All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

We no longer have real discussions about critical civic issues in part because we’ve stopped calling things by their proper name. Our lack of nuance causes those conversations to degrade into predictable, exhausting patterns. Let’s figure this out before it’s too late.

A big day for the Green New Deal, tax policy old and new, a solution for morale problems at Palantir and a solution for god only knows at Davos.

Watching Jay Powell’s press conference today, it hit me – THIS HAS ALL HAPPENED BEFORE.

Back in September, 2013 to be precise, when Ben Bernanke told us that QE was not going to roll off as expected, that “data dependent” meant “market dependent”, and the Fed was a prisoner of the White House and Wall Street.

You are here. Again.

Today’s Zeitgeist has a bit of private markets, Boeing and Apple, conspiracies and tax avoidance.

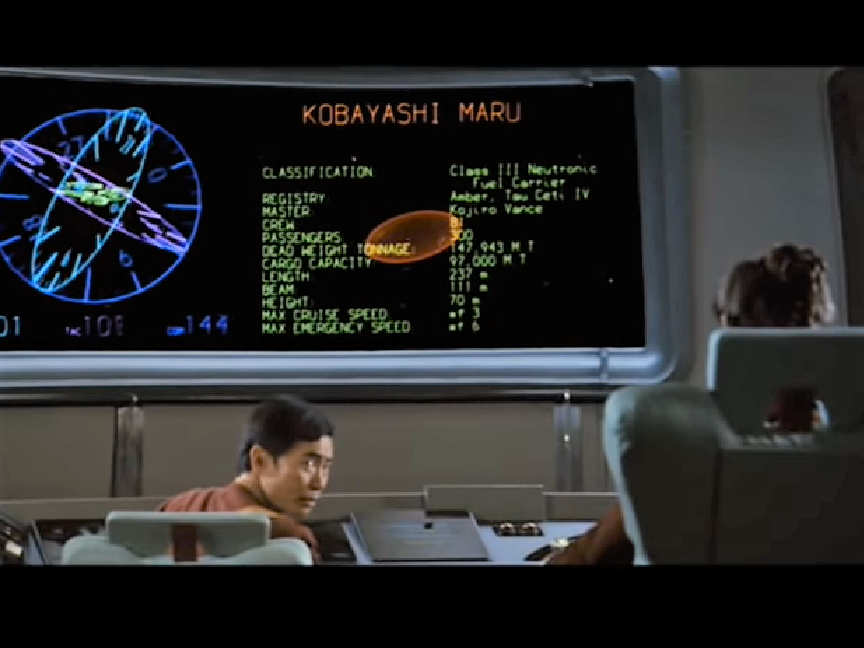

When facing a no-win scenario, sometimes the only rational choice is for our advisers and managers to change the conditions of the test. That doesn’t mean we have to buy what they’re selling.

Food and retailing are top of mind (and…bullish?), trade continues to dominate content and commentary, and a hero rides in to protect the Lu Ann Platter.

The next stops in our discovery of the process of discovery? A town of 1,282 people and the mind of a German physicist named Arnold Sommerfeld.

Like it or not, the 2020 election season has begun. But I’ve got good news for you: someone has The Answer for the political center, and he’d very much like to discuss it with you.

Oil falls, gas bounces, banks are buoyed. It’s apparently a weird gravity metaphor grab-bag on a Monday Zeitgeist.

When an inflation regime shifts, the only question that really matters for your investments and your business model is this: do you have pricing power?

Pt. 1 of a three-fer Brief series … why the worst place to be in any services industry is on the product side.

Billionaire penthouses, vertical integration in cannabis, non-musical music power, and a shifting tone in tech.

Time to resurrect an old Epsilon Theory feature and make it a regular thing. Because the ET pack has a voice that’s worth hearing.

An American mutual fund gatekeeper does PR for China, DNC gunning for Wall Street, multiple missionaries live from the pulpit in Davos.

Talking ourselves into a recession, trusting our employers, and a fine example of government shutdown Fiat News.

Welcome back, folks. Today, it’s all about cloud and blockchain, but no cannabis. Also: tech earnings, Trump can’t make a deal, and corporate debt.

A generation of investors has Paul Volcker to thank for almost 40-years of slowly falling rates. He handed countless baby-boomers a free 100 points of investing IQ, for which most never thanked him. It was as good as it gets.

The gyre widens again, and if we are not careful, it will force us into positions that require us to deny the basic humanity of our fellow citizens. Reject it.

We asset owners and allocators (rightfully) obsess about alignment, but too often that obsession becomes an outward one, motivated by our rights and entitlements instead of our ultimate best interest.

Today it’s Morgan Stanley, the price of rice, Morgan Stanley, the art of AI and a bit more Morgan Stanley.

Modern Monetary Theory is neither modern nor a theory. It’s a post hoc rationalization of politically expedient policy that makes us feel better about all the bad stuff we’ve done with money and debt in service to Team Elite.

And all the bad stuff we’re going to do in the future.