All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

The emphasis of asset owners on private assets investments is meta-stable – robust to a lot of potential changes in market environment. The reason? The deals! Meme.

Every idea has a story, but the story is not the idea. Stories are born, they live, and they die. But if the idea is powerful enough, it can find a new story and be reborn. Crypto must find a new story.

It’s an invitation to explore a joint research program, as described in TFA3. It’s an invitation to share ideas on liberty, resistance and technological advancement. It’s NOT an invitation to share ideas about money.

To our readers, to our supporters, to our engaged commenters, and to the people who have compared Epsilon Theory to drinking paint, a word: thanks.

It’s an old chess saying: “The easiest way to defeat a gambit is to refuse it.”

But that’s just the start of a successful metagame.

I don’t know what the Fed should do in December. But I do know how financial media (and Donald Trump) want you to think about what they should do in December.

“What do you mean you don’t make side orders of toast? You make sandwiches, don’t you?”

Bobby thinks he has lots of choices, but really he only has one.

We’re all Bobby today.

Take back your vote.

Take back your distance.

Take back your data.

How to make our way as citizens in a fallen world, with Clear Eyes and Full Hearts to make it better.

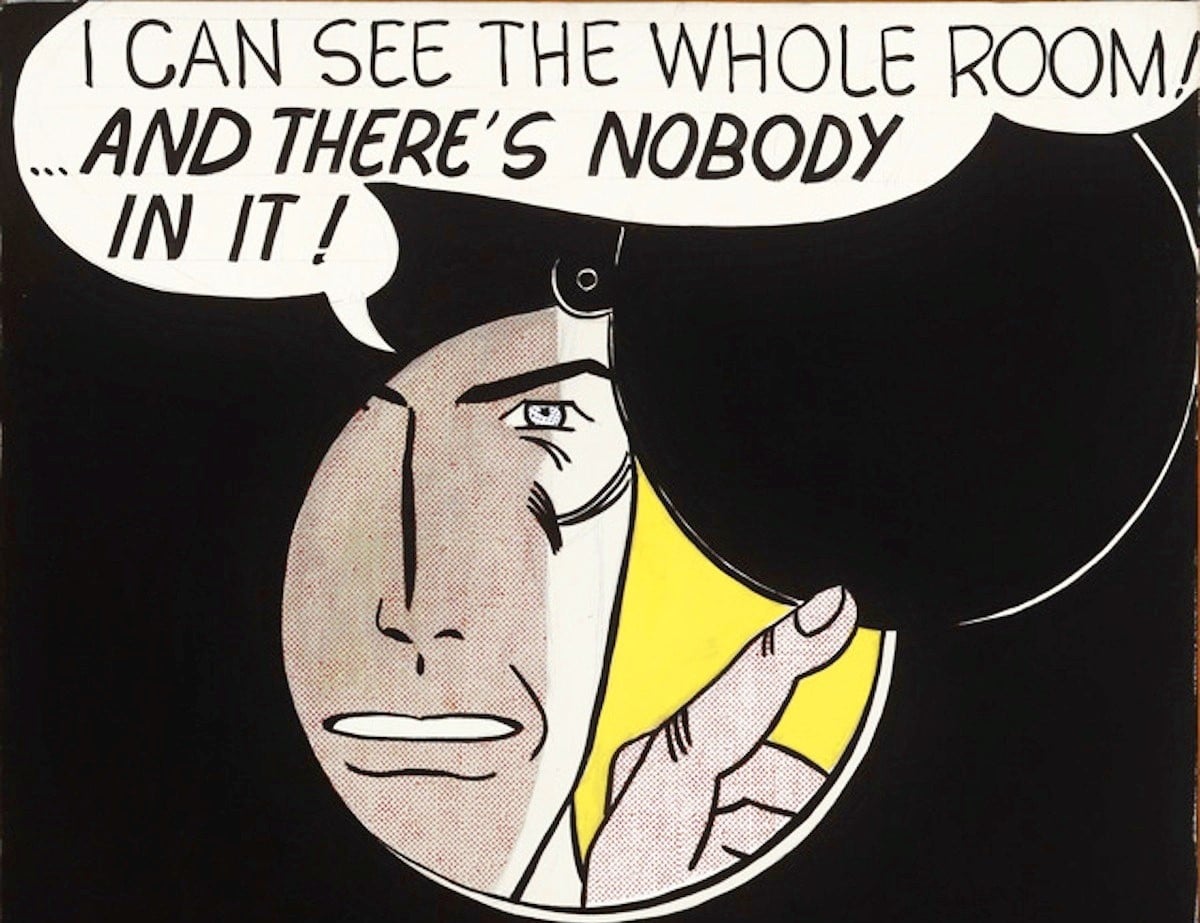

When something becomes as necessary, accepted and right-sounding as ‘process’, it can be tough to tell the difference between the Cartoon and the genuine article.

A quick note on no-coiners, people (like me) who have never owned Bitcoin, but have just watched from afar. We’re being played. Not to buy Bitcoin, but to obey the logic of the flock.

Our brains’ responses to memes are mostly existential – fight or flight. We can’t turn off these responses. But we can train our behavior to question them.

I don’t know that any investor’s mean expectation for Amazon ought to have moved an inch. But should a poorly played metagame change investors’ probabilistic outlook? I think so.

In the construction of Fiat News, it’s the choice of facts and the choice of words that preserve the power to make us feel. Because that’s the only thing that really matters – how do the words make you FEEL?

With technology, even totalitarian surveillance technology, there typically is no ‘big bang’, just a bunch of independent systems coming on line, getting networked together, and then a tipping point. We’re there with China.

How can US household net worth continue to outpace US economic growth if the Fed won’t play ball with easy monetary policy? History shows another way to keep the party going

Common criticisms of the news media tend to focus on bias. But when it comes to learning to resist the unavoidable influence of Narrative and meme on our brains, our focus should be on how much we allow others to explain things to us. We’re working on tools to allow citizens to do exactly that.

Peer group comparisons are the primary measuring stick of both baseball GMs and investment PMs. Here’s how they are used and (more often) abused.

There’s a dog that didn’t bark in the midterm campaign. And its silence tells me a lot about where this country is going.

A good model isn’t just right. A good model has to be relevant. And in a world of abstraction and narrative, engaging in relevant ways demands much more of us.