Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

There are two systems states use to control our data: The Black Mirror version in China, and the western system that is well on its way there. There is another way.

In which a fellow Slummerville old-timer writes in with a Savenor’s update: A dream job has been posted, and is now available. But who can afford a dream anymore? Oh, also I got an email from my mom. Hi, mom!

Coinbase – do they run a prop desk or don’t they run a prop desk? My answer: it’s not a prop desk. No, what they are doing is worse and less fair to clients than a prop desk.

In investing and in life, we are always quick to judge the book by its cover. We’re quicker to judge a book by who wrote it. We’re quickest to judge a book by what shelf it’s on.

In which I discuss that one time I followed Julia Child through a grocery store in the least creepy manner I could manage, and the most delicious white corn I’ve ever enjoyed.

The modern use of stock-based compensation is a confidence game, in the true sense of the word, that would be very familiar to the Music Man (but he doesn’t know the territory!).

Part 2 of the Notes from the Road series, about the value of and problems with adaptive frameworks. In this installment, an exploration of…

Billionaires don’t buy media properties as vanity projects, because they care deeply about them as institutions, or for profit. They buy them because they understand the political and economic power of Fiat News.

Our liberty is our birthright, not granted to us by the State or the Oligarchs. It is not theirs to give. It cannot be taken away. But we can give it away. Don’t.

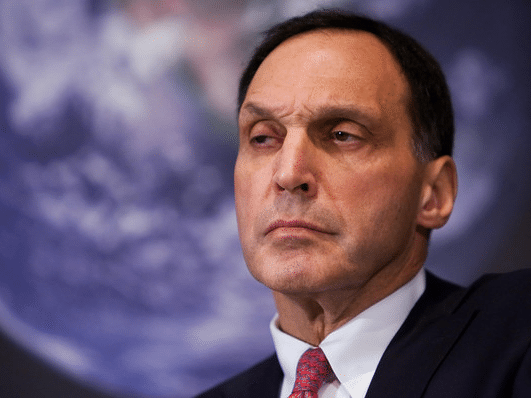

Everyone has their Lehman war stories. Everyone at least in their 30s, anyway. Here’s one of mine that was particularly formative for Epsilon Theory and our stories about stories.

Hunt’s Law – fake news drives real news out of circulation – is a perversion of Gresham’s Law about currency that applies everywhere today, even to Hunt. Especially when it comes to social media.

A refresher on the power of abstraction to devalue the real. Gresham’s Law: bad money drives good money out of circulation. Hunt’s Law: fake news drives real news out of circulation.

Every time Dick Fuld’s publicists succeed in getting a “redemption story” published in the WSJ or NYT, I’m going to write an ET piece about Repo 105. Its consequences for investors haven’t gone away, and neither should we.

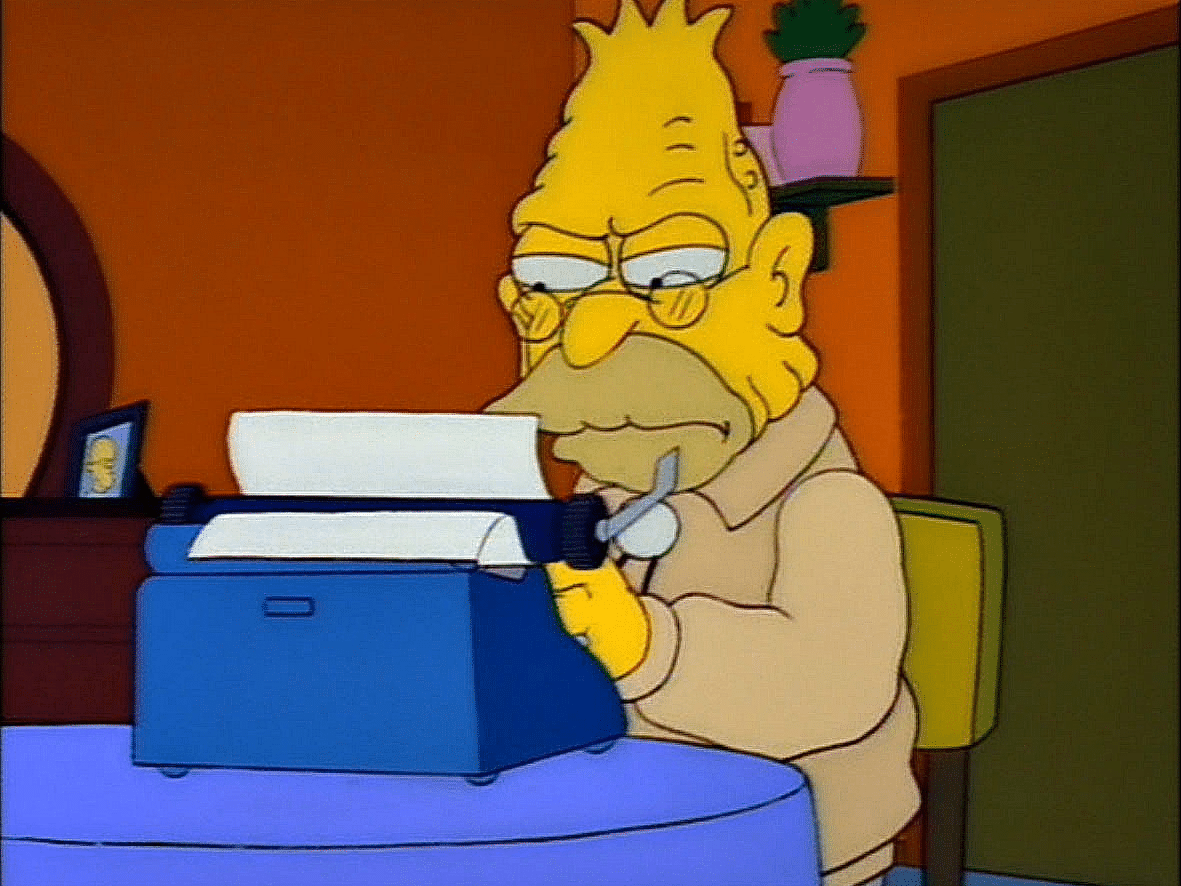

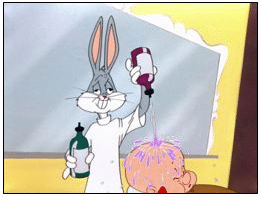

The key to political and commercial success in a Widening Gyre? Controlling your own cartoon. In other words: if you don’t tell your own story, someone else will.

How much richer are we than we “should” be in the Great Financial Asset Bubble? Not you, I mean, you’re just as rich as you should be, of course. I mean everyone else.

Two short stories from the 19th century that teach us more about investing than any white paper. Although I suppose that isn’t saying much. What I’m saying is they’re good and you should read them. And this.

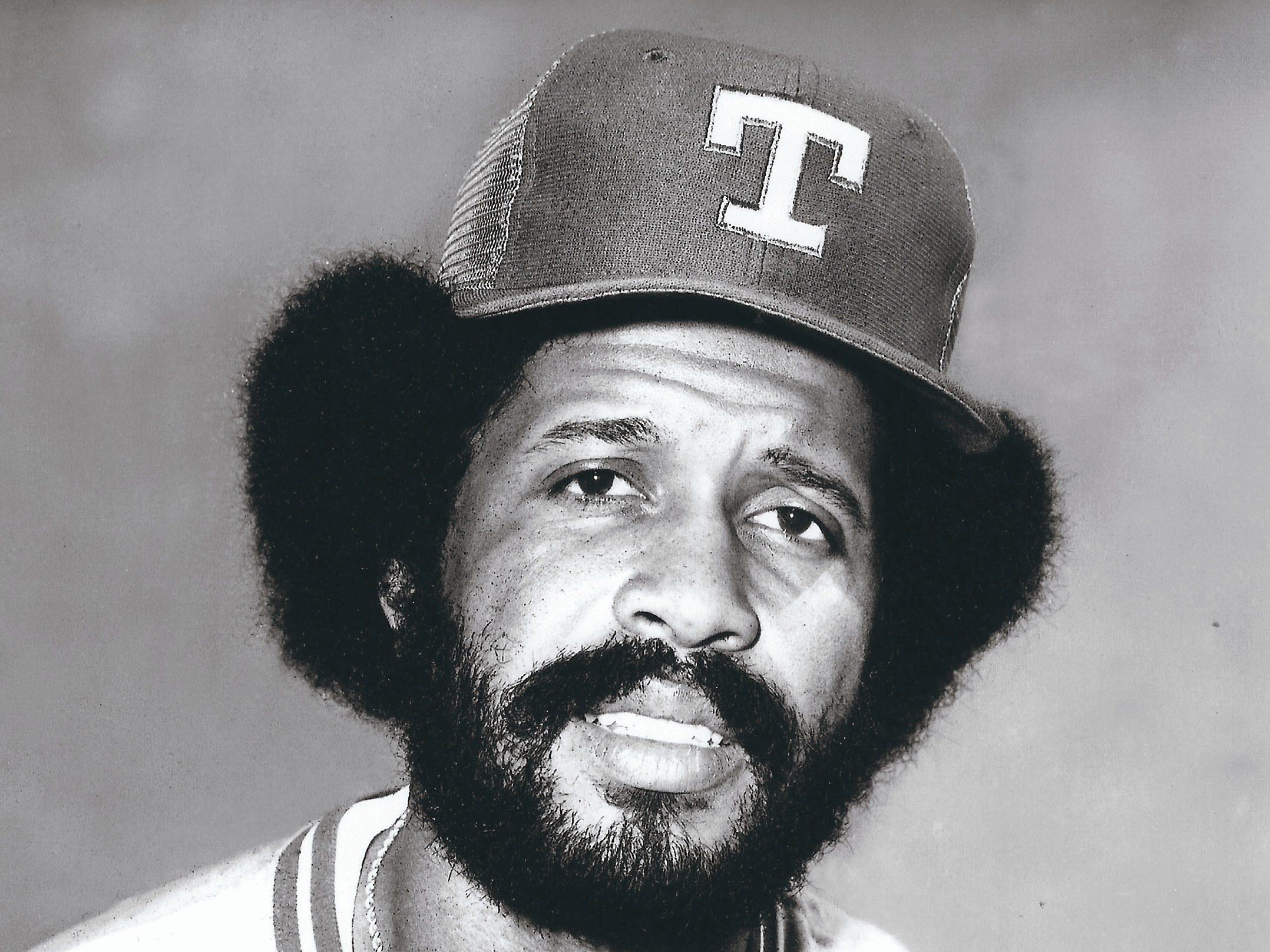

In baseball and in investing and in life, we often miss the obvious truths that are staring us in the face. Sometimes that delusion is willful and sometimes it is accidental.

Nowhere is the cartoonification of data more obvious than in the construction and publishing of labor reports, and nowhere is it more influential on markets and politics.

Part 2 of a three-part series on what it means to have a polarized electorate and a monolithic market. Today’s note: How do things fall apart in a monolithic market? Not with a bang but a whimper.

So many words and ideas are effectively unusable today, because it’s impossible to use them without triggering readers. It’s a whirlwind brief of centrifugal…I mean, centripetal force.