All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

A quick note on no-coiners, people (like me) who have never owned Bitcoin, but have just watched from afar. We’re being played. Not to buy Bitcoin, but to obey the logic of the flock.

Our brains’ responses to memes are mostly existential – fight or flight. We can’t turn off these responses. But we can train our behavior to question them.

I don’t know that any investor’s mean expectation for Amazon ought to have moved an inch. But should a poorly played metagame change investors’ probabilistic outlook? I think so.

In the construction of Fiat News, it’s the choice of facts and the choice of words that preserve the power to make us feel. Because that’s the only thing that really matters – how do the words make you FEEL?

With technology, even totalitarian surveillance technology, there typically is no ‘big bang’, just a bunch of independent systems coming on line, getting networked together, and then a tipping point. We’re there with China.

How can US household net worth continue to outpace US economic growth if the Fed won’t play ball with easy monetary policy? History shows another way to keep the party going

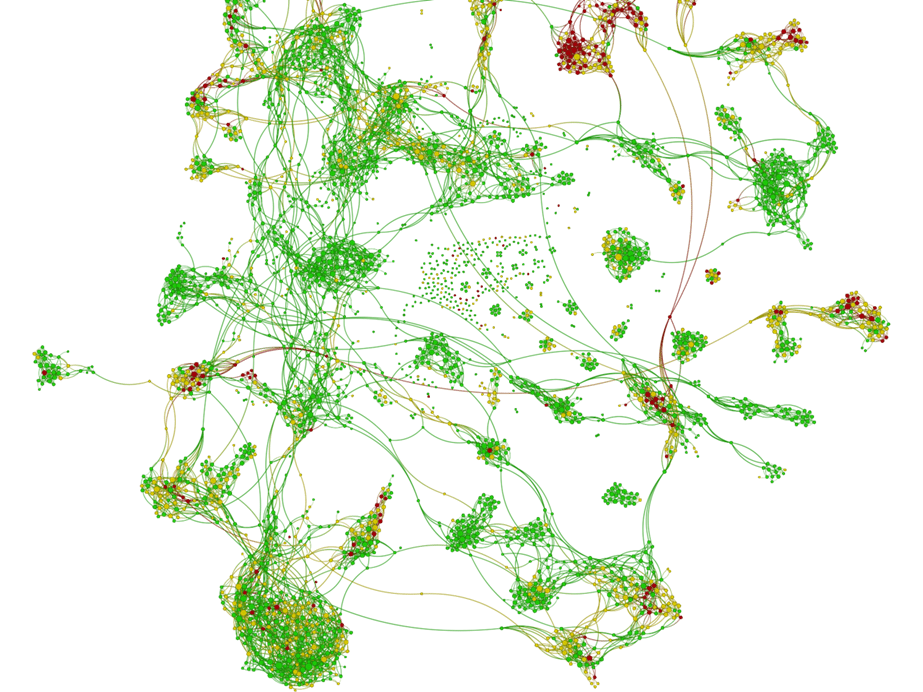

Common criticisms of the news media tend to focus on bias. But when it comes to learning to resist the unavoidable influence of Narrative and Meme on our brains, our focus should be on how much we allow others to explain things to us. We’re working on tools to allow citizens to do exactly that.

Peer group comparisons are the primary measuring stick of both baseball GMs and investment PMs. Here’s how they are used and (more often) abused.

There’s a dog that didn’t bark in the midterm campaign. And its silence tells me a lot about where this country is going.

A good model isn’t just right. A good model has to be relevant. And in a world of abstraction and narrative, engaging in relevant ways demands much more of us.

Neville Crawley, CEO of Kiva, returns to Epsilon Theory with “Rabbit Hole”, a regular series of notes on the nexus of government, society and technology.

We are wired to associate outcomes with the biggest single visible variance. This is a process-breaking flaw for general managers and portfolio managers alike.

A round-up of the most representative stories about the midterm elections between 9/30/2018 and 11/5/2018.

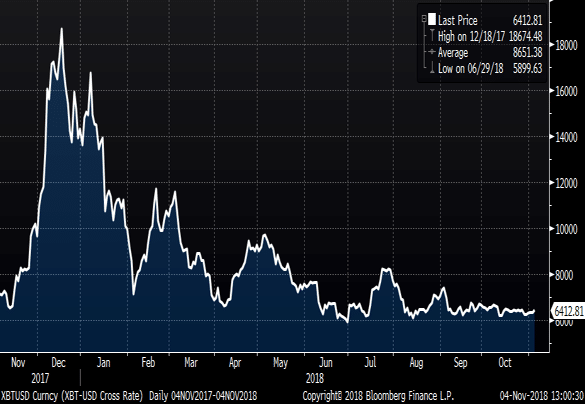

One way or another, boredom must be eliminated. It’s as much an iron law of markets as the impact of greed and fear. And it’s just as powerful.

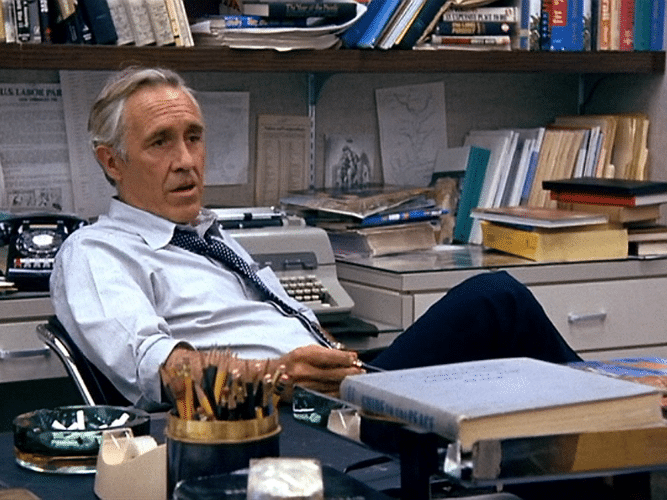

It’s the defining quote for any performance-based social system, whether it’s football, politics, or markets. So let me ask you this: who owns your record?

Humility is in short supply on Wall Street. But the humility! meme is not. Developing a process to understand the difference is important for any asset allocator.

Ben and I are pleased to announce the launch of Epsilon Theory Live – our audio/visual supplement to the existing written Epsilon Theory content! Epsilon…

The iPhone XS launch is attached to the strongest pre- and post-launch narrative of any September launch since the iPhone 6. Does that tell you how to trade it? No. Can it help you think about how different outcomes might shape your thesis – and the thesis you believe other investors are following? Yes.

It’s easy to feel like we need more than hope to pass through troubling times, and it’s usually true. But sometimes hope is exactly what we need.