All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

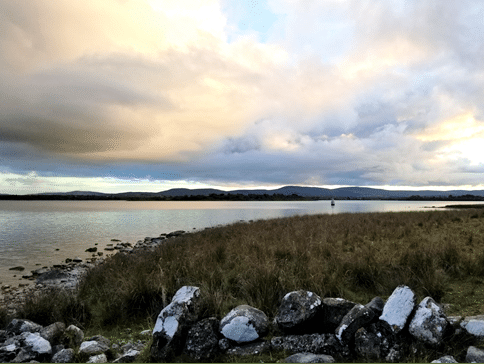

In Part 1 of his Notes from the Road series, Rusty takes us to Ireland. There he begins an exploration of path-dependence and priors in our thinking as investors and citizens.

Well, you know you’ve really made it in this business when Grant Williams shows up on your doorstep with his crew. What an honor to…

Part 1 of a three-part series on what it means to have a polarized electorate and a monolithic market. Today’s note: the Age of Ridiculousness and the decline and fall of the American Empire.

Part 3 of the Three-Body Alpha series, written for anyone puzzled by value’s underperformance over the past NINE YEARS. Systematic value still works in markets warped by the Three-Body Problem, but works differently.

MLK Day reminds us of the foundations of a UNITED States of America, a reminder that has never been more important to take into our hearts.

It’s not too late, you know. We can still find that unifying Narrative of what America can – and should – mean.

Investing requires mental toughness, but it doesn’t require us to pretend that we — or our colleagues — are invincible. More often, it instead requires us to acknowledge our weakness.

Many of the memes that drive our political behaviors inherently push us toward Competitive Games and tribalism. Resisting these memes means losing both arguments and credibility – and we have to be willing to do both.

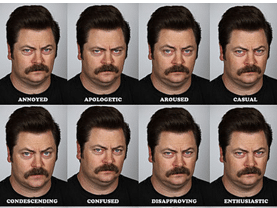

Part 13 of the Notes from the Field series discusses The Narrative Machine, which can help us see the invisible memes that drive our political behaviors. Because you’re smart enough to make up your own damn mind.

Part 2 of the multi-part Three-Body Alpha series, introduced in Rusty’s recent Investing with Icarus note. The Series seeks to explore how the increasing transformation of fundamental and economic data into abstractions may influence strategies for investing — and how it should influence investors accessing them.

Two negative narratives have derailed ebullient markets – Inflation and Trade War. While I think both are here to stay, I’ve put inflation through the Narrative Machine first. The result? Inflation is Coming.

The allure of a fundamental truth is powerful. Investors are hungry for that kind of clarity about markets, but it doesn’t exist. In the first in a series, Rusty discusses a framework for investing in a time of Icarus.

We live in a Cartoon Age, an era not of alienation per Karl Marx, but of alienation per Groucho Marx. What’s the cause, what’s the future, and what do we do about all this? It’s a TL;DR cri de coeur in Part 12 of Epsilon Theory’s Notes from the Field series.

The #1 question investors ought to ask of a financial services company trying to sell them something is: “What is it, really?” If you don’t know what you’re investing in, you’re liable to end up eating a lot of crunchy frogs.

This is Part 11 of Ben’s Notes from the Field series. I don’t need to calculate a Sortino ratio to know if my dogs are doing a Good Job. Same with active investment management. Same with active citizenship. It’s all about embracing Convexity, not as a mathematical cartoon, but as a philosophy.

Most investors think that other investors think that last week’s correction was about vol-selling. The real story? Everybody knows that everybody knows that inflation will change the way portfolios are built and managed.

The inevitable result of financial innovation gone awry, which it ALWAYS does, is that it ALWAYS ends up empowering the State. When too clever by half people misplay the meta-game, that’s all the excuse the State needs to come swooping in and crush them, just as they are with Bitcoin today they did with Bear and Lehman in 2008. Installment #10 from Notes from the Field.

Everyone reading this note has, at one time or another, gotten scared about markets and decided to hedge their professional portfolio or personal account. The Game of Markets is changing. But should we be scared?

We’ve had a heckuva busy year at Epsilon Theory, so to ring out 2017 I thought it might be helpful to distribute a master list of our publications over the past 12 months. We’re long essay writers trying to make our way in a TLDR world, so even the most avid follower may well need a map!

In a two-body market, the interactions of fundamental data and prices are generally predictable. In a three-body market, the epsilon — investor behaviors in response to narratives — exerts a powerful gravitational force which must be considered when building a portfolio.

What if I told you that the dominant strategies for human investing are, without exception, algorithms and derivatives? I don’t mean computer-driven investing, I mean good old-fashioned human investing … stock-picking and the like. And what if I told you that these algorithms and derivatives might all be broken today? You might want to sit down for Part 9 of the Notes from the Field series.