Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

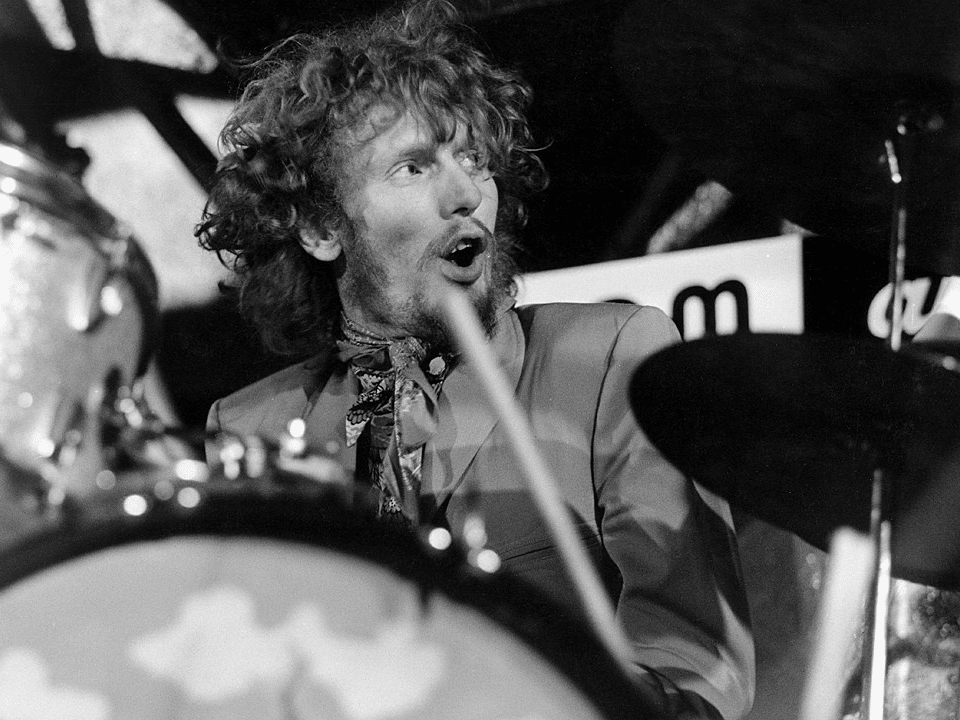

The behaviors that influence markets must be considered in context of archetypes, the languages and identities which group investors every bit as much as identity politics groups voters.

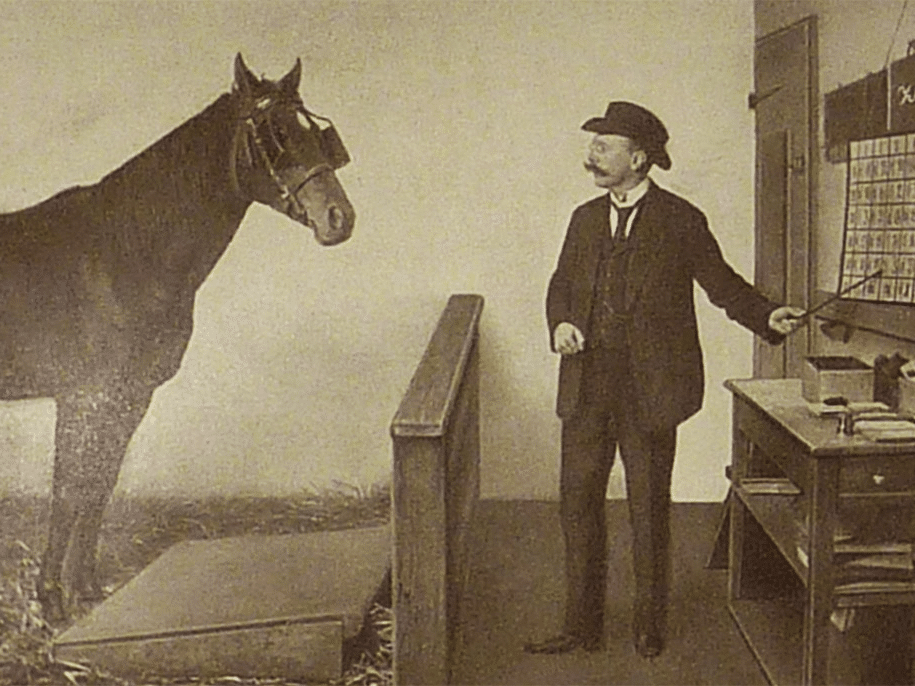

Part 7 of Ben’s Notes from the Field series reminds us that you don’t break a wild horse by crushing its spirit. You Nudge it into willingly surrendering its autonomy. Because once you’re trained to welcome the saddle, you’re going to take the bit. We are Clever Hans, dutifully hanging on every word or signal from the Nudging Fed and the Nudging Street as we stomp out our investment behavior.

When we try to define others’ Cartoon, we take away their agency, and strip away their humanity. And we do it with our clients, every time we guess what behavioral box they fit it.

On episode 25 of the Epsilon Theory podcast, we’re joined by Peter Cecchini, Chief Market Strategist, Head of Equity Derivatives and Cross-Asset Strategy at Cantor Fitzgerald, to discuss one of his recent notes, “Failure to Inflate.” As Peter writes, “The theories that guide monetary policy fail to explain why growth and inflation remain so low in developed economies.” Tune in to hear why this is and what might bring about higher inflation.

I’m limiting this week’s Rabbit Hole to three links which represent the rapid tick-tock of the trifecta of massively fast compute, AI algorithms and blockchain development as I believe that these are the top three technology mega-trends of the 2015 – 2025 period (ex-Life Sciences innovation).

In Part 6 of the Notes from the Field Series, Ben observes that we think we are wolves, living by the logic of the pack. In truth we are sheep, living by the logic of the flock.

A new idea called the “information bottleneck” is helping to explain the puzzling success of today’s artificial-intelligence algorithms — and might also explain how human brains learn.

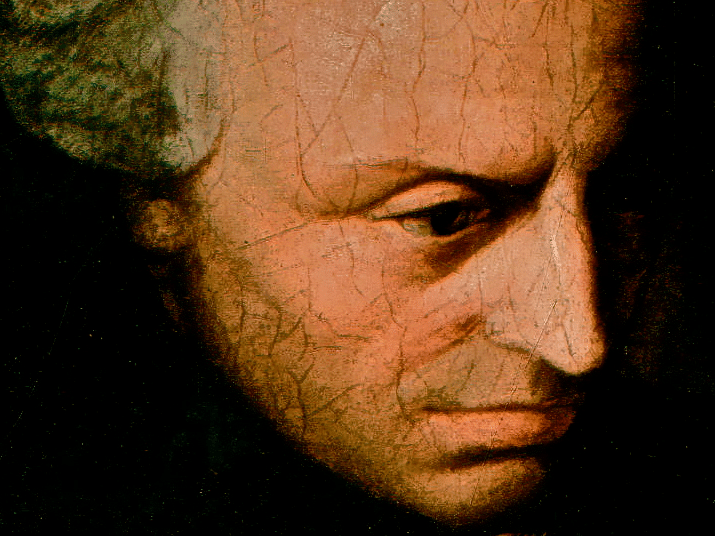

Benjamin Graham famously said that the market is a voting machine in the short run, and a weighing machine in the long run. This is a right-sounding idea. It is also wrong. Behavior matters over every horizon.

We’re back with episode 24 of the Epsilon Theory podcast! Ben shares his thoughts on the inflation Narrative and a new idea reminiscent of C-SPAN to make politics at every level more transparent and engaging.

This week’s Rabbit Hole column is more thematic with recent links that I found interesting around the topic of ‘news,’ on which Ben wrote the defining commentary of recent years with Fiat Money, Fiat News.

Back by popular demand, it’s the Epsilon Theory Mailbag! “Always Go To the Funeral” and “The Arborist” Another rifle shot to the crux of the…

Leonid Moroz has spent two decades trying to wrap his head around a mind-boggling idea: even as scientists start to look for alien life in other planets, there might already be aliens, with surprisingly different biology and brains, right here on Earth. Those aliens have hidden in plain sight for millennia…

What does the path of history tell us? What does the aftermath of one of America’s greatest natural disasters and human tragedies tell us? What can we do to survive and escape a Competitive Game that doesn’t allow us to pull away from the table? If you’re reading this, you’re probably in the investment industry, or at least have an interest in financial markets. If you’re in the investment industry or in the financial markets, you like to win. So you’re not going to like my answer.

We play. And we lose.

There’s a pose that very sick farm animals sometimes take when they’re near death, where they lie down and twist their head way back into their shoulder in a very unnatural way. It’s an odd sight if you don’t know what it signifies, a horrible sight if you do.

Both the Republican Party and the Democratic Party are starting to twist their heads back into their shoulders. I don’t know if it’s too late to save them or not, but I’m increasingly thinking that it is. We need to start thinking about the funeral, who’s going to speak, and what they’re going to say.

Portfolio Manager — Of all the roles this is where I think things really need to change in terms of who sits in this seat. It can no longer be hedge fund bros, they simply won’t survive here. Nor will the pure gunslingers and tape readers, gone. And you certainly don’t want the pure quants sitting in this seat. PMs of the future are going to be far more interpersonal and process driven….

A couple of weeks back I shared a link to the story of ImageNet and the importance of data to developing algorithms. Ars Technica reports on two ‘at the coalface’ battles over data access with HiQ and Power Ventures fighting with LinkedIn and Facebook over data access. I’m not advocating a position on this but, to be sure, small — and currently obscure — court cases like these will, cumulatively, end up setting the precedents which will have a significant impact on the evolution and ownership of powerful algorithms that are increasingly driving behavior and economics.

In Part 4 of the Notes from the Field Series, Ben identifies how the natural lines of a tree and shaping the tree to follow those lines over time is a lot like shaping a portfolio.

Diversification is clearly one of the things that matter. Unfortunately, most investors pursue the Meme of diversification! instead of the real thing, and end up with a false sense of security and inefficiency.

Confidence levels for the Social and Behavioral Sciences, Claude Berrou on turbo codes and informational neuroscience, and thermodynamics in far-from-equilibrium systems.

There is no animal more important to the ascendancy of Western Civilization than the horse, and no invention more important than the horse collar. After all nothing shapes history like advances in productivity. Part 3 of Ben’s Notes from the Field series here.