Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

I was mad, and I was going to write an article about what had made me mad.

Except I was wrong. And the truth about what is happening in media should be much more concerning. It is seductive in ways that will make it difficult to resist for anyone who hasn’t decided to pay attention to those who would tell us what the crowd thinks the crowd thinks.

Missionary activity isn’t always intended to mislead. But when it is, it is almost always aided by another sociopathic tendency – the complete unwillingness to admit error. What’s worse – we are practically designed to empower it.

The Half-Happy Horror is the realization that pursuit of multiple objectives can end up with a baby split in two.

At best we give lip service to secondary or tertiary goals, all as part of some Cartoon we’ve constructed about our “process”.

Yes, optimization is a scourge, and it hits every aspect of modern life. It hits the professional investor hardest of all.

So if you COULD prepare most Americans for their jobs and lives in less than a year, how WOULD you? Well, we took a shot at answering just that, and I’m sure you’ll all agree completely and wholeheartedly with our conclusions.

The recent rally in U.S. equities is largely a result of market participants believing they can have their rate-cut cake and eat it, too.

ET contributor Pete Cecchini doesn’t think the Fed will cut rates proactively. Will they cut? Sure. But only if the real-world economic data deteriorates further. Which it probably will.

But don’t eat that cake just yet.

It’s all been leading up to this.

We’re sharing the summary results of our core investment research project with The Narrative Machine.

If you’ve ever wondered, “Gosh, how DO you apply these cool narrative maps to an actual investment strategy?” … well, here’s your answer.

There’s a point in any human activity – investing, politics, religion, or business – where a thing we do together becomes a thing in-itself. It’s a point that changes our thinking and the moral questions we are forced to answer. Knowing where this point lies is in all our activities is important.

Great Truths can be important engines for social unity and shared identity. In the hands of some, however, they can become tools for obscuring actual truth – facts – in service of cynical use of the emotional memes attached to those Truths.

We spend a lot of time on our trade ideas, and do a lot of hand-waving at what we believe that everyone else believes. It’s a core problem for investors, and one that can’t be avoided.

We are the human animal.

We are non-linear.

We ARE a song of ice and fire.

It’s a song that has built cathedrals and fed billions and taken us to the moon. It’s a song that can do all of that and more … far, far more … if only we remember the tune.

The Pack remembers.

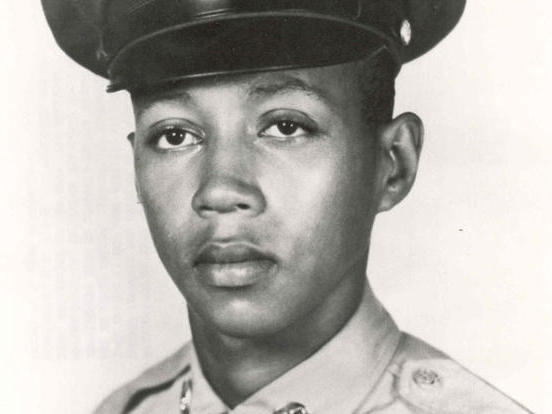

If Memorial Day is anything, it is a day for telling and re-telling stories about Full Hearts. Let me tell and re-tell you the story of Milton Lee Olive III.

I like to think that we do a good job responding to our readers’ questions. If we have a weak spot, however, I know where…

New from ET contributor Demonetized … how do you handle a counterparty that has engineered a Heads I Win, Tails You Lose investment?

You must be able to hurt your counterparty for realz. No matter what the docs say.

Or in the immortal words of Steve Zissou, “What about my dynamite?”

Hyper-awareness of narrative, memes and cartoons can become paralyzing. Once we see them, we see them everywhere. But much of that paralysis comes because the demands of Clear Eyes are less than the demands of Full Hearts. And it’s the latter – identity – that truly matters.

Wage stagnation in 2016 was actually much worse than you were told. Did this make a difference in the Midwestern states that swung the election, in that actual labor conditions were worse than everyone thought they were? I think yes.

Wage growth in 2018 was actually much better than you were told. Did this make a difference in the current Fed/Wall Street/White House narrative that inflation is dead and the easy money punchbowl can be maintained without consequence? I think yes.

For a few days, we’re making this ET Professional note available to everyone to review. We think the ET Pro service is something that every portfolio allocation, wealth management and active investment team can find useful, particularly for risk management.

At some point, all Fed Chairs learn that their primary function is just to wave their hands. Jay Powell has learned this sooner than most.

ET contributor Pete Cecchini goes way off the Wall Street reservation with this: the bullish narrative for U.S. equity risk makes sense only if one accepts a narrative that the Fed will proactively move to prevent a U.S. slowdown before it happens.

Don’t believe it.

The student loan crisis is a Big Deal. And it is only a part of a Bigger Deal: the Myth of College.

This issue will be front-and-center in the upcoming elections. We will all be handed our very own ‘Yay, College’ signs to raise high. More often than not, we will be asked to raise them in service of market-distorting policies which will make our problems worse.

ET contributor David Salem is back with five core tenets for achieving 5+% real returns over the next few decades.

It’s all a must-read, but I’m gonna highlight #4: “Favor equity investments in companies employing or serving primarily people with abundance as distinct from scarcity mindsets.”

This is the foundation for behavioral economics on a macro scale.

We know what Fiat News is: the presentation of opinion as fact. We also know what fiat news looks like: pop on over to Vox and skim a few stories.

But how does fiat news WORK?

New from ET contributor Demonetized, a clear-eyed look at wolf traps and sales funnels.

Capitalist productivity has become capitalist financialization.

Wall Street gets something to sell, management gets stock-based comp, and the White House gets re-election.

What do YOU get out of financialization? You get to hold up a card that says “Yay, capitalism!”.