Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

Friedrich Hayek was a keen observer of the human condition, particular in the era of the Strong Man. He was an even keener observer of the use of Narratives to exploit that human condition.

A portfolio is, after all, a vessel. It is a container for our financial investments, and what we leave OUT of that container is every bit as important as what we put IN.

Catching up on correspondence with some notable reader emails. In this edition, we take a look at some reader responses to the recent note ‘Letters from a Birmingham Museum.’

Climbing a wall of worry is the least understood and most powerful crowd behavior of a bull market. When there’s no real information, we create it by conquering artificial hurdles and challenges.

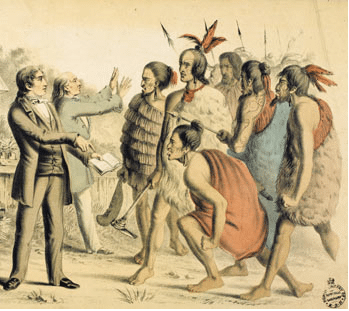

The OG Epsilon Theory reading list, now 4 years old. Luckily the classics never change. (Ed. Note: This is true, Ben, but not an excuse to keep quoting The Godfather) (Ed. Ed. Note: Got any more LOTR quotes, Rusty?)

Teaser: What do Tesla, crypto, and men-who-wear-hats all have in common? They’re all driven by fashion, which is another word for the Common Knowledge game.

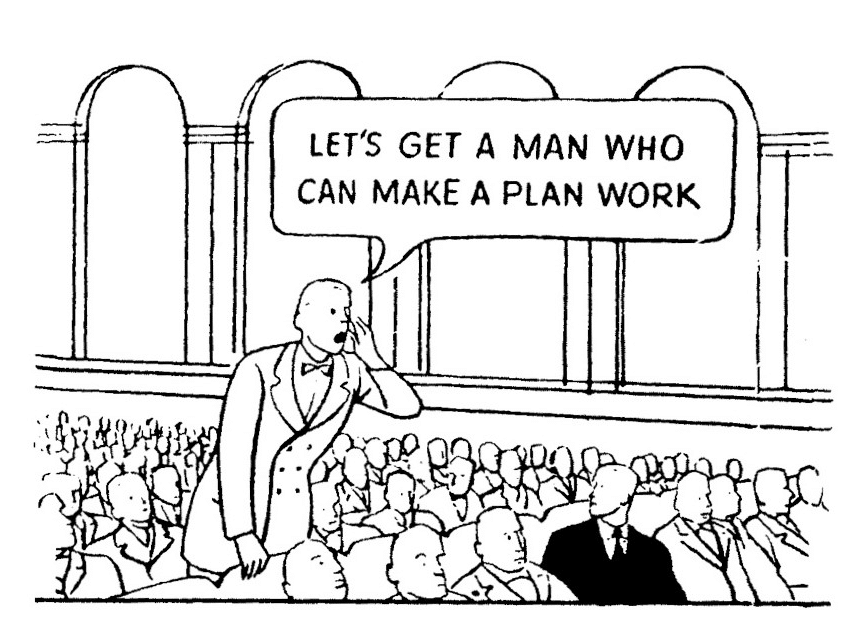

Nowhere is the cartoonification of politics and investing more prominent than in PensionWorld, where the need to appear to do something is often more powerful than our ability to do so.

Isaac Asimov’s Foundation Trilogy isn’t just science fiction. It’s a blueprint. It’s a blueprint for how civilization falls, or a culture fails, and what it takes to rebuild it as quickly as possible.

The true face of Futurism is one part technological dependence, and two parts obsession with the technologies we create, instead of the people they were designed to help.

In which Ben discovers that losing a hive of bees, like losing sociopathic sheep, industrially inefficient chickens, or really any farm animal, teaches its own lessons.

In which readers ask how to apportion the market effects of Fed jawboning and Fed asset purchases and sales (to the extent that the latter is not just part of the former’s cartoon).

In tangible terms, I’m not sure that Michael Cohen’s flip on DJT has done much to change anything, as much as the left would like it do. From a Narrative perspective, however, it is a big deal.

In which we reference an interesting article from Colin Woodward arguing against Common Knowledge of the rural/urban divide in the United States.

We write about the Common Knowledge Game a lot in Epsilon Theory, because it’s the central game of crowds and narratives.

Common knowledge is something that we all believe everyone else believes.

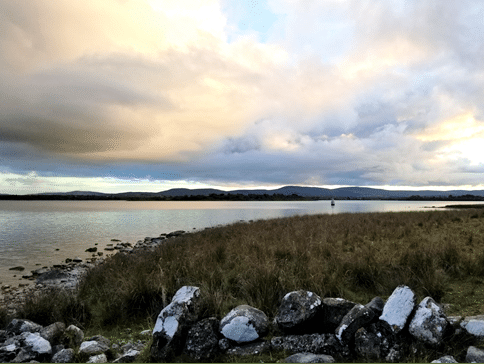

In Part 1 of his Notes from the Road series, Rusty takes us to Ireland. There he begins an exploration of path-dependence and priors in our thinking as investors and citizens.

Well, you know you’ve really made it in this business when Grant Williams shows up on your doorstep with his crew. What an honor to…

Part 1 of a three-part series on what it means to have a polarized electorate and a monolithic market. Today’s note: the Age of Ridiculousness and the decline and fall of the American Empire.

Part 3 of the Three-Body Alpha series, written for anyone puzzled by value’s underperformance over the past NINE YEARS. Systematic value still works in markets warped by the Three-Body Problem, but works differently.

MLK Day reminds us of the foundations of a UNITED States of America, a reminder that has never been more important to take into our hearts.

It’s not too late, you know. We can still find that unifying narrative of what America can – and should – mean.

Investing requires mental toughness, but it doesn’t require us to pretend that we — or our colleagues — are invincible. More often, it instead requires us to acknowledge our weakness.