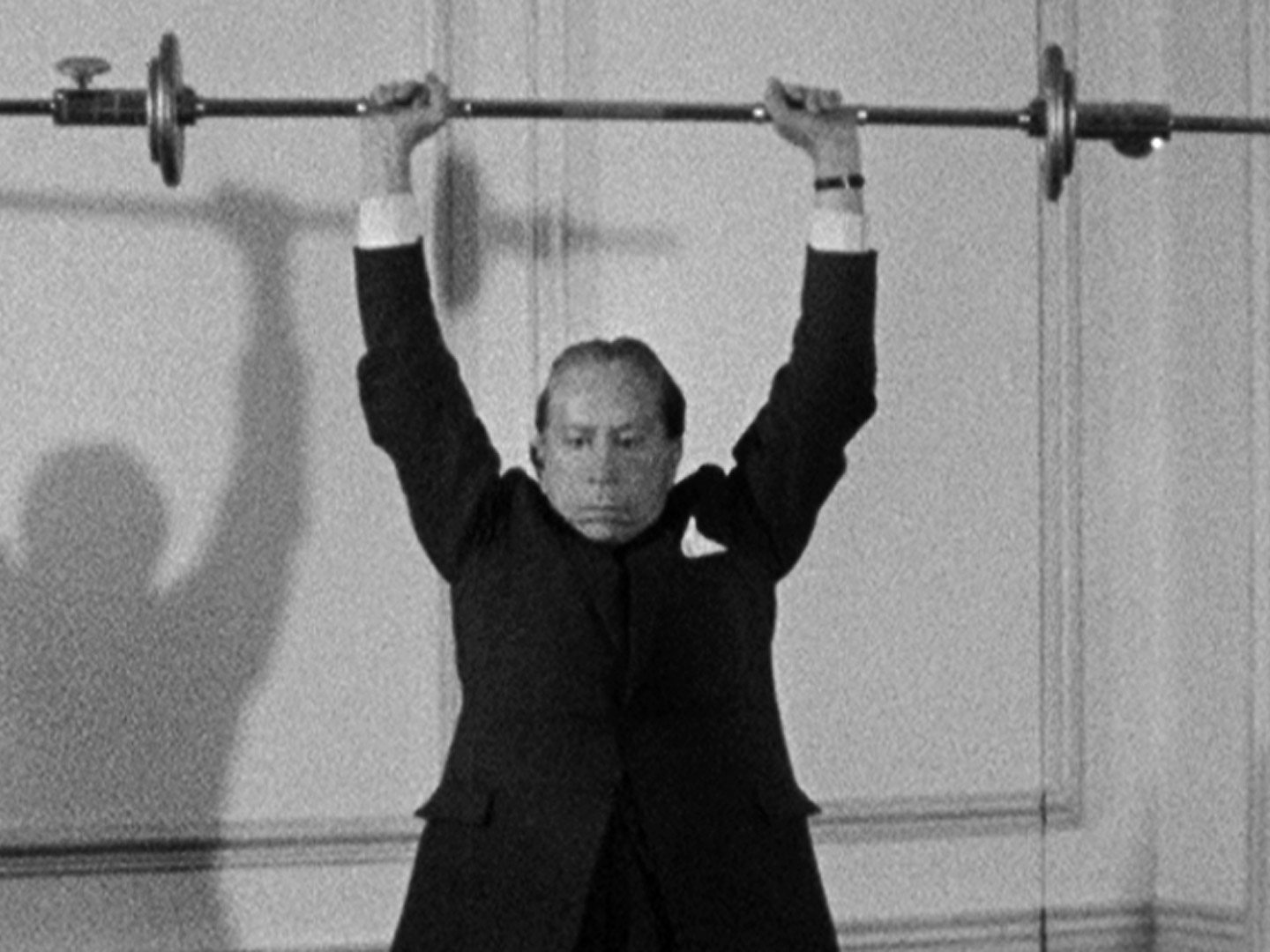

Written during last week’s sell-off, ET Contributor Peter Cecchini coins a phrase – The Portnoy Top.

What do you get when you combine Barstool Sports and Printer Goes Brrr?

Our bi-modal political environment doesn’t just impact our politics. It shapes our social and cultural narratives and channels our responses to every event.

Yet Americans are large. They contain multitudes. And they can reject the political archetypes into which narratives seek to channel them. If this is to be our finest hour, then they must.

ET contributor Demonetized is back, grappling with some investment themes here at the end of the beginning.

The skinny: deep value is at best a tactical trade. At best.

ET Contributor Pete Cecchini looks at the monetary and fiscal policy stimulus coming out of Washington and sees a staggering price to pay in lost real growth and massive institutional corruption.

We have written that one of the major social changes occurring at present is the transformation of capital markets into public utilities.

The COVID-19 pandemic and policy response have accelerated that transformation. It is now the water in which we swim.

There was no greater sin between 2009 and 2020 than enduring a ‘constant drag on returns’. This is the Meme of Yay, Efficiency!, and it permeates every layer of our economy and markets.

ET contributor Peter Cecchini makes a strong case that the Fed is playing a dangerous game with its constant use of the “exigent circumstances” exception to Section 14 of the Federal Reserve Act.

Does the alphabet soup of new facilities and SPVs established by the Fed in recent weeks amount to an illegal taking of assets? It’s a reasonable question.

Even more reasonable: if not here, where do you draw the line?

The oil Narrative is not as it seems.

The White House and others assume the Saudis and Russians are at odds. Don’t be so sure. Their interests are aligned around disabling U.S. production. Period.

There is no country in the world that mobilizes for war more effectively than the United States. And I know you won’t believe me, but I tell you it is true:

This will be #OurFinestHour.

We have been asked to discuss our views about the CARES Act. In order to facilitate future such requests, we have provided what we hope to be a helpful rubric.

Saying that “America needs to reopen for business” isn’t the same thing as doing what we need to reopen America for business. Words matter, but actions matter more.

Let’s do the right things. Now.

This is our personal effort to help identify *need*, *sources*, and *money* for personal protective equipment distributions to healthcare workers and first responders.

When people stop asking “How much worse is this going to get” and start asking “How much longer is this going to last”, things really start changing.

But we can change that, too.

Levering up a portfolio based on a model that we know cannot act as a representation of the state of the world is perilous.

Doing the same with a country is far, far worse.

In a potential recession, need isn’t evenly distributed. In a pandemic, that’s even more true. The time to start helping is now.

Originally published in Quillette, it’s the Epsilon Theory take on Don’t Test, Don’t Tell” – the single most incompetent, corrupt public health policy of my lifetime.

Second Foundation Partners is looking for a new member of the team to help us spearhead the development of technologies for narrative analysis.

Two weeks ago we were being told about the coronavirus outbreak. This week we are being told how we should think about it. Right or wrong, it is important to have Clear Eyes about this kind of Fiat News.