Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

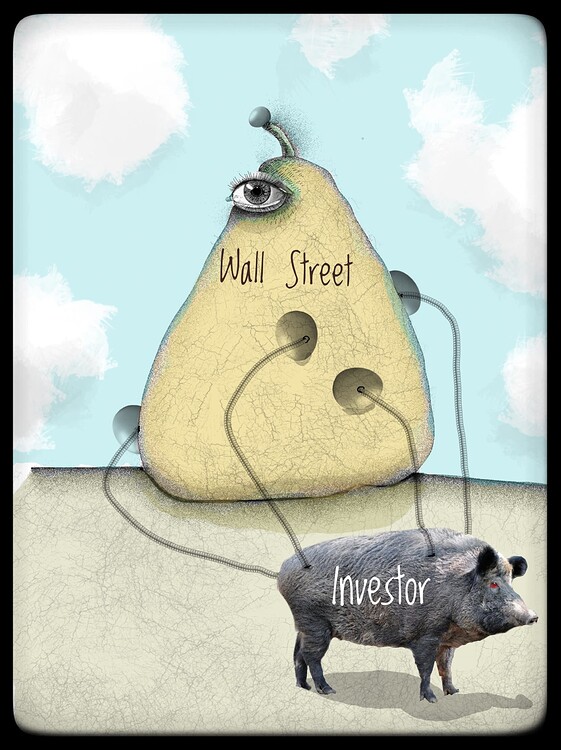

No, the real story here probably isn’t about a revolution against Wall Street. But that doesn’t mean that there isn’t an opportunity to build a movement – right now – to transform it toward fair, free and open markets.

The South African variant virus (501.V2) is not the immediate threat to the United States as the UK variant virus (B117). But 501.V2 has the potential to create a far more powerful Narrative – vaccine resistance – that can have a greater market impact than the more pressing issues of B117.

More and more, I think the variant viruses create a tradeable event for markets.

Everything you always wanted to know about r/Wallstreetbets and Gamestop*

*but were afraid to ask

The spread of B117 in a Covid-fatigued country like the US is a profoundly deflationary, risk-off, dollar higher, flight to safety event in real-world.

Does it matter to market-world?

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

In episode #3 of the Epsilon Theory podcast, Rusty and I discuss the spike in Covid cases in Ireland and the risk of seeing a similar “Ireland Event” here in the US.

The time to act is NOW, not with indiscriminate lockdowns, but with strong restrictions on international and domestic air travel to contain the UK-variant virus while we accelerate vaccine delivery.

I believe there is a non-trivial chance that the United States will experience a rolling series of “Ireland events” over the next 30-45 days, where the Covid effective reproductive number (Re not R0) reaches a value between 2.4 and 3.0 in states and regions where a) the more infectious UK-variant (or similar) Covid strain has been introduced, and b) Covid fatigue has led to deterioration in social distancing behaviors.

There is a brief window where I think we have the opportunity to commit to building a common national identity together. Seizing this opportunity will mean leaving a lot of anger we will feel is entirely justified at the door.

Not seizing it, I fear, will mean that we all reap the whirlwind.

ET contributor Pete Cecchini isn’t buying the reflation / small-cap rally narrative, even with a mini Blue Wave.

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

A conversation with Brian Portnoy, author of The Geometry of Wealth, about the role of money in shaping a life of meaning. How do we give better advice about money to others … and to ourselves?

As Monty Python would say … and now for something completely different.

It’s JPow fanfic day here at Epsilon Theory! Or “every day” as they refer to it on Wall Street.

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

It may seem ironic that a narrative about the long-term could be deployed to distort the rewards of effective, market-based long-term capital allocation for short-term benefit.

This is, I think, the heart of The ZIRP Paradox:

The myth of infinite horizon investing is the enemy of long-term investing.

So an agent for a new over-the-top variety act finally gets a meeting with the biggest producer in the world. I mean, maybe ‘the world’ is selling it short. Word on the street is this guy’s even got God’s ear, if you can believe it.

In this kick-off Epsilon Theory webcast, I’m joined by renowned cryptocurrency miner and trader @notsofast for a wide-ranging conversation on Bitcoin and crypto. Here’s the core topic:

Can Bitcoin preserve its revolutionary potential after a Wall Street bear hug?

I’m highly skeptical, but @notsofast has some ideas on how to make this work.

The merger between the Treasury and Fed is now complete with Janet Yellen’s apparent appointment as the Secretary of the Treasury. Let the self-fulfilling market narratives begin!

These are The Ghosts of Wall Street Commentary Future. And if their chains are not already clanking around in your inbox, they will be very, very soon.

COVID-19 is endemic, and its mutations will likely be part of our lives going forward.

But there is another disease this virus has caused, and it is a disease of the mind. It is the endemic mindset. And we can eradicate it.

Today.

There’s a moment when the real world peeks through the narratives that surround us, and we convince ourselves that this will be the truth that frees our fellow citizens/investors/neighbors from their delusions.

But truth is only one of the necessary conditions for this kind of change. The other?

Mercy.