Epsilon Theory In Full

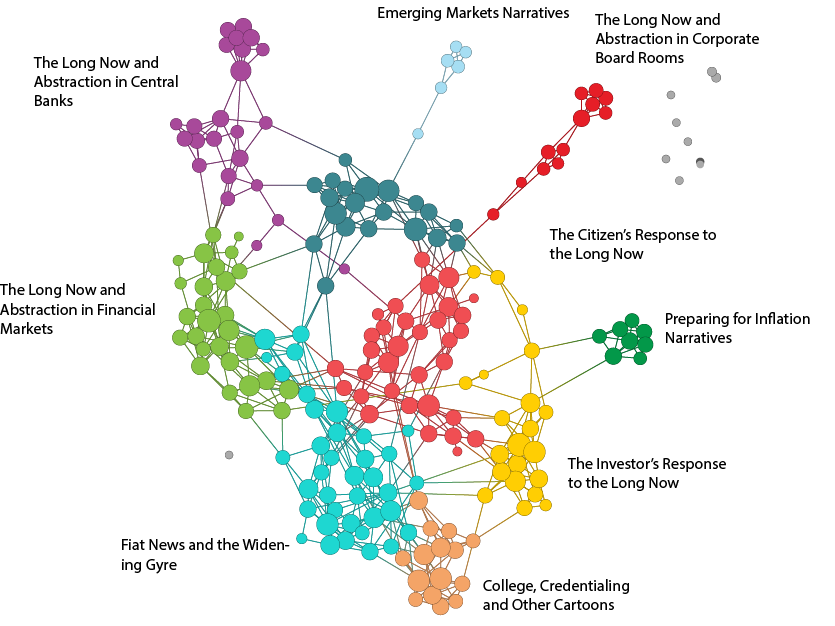

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

The decline in the strength of the Q4 Narrative of a risk of “collapse” in credit markets continued in January.Uniquely among our macronarratives, cohesion actually…

Two weeks ago we were being told about the coronavirus outbreak. This week we are being told how we should think about it. Right or wrong, it is important to have Clear Eyes about this kind of Fiat News.

Axioms to live by in baseball and in investing!

1) Outsiders to an organization can never know in real time what goes on inside it.

2) Human labors can never be gauged fully and dispositively in real time.

3) Chains are never stronger than their weakest links.

There is a median narrative theorem that can serve as a central pillar of a NEW approach to social choice theory, an approach less pedantic in its assumptions about human nature and less naive in its assumptions about modes of social power.

The median narrative theorem generates powerful predictive hypotheses about elections, hypotheses that predicted Trump’s Republican primary victory in 2016 and – if current data holds – predicts Sanders’ Democratic primary victory in 2020.

There are many roads to serfdom, and they have all become faster and more perilous. We are walking down one of them now.

On MLK, Jr. Day, we present an excerpt from a powerful and under-read sermon about status delivered to the Ebenezer Baptist Church.

More from the world of universities-as-guilds and the weird war between the merely rich and ultra-rich.

There is a chart I’ve been thinking about a lot lately, and I want to tell you about it. Before I do, I also wanted…

The Long Now has severed the tether between taxation and spending – the most important macroeconomic policy relationship in our social lives as both investors and citizens.

Here’s what that means.

And here’s what we’re going to do about it.

It is our second time now to turn the lens we apply to other news sources to our own creative output. Here is a Very Epsilon Theory retrospective on 2019.

We’ve gotten a lot of responses and thoughts on By Our Own Petard, so we thought we would talk about some of them in another Mailbag feature.

ET contributor Demonetized creates his own koan in this very personal note.

Is morality socially constructed through a process where biological systems are socially conditioned to respond in particular ways to particular stimuli, or is morality an innate moral compass manifested in Kantian ethics?

Yes.

Negative rates create a cycle of addiction to even more negative rates in the future.

Why? Because captive buyers like pension funds require capital appreciation to make up for negative yield, so central banks must guarantee a commitment to still more negative yields.

New from ET contributor Pete Cecchini!

Fiduciary standards, prudent man rules and client sensibilities compel us toward fervent pursuit of “alignment.” There’s just one little problem: we can never be aligned with our agents.

I think it’s impossible to separate management self-enrichment through stock-based comp from the practice of stock buybacks.

One day we will recognize the defining Zeitgeist of the Obama/Trump years as an unparalleled transfer of wealth to the managerial class.

Every now and then we come across an article or blog post that’s directly relevant to what we’re trying to say on Epsilon Theory, but is too big and thoughtful to be carved up for a Mailbag note or Zeitgeist post.

Make / Protect / Teach is a Big Tent.

The NBA, Blizzard and others are in hot water after kowtowing to the Chinese government. America will have forgotten about both within weeks. But the awareness of just how long the CCP’s reach has become? That can’t be unseen.

I believe that we are on the cusp of the Long Now becoming irreversible. Or at least irreversible without a cataclysmic Fall.

Why? Because they have mastered the art of stealing our tells. At scale.

Here’s how we start to confound the stolen tells. At scale.