Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

Allocators and investors can learn a lot from professional baseball about how to structure incentives and compensation for portfolio managers. And how NOT to do it.

Enmity and competitive games can be beaten. Sometimes doing so requires someone willing to be booed by his home crowd.

The Fed, China and Italy are the Three Horsemen of the Investment Semi-Apocalypse. They’re major market risks, but you’ll survive.

There’s a Fourth Horseman. And it will change EVERYTHING about investing.

In Part 4 of the Three-Body Alpha series, we explore how Narrative may shape the tendencies of certain trend-following strategies – and how investors should respond. We also talk Tesla, if you’re into that sort of thing.

When reading news, especially financial news, be vigilant for strings of causality. Most financial events are extremely overdetermined.

We have built industry standards around minimizing the appearance of risk. As a result, we now have an epidemic of ability-signaling, when what we really need is humility.

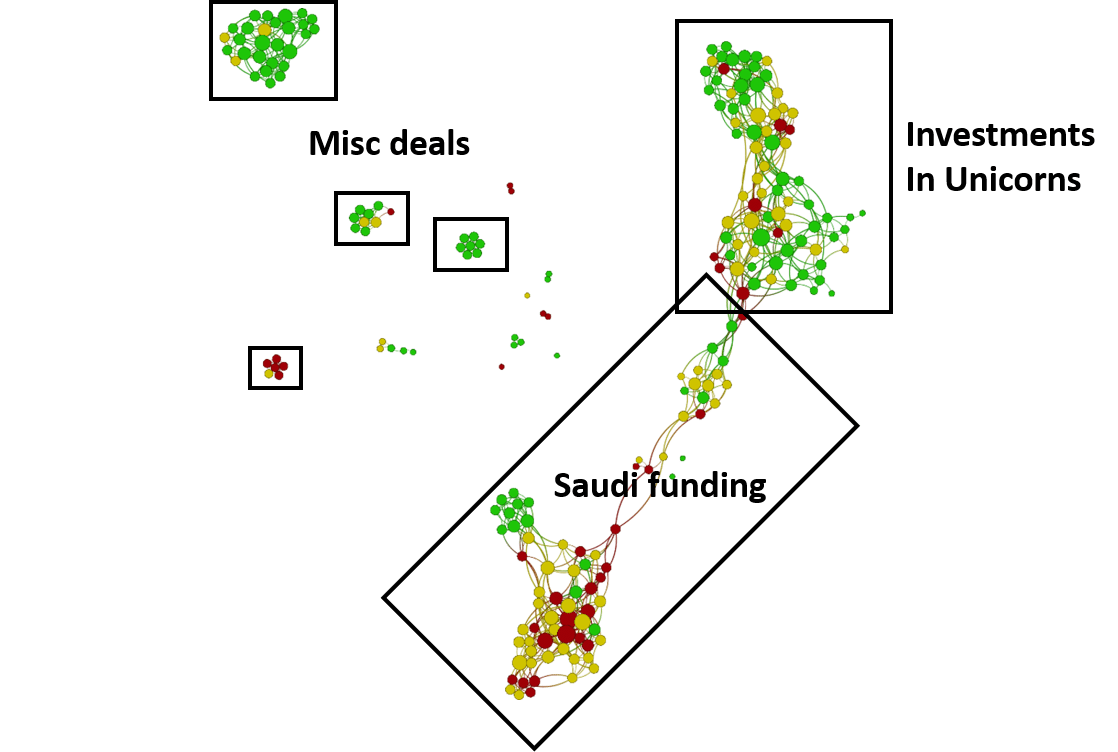

Shifting Common Knowledge on Saudi Arabia has infected the narrative around SoftBank’s Vision Fund, which in turn places unicorn valuations at risk.

The mechanics of effective storytelling and the tells of Fiat News are very similar. Add knowledge of them to your news-reading arsenal.

Take it from a list of terrible pop songs (and one OK, if overrated song from the Doors): lessons that provide an answer instead of a process are usually lessons badly taught and badly learned.

Nobody likes to admit it, but the investment industry hires and invests with the smartest-seeming people that seem sufficiently likable. And it doesn’t work.

“Order should not have priority over freedom. But the affirmation of freedom should be elevated from a mood to a strategy.” Yes, please.

An historic night it was.A pleasure to have a private dinner with the Crown Prince of Saudi Arabia, Mohammed bin Salman, his royal family and…

There is a huge gap in the narrative and language used to describe private equity and hedge funds. Even when it is correct, it calls for caution in our discussions and decision-making.

The Ben Sasse Cartoon does not match the Ben Sasse life, and that’s a politically existential problem here in the Widening Gyre.

The thing is, Butch, right now you got ability. But painful as it may be, ability don’t last. You came close but you never made it. And if you were gonna make it, you would have made it before now.

Two emails from soldiers, both asking questions that I can’t answer alone. We need a pack.

Sometimes the meanings of words change. Sometimes that doesn’t mean anything. Sometimes it does.

A brief selection of stories from my daily news routine that made me wonder: “Why am I reading this now?”

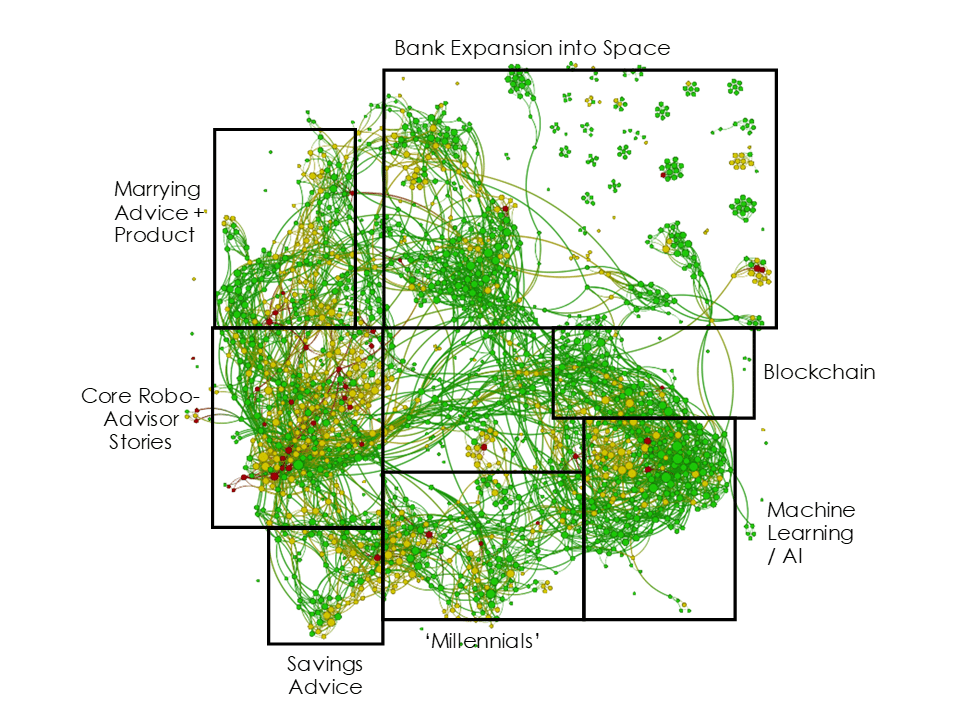

When it comes to robo-advisors, there is a wide gulf between common knowledge within the industry and without. I’m not sure what that means yet, but it means something.

The growing strength and coherence of Narrative Machine visualizations show the creation of powerful common knowledge around inflation, where everyone knows that everyone knows that inflation is rearing its very ugly head.