All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Turns out that we may not be on the precipice of a global recession after all, that AOC may be pretty good at this politics game, and that parasitic companies enjoy Insane Clown Posse more than most. Also, Bob Pisani reveals CNBC’s noble mission.

Capitalist productivity has become capitalist financialization.

Wall Street gets something to sell, management gets stock-based comp, and the White House gets re-election.

What do YOU get out of financialization? You get to hold up a card that says “Yay, capitalism!”.

It’s the Wednesday Zeitgeist, chock full of belied recessions, a little bit of humility, a little bit of YOLO, an expensive investment sold on yield, a less expensive investment sold on yield, slow maybes and a peek into the Widening Gyre.

It’s not even a wall of worry any more. More like tiny little speed hurdles that we set up to clear by a mile. Just another day’s work for the Fiat News machine.

They’re not even pretending anymore.

Disney is making a play to return to Neverland, a land where valuations are based on establishing market share and dominance of an emerging industry, where the moment you start worrying about how much money you’re making is the moment the Narrative breaks. For students of markets and narratives alike, it will be worth watching.

It’s the Monday Zeitgeist, where we keep the Star Wars image streak alive at 2, celebrate the return of a beloved phrase, laud the arrival of a very dumb phrase, listen to political predictions from economists, and hear a political proposal from a journalist.

It’s the Weekend Zeitgeist, where we try to forget about markets for a day or two to see what matters in the rest of the world. This week, it’s robots, the 1980s, self-made men, Star Wars (more than an ACTUAL black hole), Moroccan exceptionalism and the Power of Google.

My father owned a red Corvair almost exactly like this one. He loved that car. Almost died in it, too, when he was t-boned at an intersection on his way to work in Bessemer, Alabama. That was in 1966. I was two years old.

The Boeing 737 MAX is our generation’s Chevy Corvair.

Unsafe At Any Speed.

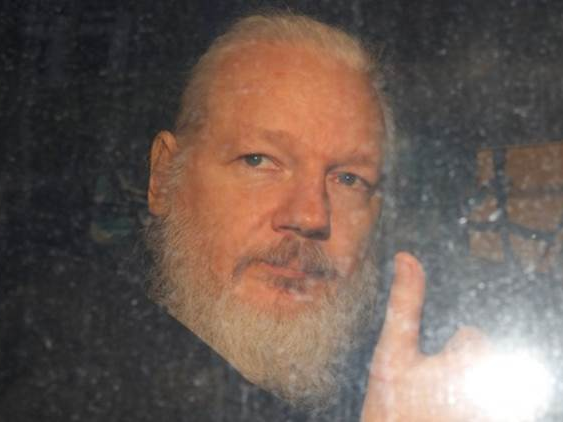

The arrest of Julian Assange presents one of the most fascinating, explainer-laden, Fiat News-driven narrative maps we have seen. Tread carefully in taking what you read about this one at face value, friends.

The gravity of political polarization is real, and the mass which lies at the base of its well are narratives of existential risk.

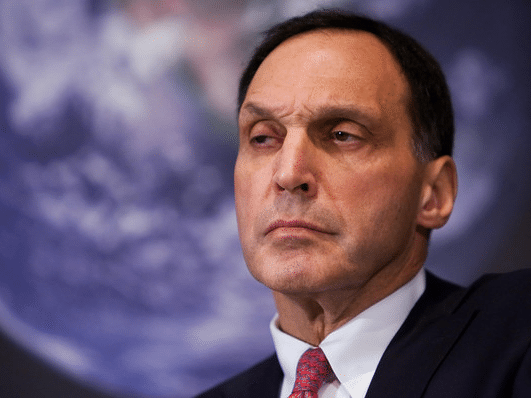

Today in the Zeitgeist, an HBR article about the “mourning patterns” of Lehman employees. Color me triggered.

If you don’t know what Repo 105 was, you should. If you do know what Repo 105 was, you should find someone who doesn’t and tell them about it.

Wait … an article about Puerto Rico that’s not about tax shelters or bond defaults or crappy local government or Trump idiocy or crypto bros? … an article that’s about entrepreneurship and the sort of small businesses that are the life blood of a vibrant local economy? What the hell, New York Times?

Not to worry, though, there’s plenty of Fiat News and the usual raccoonery here in the rest of the daily Zeitgeist.

Whether you’re a trader or a portfolio manager or a financial advisor or an allocator, ET Pro can help you identify both the inflection points and the trajectory of the market Zeitgeist – particularly the question that any long-term portfolio owner MUST get roughly right in order to succeed: are we in an inflationary or deflationary world, and how quickly (if at all) and in what ways is that world changing?

What fresh hell is this?

I know it’s originally a Dorothy Parker line, but Scream Queens made it their own. And it’s the only possible response to Forbes Brandvoice, where you, too, can “be an editor for your brand on Forbes.com”.

Just another day of fresh hell in narrative-world, here on the Daily Zeitgeist.

Today’s Monday Zeitgeist is all about book report analyses, central bank Common Knowledge, a new form of home finance in which you make principal payments over time, multi-level-marketing surprises again, and believability.

When it comes to telling us how ‘the smart money’ and ‘the dumb money’ are playing it, there’s always someone who will tell us it’s Duck Season, and someone who will tell us it’s Rabbit Season. The reality is that it’s always Elmer Season. You and me? We’re Elmer in this cartoon.

It’s the weekend, which means it’s a (mostly) finance-free zone on The Zeitgeist. This week-in-review gives us a glimpse into purchases of fine art, the comedic stylings of David Brooks, the continued relevance of Marvin Gaye, a marketing word salad and a solemn hymn to solemn hymns.

March wage growth came in at 3.2% today, which is being described by everyone in financial media as “muted”.

Kinda like the Disney flacks telling us that Blue Will Smith is “fine”. It’s a different genie, but still.

As the immortal line in The Outlaw Josey Wales would have it, “Don’t piss down my back and tell me it’s raining.” Just another day in the Zeitgeist.

Jeff Skilling is back, baby!

And that takes me back 30+ years, when a kid fresh out of college had a ticket to Houston Hobby airport and an offer letter from McKinsey.

Our lives are defined by the roads we avoid as much as by the roads we take. And more often than not, sheer blind luck is responsible for the difference.

In which Fiddy does his part to jumpstart the Connecticut economy, Kendall Jenner shows us the way, and Chrissy Teigen shares the stage with … Jay Powell?

It’s all the news that’s fit to Nudge, here in the Daily Zeitgeist.