Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

On episode 17, Dr. Ben Hunt is joined once again by Downtown Josh Brown. He’s an author, CNBC contributor, and CEO of Ritholtz Wealth Management. The last time Josh joined the podcast was right after the first presidential debate. With the election and inauguration behind us, now what? Ben and Josh take on the proposed 2017 Fed rate hikes, the potential impact of a higher dollar, and what matters most in investing.

Over the past few weeks, I’ve had a fight with my wife and email spats with two of my best and oldest friends. In each case, I didn’t recognize that we weren’t really talking about what I thought we were talking about, and by the time I did recognize the real issues, I was already too far down the path of combative Ben to care.

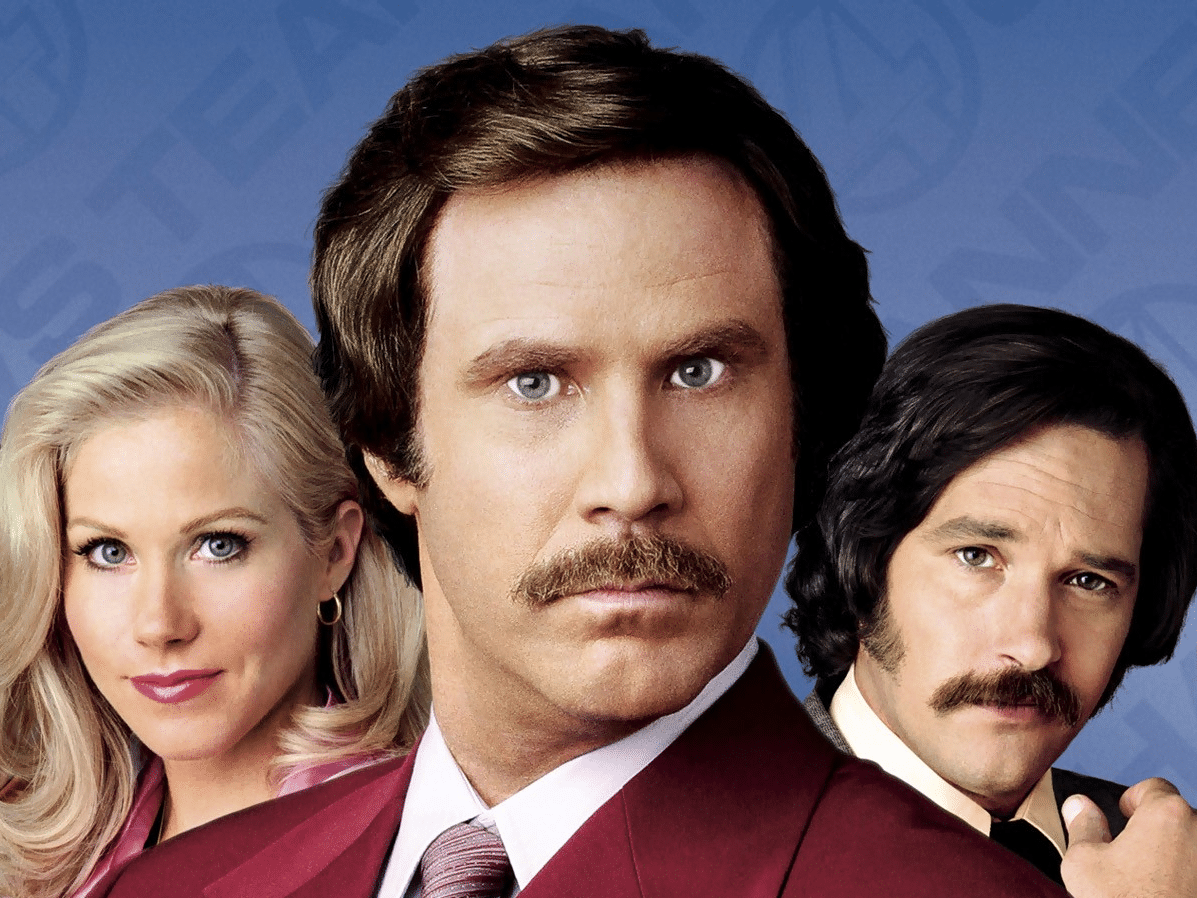

A new year and a new president. On episode 16, Dr. Ben Hunt is joined by Rusty Guinn, executive vice president of asset management at Salient, to explore when the media morphed from agent to principal.

In which Ben introduces the concept of fiat news, which is to “real news” what fiat currencies like dollars and euros and yen are to “real money” like a gold coin.

On episode 15 and the last of 2016, host Dr. Ben Hunt answers listeners’ questions about the Eurozone and what’s next in Italy, OPEC, and rates.

On episode 14 of the Epsilon Theory podcast, Dr. Ben Hunt is joined by Salient president and chief strategy officer Jeremy Radcliffe and co-CEO, chief investment officer, and portfolio manager from Broadmark Asset Management, Chris Guptill. As they explore how a Trump presidency might be similar to Reagan’s presidency and what a “no” vote in Italy could mean for markets, Ben and Jeremy are in awe of Chris’s encyclopedic knowledge of market history.

We often write about Common Knowledge – the game of markets. It’s time to talk about how to play it. So how can you be a better game-player? What are some specific strategies one can adopt to play the game of markets more effectively?

There are three questions I’d like to answer in this Epsilon Theory note: what did The Narrative Machine tell us about the market immediately before and immediately after the November 8 election, what am I preparing for now as an investor, and what am I preparing for now as a citizen? I’m giddy about the first, quietly confident about the second, and pretty darn depressed about the third. Could be worse, I suppose.

On episode 13 of the Epsilon Theory podcast, Dr. Ben Hunt is joined in San Antonio by Grant Williams, founder and publisher of Things That Make You Go Hmmm… and co-founder of Real Vision TV. It’s the day after the 2016 presidential election and time to explore how and why Trump won, what it might mean for markets, and where Dr. Hunt and Grant are turning their attention.

Every dog needs a job, and every investment does, too. No single dog can be all things to all people, and neither can a single investment. Nor can any pack of dogs accomplish anything and everything you like. The biggest mistake people make when they get a dog is trying to make the dog fit into the life they wish they led, rather than the life they actually lead.

On episode 12 of the Epsilon Theory podcast, Dr. Ben Hunt takes a trip down memory lane to look back on the cause of the 2008 financial crisis. He applies those lessons to today’s markets and upcoming election, and nostalgically shares what might boost his spirits.

I want to be a patriot again. I want to be a fundamental investor again. It won’t ever be exactly like it was before, but that’s okay. A renewed faith can be a stronger faith. It just won’t be a blind faith. It has to be a faith based on my own labor and my own time, a non-alienated patriotism and a non-alienated investment strategy. It has to be a political participation and a market participation based on who we are, not who we are paid to be.

On episode 11 of the Epsilon Theory podcast, Dr. Ben Hunt is joined by two of his daughters, Hannah Hunt and Harper Hunt, to find out if they have an anthem this election season: a rousing cause or political movement about which they feel passionate. They also discuss the role of government and if their difference of opinion is a result of a generational gap.

Don’t get me wrong. I’m thoroughly despondent about the calcification, mendacity, and venal corruption that I think four years of Clinton™ will impose. Trump, on the other hand … I think he breaks us. Maybe he already has. He breaks us because he transforms every game we play as a country — from our domestic social games to our international security games — from a Coordination Game to a Competition Game.

On episode 10 of the Epsilon Theory podcast, Dr. Ben Hunt is joined by Downtown Josh Brown, author, CNBC contributor, and CEO of Ritholtz Wealth Management. Ben and Josh discuss their reaction to the first presidential debate and what it would mean to have a President Clinton or a President Trump.

Here’s the thing. The Fed is now revealing its one True Love — its own reputation and its own political standing — and that’s going to be a bombshell revelation to investors who think that the Fed loves them.

We’re back in Houston on Episode 9 of the Epsilon Theory podcast. Dr. Ben Hunt is joined by Salient’s chief investment officer Lee Partridge and…

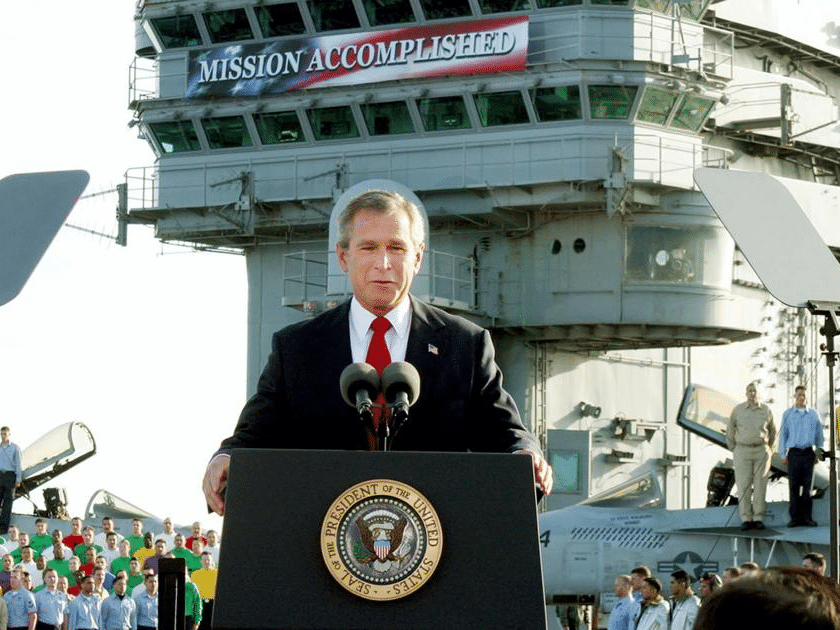

The problem with magical thinking run amok and its perpetuation of a fantasy world is that sooner or later the dream of the delusional king becomes a real world nightmare for real world people. It’s time to wake up.

Live from New York in episode 8 of the Epsilon Theory podcast, host Dr. Ben Hunt tackles LIBOR, the money market, and explores magical thinking…

“So, in the interests of survival, they trained themselves to be agreeing machines instead of thinking machines. All their minds had to do was to discover what other people were thinking, and then they thought that, too.” – Kurt Vonnegut

If there’s a better description of modern markets, I have yet to find it. We have become agreeing machines.