All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Lots of ‘playing’, ditching New York, and a piece of hard-hitting analysis demonstrating that sitting at the crossroads of government and business can be personally profitable.

We don’t have to treat it like a cardinal sin any time an author, politician, consultant, adviser or expert tries to make us feel a certain way. Just don’t be the only one at the table who doesn’t realize what’s happening.

Today’s Zeitgeist poses a riddle: what is noxious, may not be a catalyst, extends a rally and awaits cues all at the exact same time?

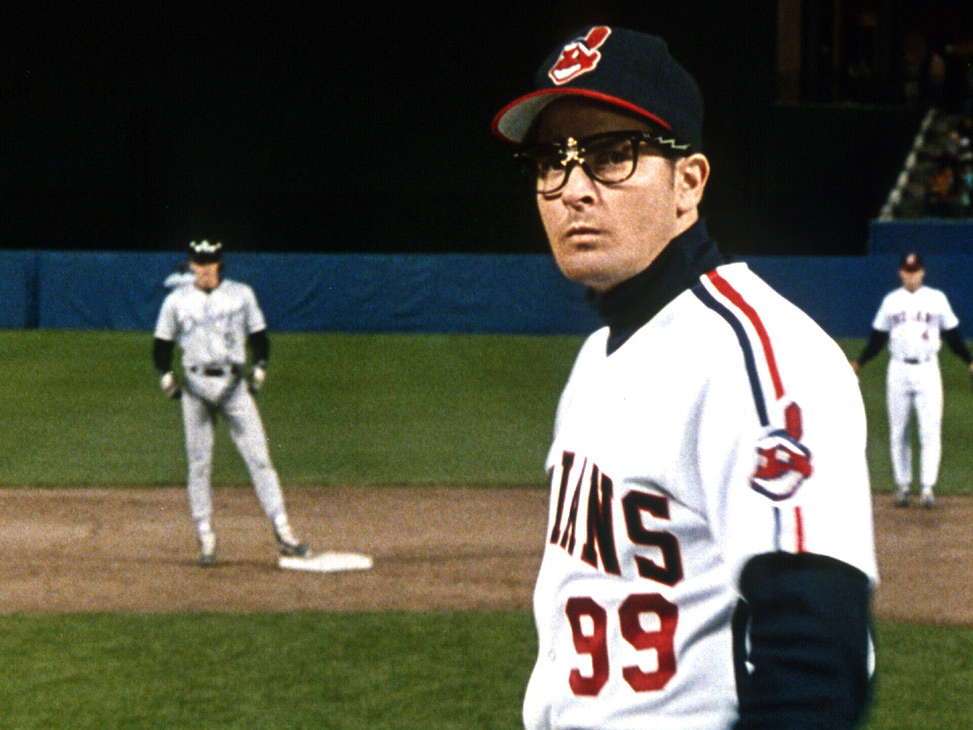

In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.

In the 8th or extra innings (what about the 9th?), allocations to alternatives, fixed income ETFs, offensive hacking and “markets up on trade deal hopes” (again).

ET contributor Neville Crawley is back from time well spent at an amazing library, with thoughts on no-end state architecture, marketing alpha, DOD AI, wonderfully goofy blogs, and a new addition to the Rumsfeld canon: unknown knowns.

Maine cashes in, investors cash out, stocks get a lift from trade hopes (version 28), the Brexit pantomime and a shadow over strawberry fields.

If you view the world through Clear Eyes, and hold loosely to your convictions, you’ll have an easier time adapting to a dramatic shift in the market regime than your competitors who’ve been lulled into a Narrative-induced fugue state. You’ll make up your own damn mind. You, your clients, and your business will all be better off for it.

Why VC loves fintech for some reason, populist messages, “optimism over trade talks” take 25, and more popullsm.

We’re all passengers in the backseat of the State-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.

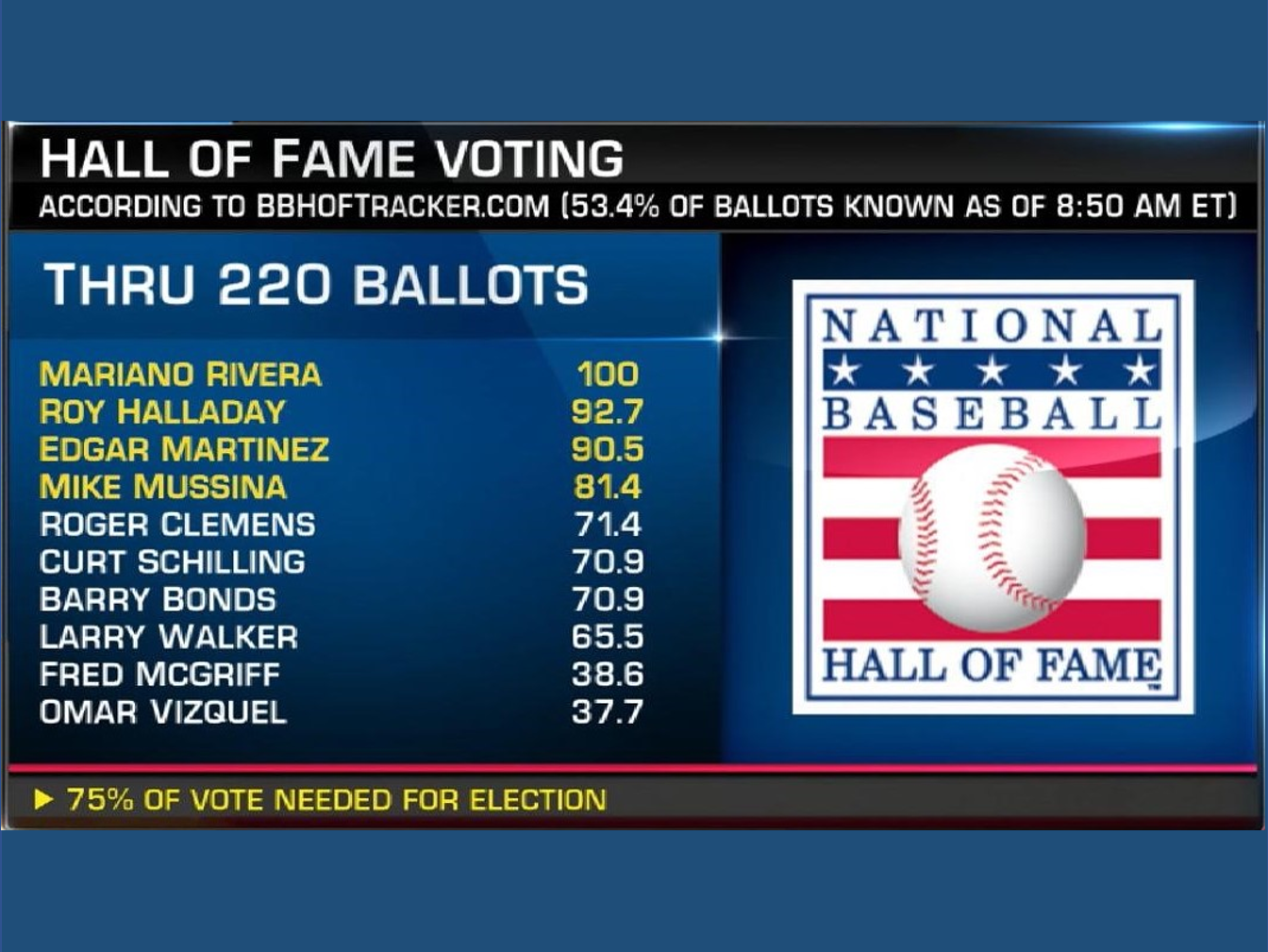

What the rise and fall of baseball cards can and can’t tell us about bubbles and the turning of markets into utilities.

Fawning Tesla press, coming storms, ESG and data, striking a balance between tasteful display of art collections and pay cuts at banks, and post-Yorkshire pudding walks.

Today’s specials: Megadevelopments in Chicago, online grocery shopping, slowdowns at Apple, vagueness at Alphabet and Canadian weed.

Your mother was a hamster and your father smelt of elderberries … the pricing power found in intellectual property. It’s not as easy as it looks.

In today’s edition, it’s captain obvious takes on the ECB, is there anything active funds CAN do?, more Brexit and dead-cat bounces.

Trust in media is being debased from without and within. The Clear Eyed, Full-Hearted answer? Don’t pick and choose. Set yourself against both threats.

In which we hear the term, ‘megadeal hunger’, contemplate a Larry Fink v. Ken Fisher celebrity steel cage match, and boggle at the unironic advocacy of regulation as the solution for lack of trust in blockchain applications.

The near-term focus of financial markets coverage seems squarely on M&A in the U.S. Elsewhere, Lord Fink (!) roasts Corbyn and Australian housing has become a media obsession.

There is a paradox – only it isn’t really a paradox – in that to act boldly on and hold loosely to our beliefs requires us to design processes which are subject to an almost opposite standard.

Amazon ‘buts’, all sorts of January 1987 comparisons, a grab bag of central banking and politics, and a notable omission from your Brexit Bunker.