Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

The Chinese real estate developer Evergrande is the epitome of Too Big To Fail. It is truly Ever Grande.

So what happens if it does, in fact, fail?

I think there’s a non-zero chance that the delta-variant becomes something that markets really are focused on. Maybe that happens months from now. Maybe days.

But until that happens, the delta-variant Narrative explaining markets is a wall of worry, an artificially easy hurdle to climb for a market that only really cares about a dovish Fed sticking to its transitory inflation story.

The language of practically every topic of any social importance is now defined by people discussing how other people are discussing it. It’s true for the environment, race, politics and now – violent crime.

Welcome to Metaworld.

I think this is how crypto can change the world. Not as “money” and not as Bitcoin! TM and not as a security and not as this speculative coin versus that speculative coin. Not by facilitating a market of goods, but by facilitating a market of GOOD.

What is Robinhood? It’s the conflation of gambling and investing. Which is … fine. I guess. But spare me the “we’re democratizing finance” BS.

Harvey Weinstein is a terrible person who did terrible things. But he doesn’t get nearly enough credit, or more accurately blame, for his role in destroying the integrity of the Academy Awards and fundamentally altering how Hollywood makes movies.

When a famous person shakes his or her finger at you, they’re not telling you a fact.

They’re telling you how to think about a fact.

The formation of new “asset classes” and their associated narratives is a fascinating sight.

Using Burford Capital as a case study, new ET contributor Bruce Packard gives us a great primer on litigation-finance-as-an-asset-class.

Over the last 6 months, there’s been a mass influx of new hedge fund PMs, many from bank trading seats leaving for greener (?) pastures. I’ve been in both seats. I’ve had good years and disappointing years. So I present this advice with the utmost humility …

The Fast and Furious movies are famous for intense action and ridiculous plots. But the truth about how these stories get made has more to do with the drama happening behind the camera than in front of it.

We write a LOT about work. And the responses we get are … weird.

Once again, the most important narratives are the ones we tell ourselves.

If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

The future of remote work after the pandemic ends has been a part of the zeitgeist for more than a year.

Now it IS the zeitgeist. It is also a narrative battlefield being actively conflated with a half dozen other major social and policy topics.

What is Deadly Theatre?

It’s corporate logos for Pride Month. It’s speaking gigs for Deborah Birx. It’s the cover up for Leon Black.

#BITFD

Lemonade (LMND) isn’t just an insurance company. No, no … they’re an AI Company! ™.

Plus Chamath is up to his old tricks.

I hate raccoons.

Mortgages are pretty standard fare in the world of finance, but the American version is special: it grants its user a free option to refinance if they can get a cheaper rate elsewhere.

Every lender thinks they can thrive in this market. But every lender can’t be right.

As a non-American there are many things I don’t understand about America.

Most of all though, I don’t understand the most American of products: the 30-year fixed-rate fully prepayable mortgage.

The Colonial Pipeline embarrassment will accelerate the US gov’t’s efforts to control and co-opt crypto.

Binance, Kraken, BitMEX … they’re all squarely in the wrathful gaze of the Eye of Sauron now.

Over the past four quarters, the United States has generated more wage inflation than at any point over the past 40 years.

This is not an anomaly. This is not a single quarter aberration. A wage-price inflation cycle is here.

I’m not predicting. I’m observing.

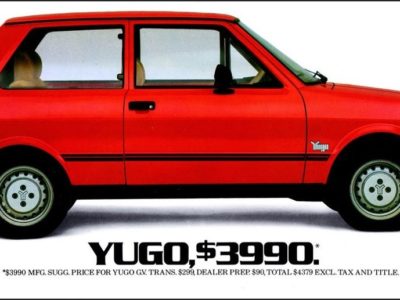

A Honda Accord cost $12,000 in 1990 and it costs $25,000 now.

A Mustang was $9,000 and now it’s $27,000.

The BLS has new car prices close to unchanged over the past 30 years.

ET contributor Brent Donnelly tries to wrap his brain around hedonic adjustments to CPI.