All Epsilon Theory Content

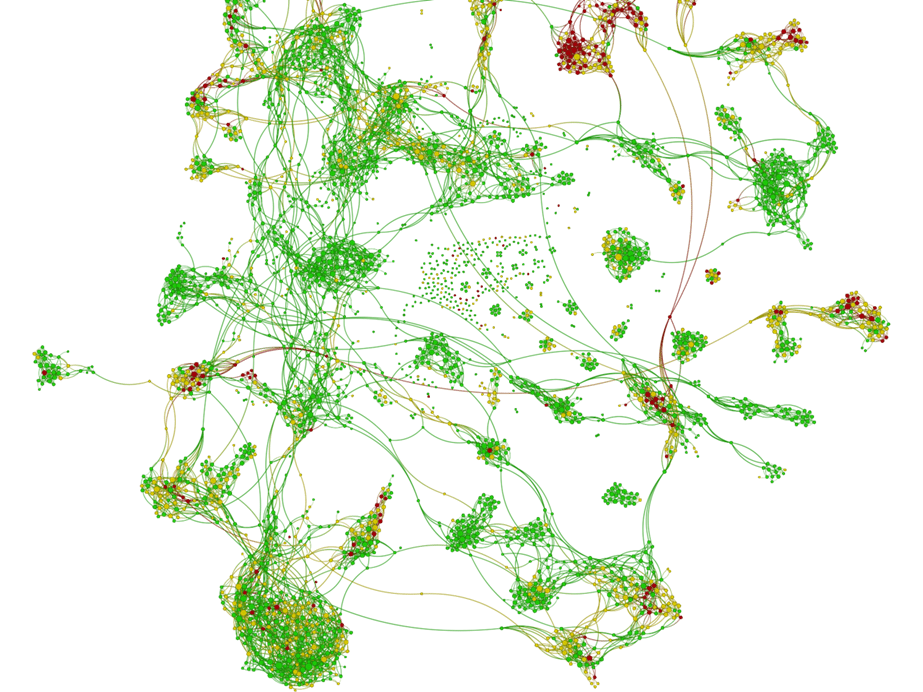

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

A good model isn’t just right. A good model has to be relevant. And in a world of abstraction and Narrative, engaging in relevant ways demands much more of us.

Neville Crawley, CEO of Kiva, returns to Epsilon Theory with “Rabbit Hole”, a regular series of notes on the nexus of government, society and technology.

We are wired to associate outcomes with the biggest single visible variance. This is a process-breaking flaw for general managers and portfolio managers alike.

A round-up of the most representative stories about the midterm elections between 9/30/2018 and 11/5/2018.

One way or another, boredom must be eliminated. It’s as much an iron law of markets as the impact of greed and fear. And it’s just as powerful.

It’s the defining quote for any performance-based social system, whether it’s football, politics, or markets. So let me ask you this: who owns your record?

Humility is in short supply on Wall Street. But the humility! Meme is not. Developing a process to understand the difference is important for any asset allocator.

Ben and I are pleased to announce the launch of Epsilon Theory Live – our audio/visual supplement to the existing written Epsilon Theory content! Epsilon…

The iPhone XS launch is attached to the strongest pre- and post-launch narrative of any September launch since the iPhone 6. Does that tell you how to trade it? No. Can it help you think about how different outcomes might shape your thesis – and the thesis you believe other investors are following? Yes.

It’s easy to feel like we need more than hope to pass through troubling times, and it’s usually true. But sometimes hope is exactly what we need.

A stalking horse is a familiar shape that a hunter hides behind in order to get close to his prey. Once you start looking for them in markets, you will see them EVERYWHERE.

Using facts in your analysis doesn’t make your analysis a fact. Punchy language that leans on these ‘facts’ doesn’t often stand up to scrutiny.

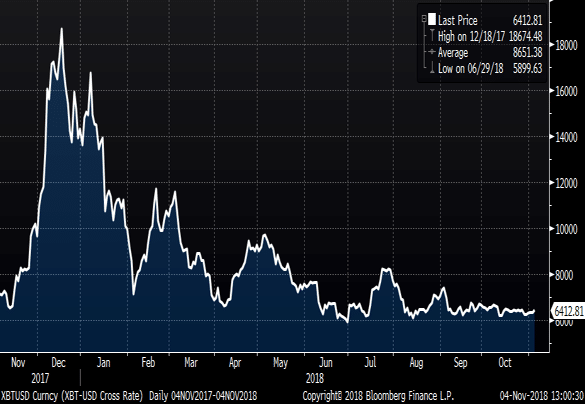

Sometimes the absence of a clear central narrative can tell us something about a stock, too.

I can’t advise you on the Answers. I won’t advise you on the Answers. But I will advise you on the Process. Because that’s what we do for our fellow pack members.

The paradox of the Widening Gyre is that even when you’re right, you may be wrong.

“Just when I thought I was out, they pull me back in!”

Vito got out. Michael never did.

Allocators and investors can learn a lot from professional baseball about how to structure incentives and compensation for portfolio managers. And how NOT to do it.

Enmity and competitive games can be beaten. Sometimes doing so requires someone willing to be booed by his home crowd.

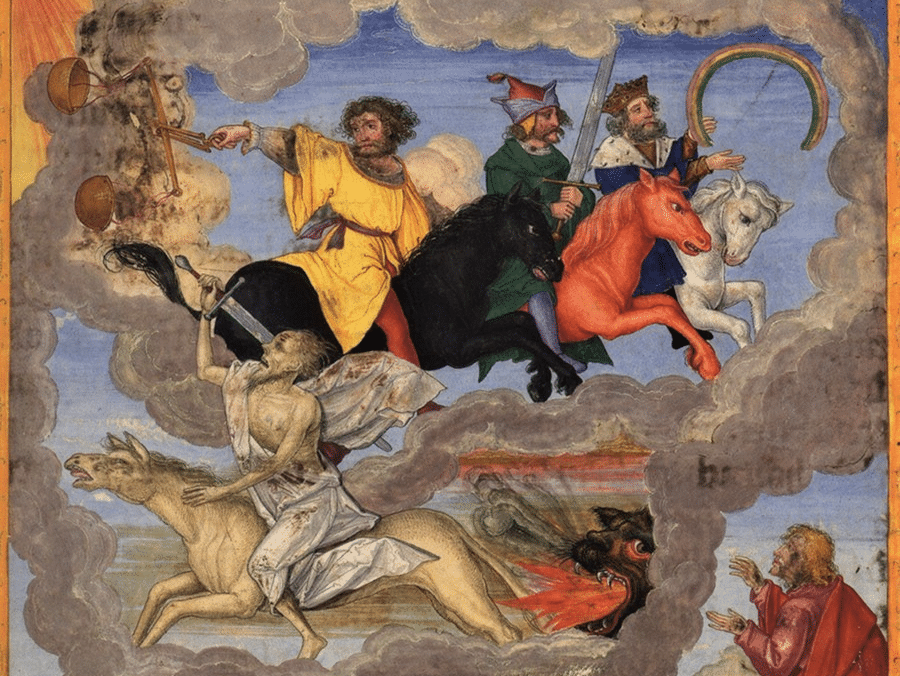

The Fed, China and Italy are the Three Horsemen of the Investment Semi-Apocalypse. They’re major market risks, but you’ll survive.

There’s a Fourth Horseman. And it will change EVERYTHING about investing.

In Part 4 of the Three-Body Alpha series, we explore how narrative may shape the tendencies of certain trend-following strategies – and how investors should respond. We also talk Tesla, if you’re into that sort of thing.