All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

The hobbyist farmer can afford to spread wildflower seeds to the wind and the elements. The professional farmer, on the other hand, doesn’t have this luxury. Neither do any of us as investors.

A tariff three-fer, subsidizing orphans like it’s a bad thing, Buffett buffetted, and MMT/GND propaganda shifts into a new gear.

What killing active investment management? It’s not some monster hiding behind the rabbit. No, it IS the little white bunny. It’s the Zeitgeist of capital markets transformed into a political utility, innocuous on the surface … but with killer teeth.

How do you defeat the Zeitgeist? You don’t. The smart move, in fact, is to help the killer rabbit.

But there IS another way.

Highs on trade hopes, mixed on trade talks, creepy refrigerators, CRM for Main Street and Insurance Love Stories.

Usually we draw attention to narratives not because we like them, but because we believe investors can’t afford to ignore them. But the intense gravity of a directionless Narrative is a different matter altogether.

In which we focus on struggles and changes at asset managers, Soc Gen misses the boat, and markets ‘move’, ‘inch’ and ‘advance’ on trade optimism.

Pesky stock analysts, an earnings season focus on power and energy, and a late run on descriptive terms for the China Trade negotiations.

We’re back with a third edition of ET Live! On the docket for this session: MMT and the Zeitgeist that brought it to the forefront of our political and economic discussions.

In which we learn about new voices in the hospital, we pile on the Fed, and we exult in stocks “edging up” on trade talk progress (I’ve forgotten what take we’re on).

The hardest job for any financial adviser is knowing when a fiduciary mindset should guide us to take a stand, and when it should guide us to adopting flexibility. If we claim to have a process, we have to have an answer for this.

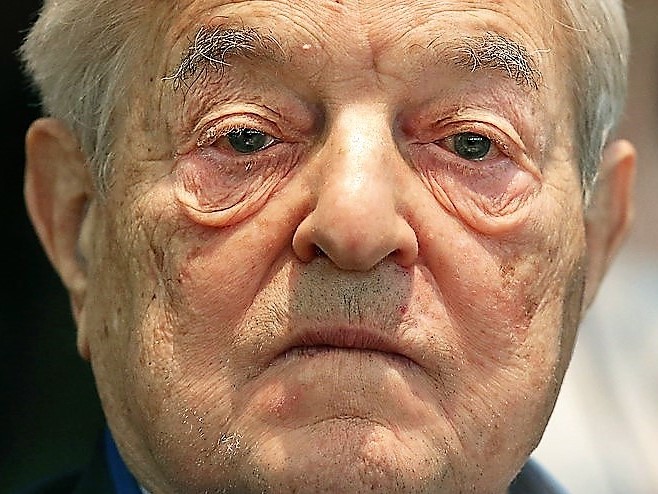

Every investor who wants to understand narrative and its impact on markets should read “The Alchemy of Finance”, by George Soros.

ET contributor Demonetized rediscovers the joys of Soros. It’s all reflexivity, all the time.

Lots of ‘playing’, ditching New York, and a piece of hard-hitting analysis demonstrating that sitting at the crossroads of government and business can be personally profitable.

We don’t have to treat it like a cardinal sin any time an author, politician, consultant, adviser or expert tries to make us feel a certain way. Just don’t be the only one at the table who doesn’t realize what’s happening.

Today’s Zeitgeist poses a riddle: what is noxious, may not be a catalyst, extends a rally and awaits cues all at the exact same time?

In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.

In the 8th or extra innings (what about the 9th?), allocations to alternatives, fixed income ETFs, offensive hacking and “markets up on trade deal hopes” (again).

ET contributor Neville Crawley is back from time well spent at an amazing library, with thoughts on no-end state architecture, marketing alpha, DOD AI, wonderfully goofy blogs, and a new addition to the Rumsfeld canon: unknown knowns.

Maine cashes in, investors cash out, stocks get a lift from trade hopes (version 28), the Brexit pantomime and a shadow over strawberry fields.

If you view the world through Clear Eyes, and hold loosely to your convictions, you’ll have an easier time adapting to a dramatic shift in the market regime than your competitors who’ve been lulled into a Narrative-induced fugue state. You’ll make up your own damn mind. You, your clients, and your business will all be better off for it.

Why VC loves fintech for some reason, populist messages, “optimism over trade talks” take 25, and more popullsm.