Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

Now that Jay Powell’s semi-annual Congressional testimony has finished up, it’s time for a brief walk down Memory Lane.

As with everything else in our Washington clown show, nothing really changes. This has all happened before.

The hobbyist farmer can afford to spread wildflower seeds to the wind and the elements. The professional farmer, on the other hand, doesn’t have this luxury. Neither do any of us as investors.

What killing active investment management? It’s not some monster hiding behind the rabbit. No, it IS the little white bunny. It’s the Zeitgeist of capital markets transformed into a political utility, innocuous on the surface … but with killer teeth.

How do you defeat the Zeitgeist? You don’t. The smart move, in fact, is to help the killer rabbit.

But there IS another way.

Usually we draw attention to narratives not because we like them, but because we believe investors can’t afford to ignore them. But the intense gravity of a directionless Narrative is a different matter altogether.

We’re back with a third edition of ET Live! On the docket for this session: MMT and the Zeitgeist that brought it to the forefront of our political and economic discussions.

The hardest job for any financial adviser is knowing when a fiduciary mindset should guide us to take a stand, and when it should guide us to adopting flexibility. If we claim to have a process, we have to have an answer for this.

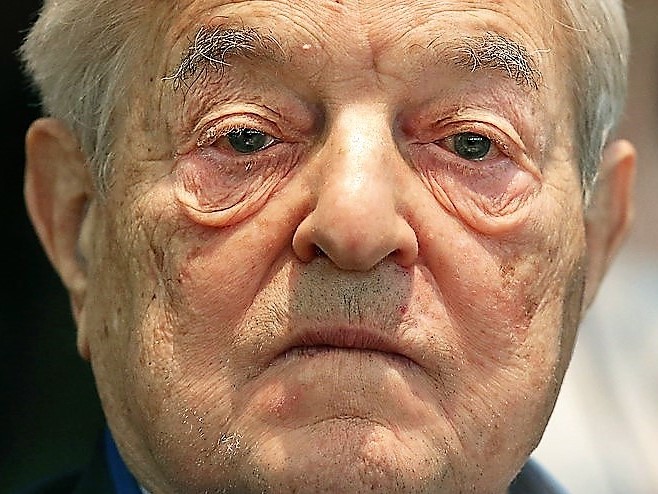

Every investor who wants to understand narrative and its impact on markets should read “The Alchemy of Finance”, by George Soros.

ET contributor Demonetized rediscovers the joys of Soros. It’s all reflexivity, all the time.

We don’t have to treat it like a cardinal sin any time an author, politician, consultant, adviser or expert tries to make us feel a certain way. Just don’t be the only one at the table who doesn’t realize what’s happening.

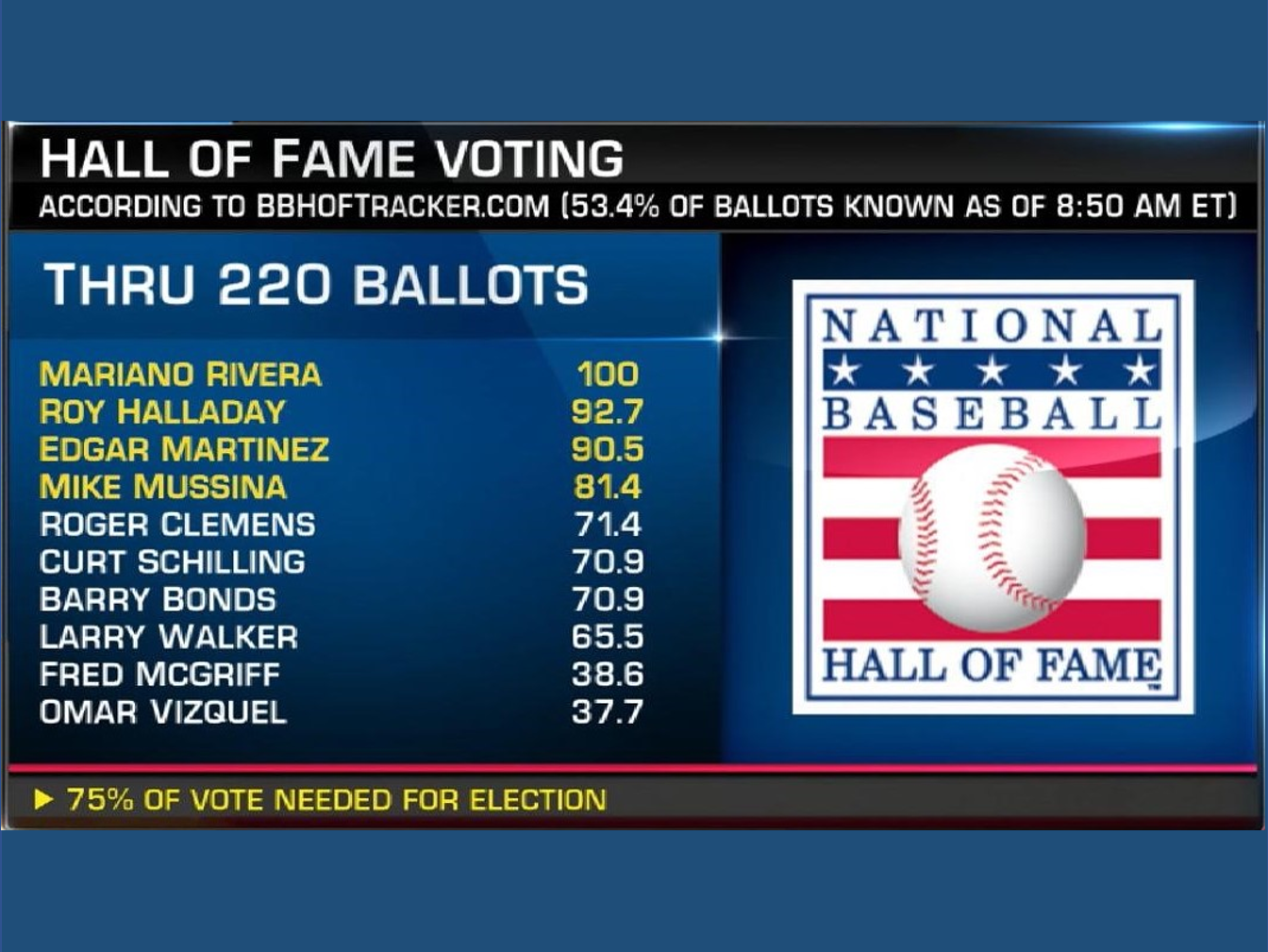

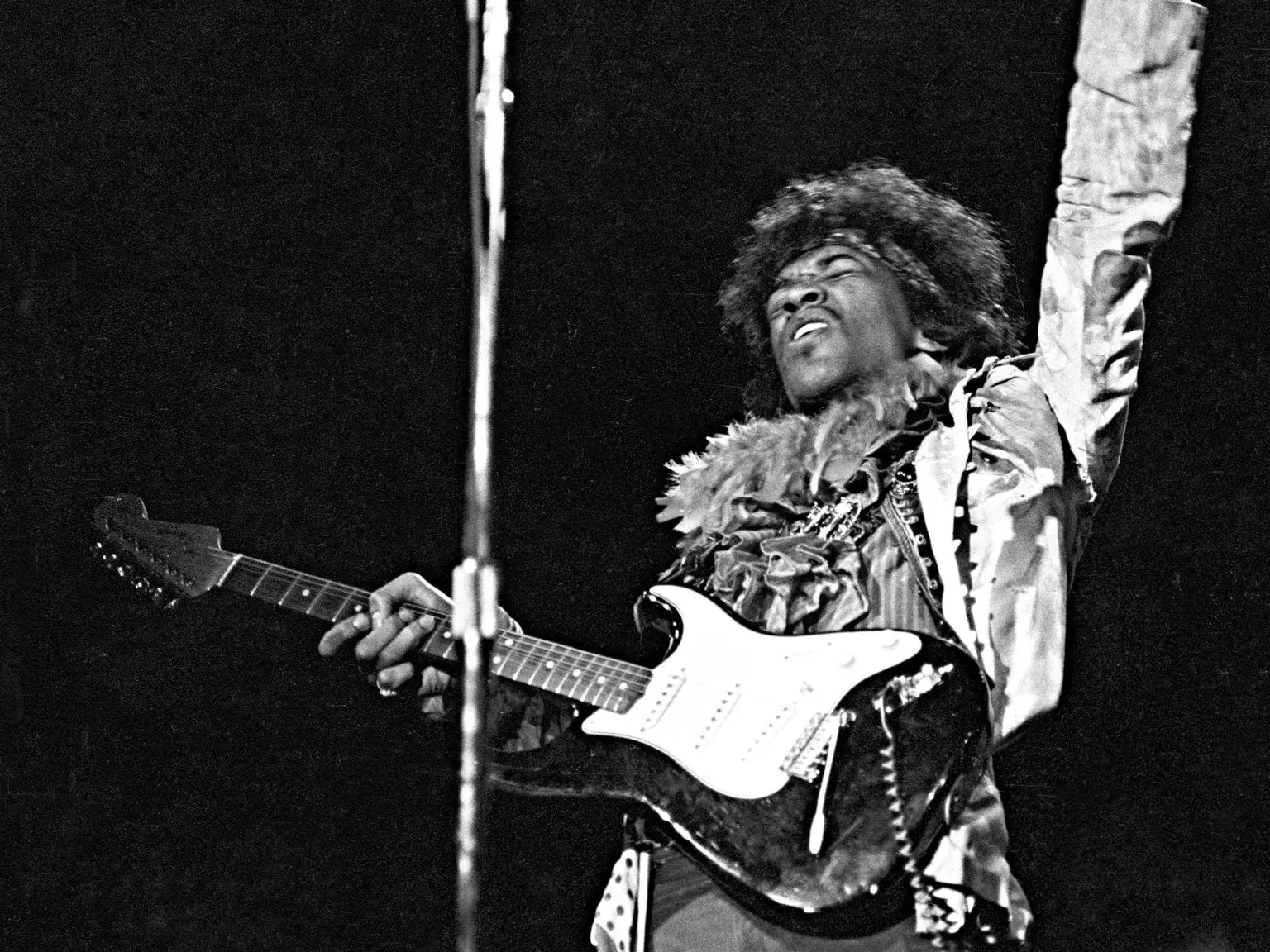

In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.

ET contributor Neville Crawley is back from time well spent at an amazing library, with thoughts on no-end state architecture, marketing alpha, DOD AI, wonderfully goofy blogs, and a new addition to the Rumsfeld canon: unknown knowns.

If you view the world through Clear Eyes, and hold loosely to your convictions, you’ll have an easier time adapting to a dramatic shift in the market regime than your competitors who’ve been lulled into a Narrative-induced fugue state. You’ll make up your own damn mind. You, your clients, and your business will all be better off for it.

We’re all passengers in the backseat of the State-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.

What the rise and fall of baseball cards can and can’t tell us about bubbles and the turning of markets into utilities.

Your mother was a hamster and your father smelt of elderberries … the pricing power found in intellectual property. It’s not as easy as it looks.

Trust in media is being debased from without and within. The Clear Eyed, Full-Hearted answer? Don’t pick and choose. Set yourself against both threats.

There is a paradox – only it isn’t really a paradox – in that to act boldly on and hold loosely to our beliefs requires us to design processes which are subject to an almost opposite standard.

We no longer have real discussions about critical civic issues in part because we’ve stopped calling things by their proper name. Our lack of nuance causes those conversations to degrade into predictable, exhausting patterns. Let’s figure this out before it’s too late.

Watching Jay Powell’s press conference today, it hit me – THIS HAS ALL HAPPENED BEFORE.

Back in September, 2013 to be precise, when Ben Bernanke told us that QE was not going to roll off as expected, that “data dependent” meant “market dependent”, and the Fed was a prisoner of the White House and Wall Street.

You are here. Again.

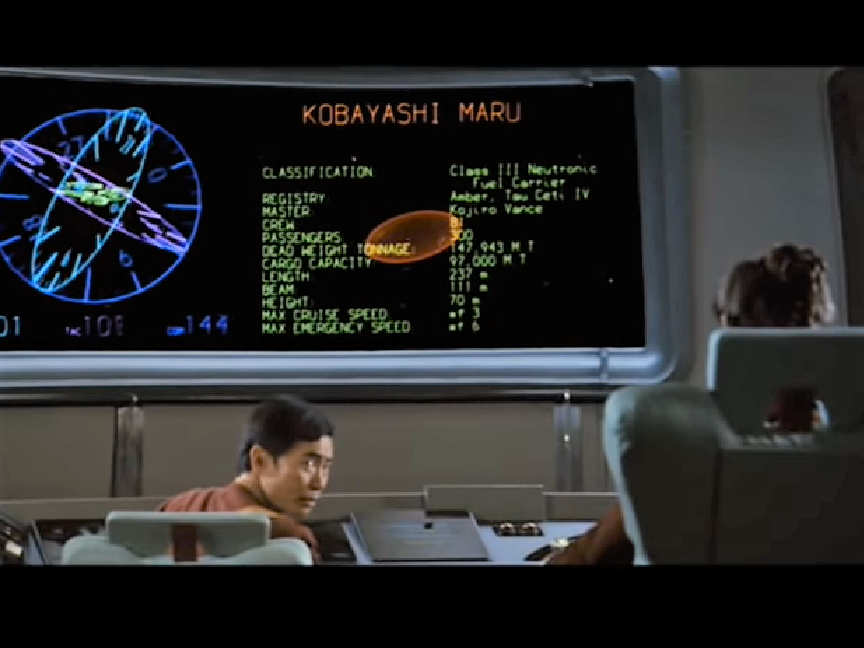

When facing a no-win scenario, sometimes the only rational choice is for our advisers and managers to change the conditions of the test. That doesn’t mean we have to buy what they’re selling.

The next stops in our discovery of the process of discovery? A town of 1,282 people and the mind of a German physicist named Arnold Sommerfeld.