Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

ET contributor Demonetized channels his inner Paul Atreides to look at possible market futures – The Great Jihad, The Great Reset, and The Zombiefication of Everything.

Because at its core, “Dune” is all about Narrative.

The asset management industry has been dying a slow death for decades, but never seems to, you know, die.

Why?

As Bill Simmons used to say, “yep, these are my readers.” He meant it as a joke after a silly email, and that’s how I’ve used it in the past, too. But no silly or funny emails today. Just Clear Eyes and Full Hearts. Because … you know … can’t lose.

Yes, these are OUR readers, and this is OUR Pack, and this is OUR platform for thought and action in service to that Pack.

Watch from a distance if you like. But when you’re ready … join us.

In an orchard, it isn’t always easy to tell the difference between rust and blight. The same goes for our cultural institutions.

Some should be pruned.

Some should be ripped up root and stem.

It’s not always easy to know which. But if we want our sons and daughters to sit in the shade of our trees, we must learn.

It’s time to start a fire. To burn, yes, but also to illuminate.

My advice? Abandon the political party as your vehicle for political participation.

My alternative? Find your Pack.

My platform? Make – Protect – Teach.

In both baseball and in investing, we need an all-purpose test of excellence, not just for identifying MVPs like Mike Trout, but for seeing how all of us mere mortals stack up.

ET contributor David Salem makes the case for an investing corollary to baseball’s Wins Above Replacement (WAR). It’s a defense of value investing, but with a twist.

The desire of central banks to forestall recession at all costs reminds us of the war that groundskeeper Carl Spackler had with the gopher in Caddyshack.

Sure, you can defeat the gopher. But you’ve gotta blow up the golf course with dynamite to do it.

Honest investing means finding a balance between approaches which imply we know everything and those which imply we can’t know anything. It means humility.

We think there are three – and only three – paths to finding this balance. One is the heart of what we are trying to achieve with Epsilon Theory.

Wherever self-determination and resistance to the encroaching power of the state and oligarchical institutions find expression, there should our full hearts be also.

And our full voices.

“I’m a superstitious man, and if some unlucky accident should befall him — if he should get shot in the head by a police officer, or if he should hang himself in his jail cell, or if he’s struck by a bolt of lightning — then I’m going to blame some of the people in this room.” – Vito Corleone

Same.

The Nudging State and the Nudging Oligarchy cannot be defeated on a single point of failure like Jeffrey Epstein’s testimony at trial. Or like the bankruptcy of AIG.

But a million effin’ points of failure? A refusal to vote for ridiculous candidates and buy ridiculous securities? A refusal AT SCALE?

Yeah, that can work.

There are some stories that we will want to believe no matter how much contrary evidence we find, and no matter how much we know that the story is bogus. And when these stories convey a sense of control? All bets are off.

“What you call love was invented by guys like me. To sell Nylons.”

Every Missionary has his own version of the Don Draper quote.

Politician: What you call values were invented by guys like me. To win power.

Fancy Asset Manager: What you call ESG was invented by guys like me. To gather assets.

The Sell-Side: What you call a rotation trade was invented by guys like me. To earn commissions.

The Long Now is everything we pull into the present from our future selves and our children.

We are told that the economic stimulus and the political fear of the Long Now are costless, when in fact they cost us … everything.

Tick-tock.

We all know we’re supposed to figure out who the patsy at the table is, but somehow everyone we see ends up being a straw man. Maybe fine in normal markets, but in periods of stress? If you don’t know who owns it, you don’t know anything.

Everyone is right about buybacks. They’re good. They’re fine. They’re ethical. Oh, and they’ll be gone, too, if the industry doesn’t realize that it’s playing a metagame and not a parliamentary debate.

Some things are only palatable when they have been transformed into a cartoonish version of themselves. For financial professionals that raises a moral question: how much emphasis on the Cartoon of expertise about us is too much?

We get a lot of email and responses, but we REALLY got a lot about our comments on a curriculum that could replace the signaling-minded post-secondary degree industry. We publish them here.

Golf, as the saying goes, is a good walk spoiled. But ET contributor Demonetized finds meaning in golf’s pathology of failure.

Swing mechanics and gimmicky shortcuts? Please. In golf and in investing, you’ve got one simple rule to improve your game.

Commit to the shot.

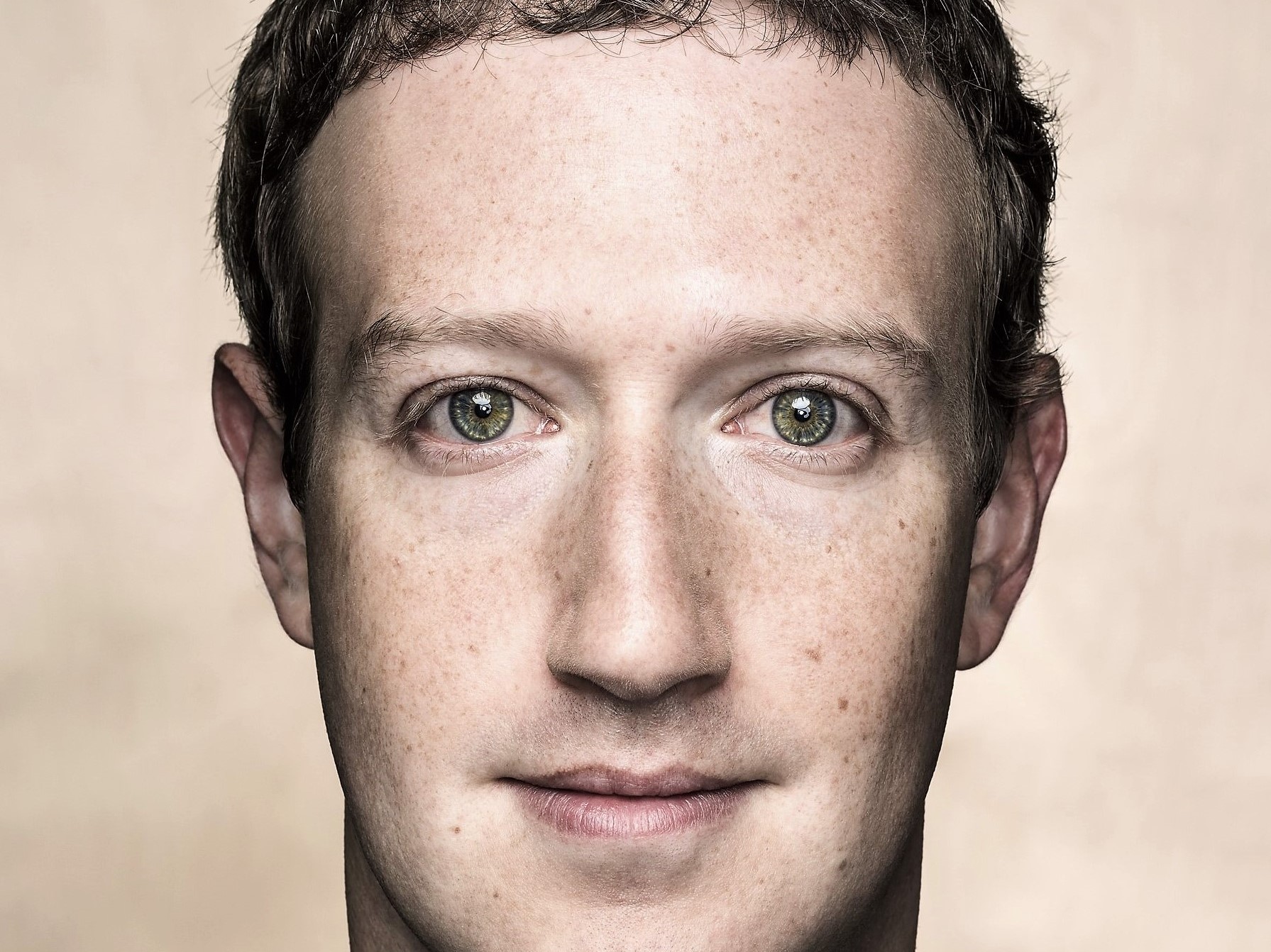

Mark Zuckerberg is not The Spanish Prisoner. He’s the guy running the con.

Libra, the cryptocoin promoted by Facebook, is a classic Spanish Prisoner con. This is how the State and the Oligarchy co-opt crypto. Not with the heel of a jackboot. But with the glamour of convenience and narrative.

It’s the Pack Gathering, a small conclave of like-minded people interested in talking ideas and enjoying good, genuine company.

The first event will take place in our headquarters town of Fairfield, Connecticut. New England and Mid-Atlantic, this is your event.