All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Today in the Zeitgeist, an HBR article about the “mourning patterns” of Lehman employees. Color me triggered.

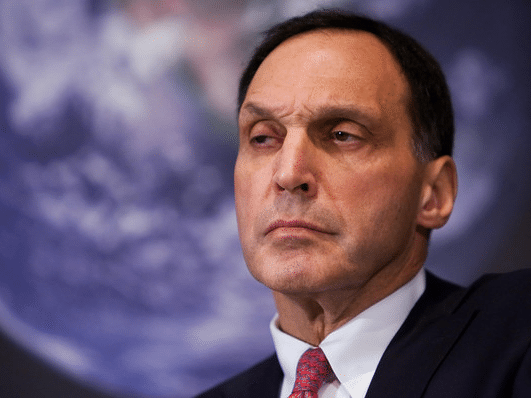

If you don’t know what Repo 105 was, you should. If you do know what Repo 105 was, you should find someone who doesn’t and tell them about it.

Wait … an article about Puerto Rico that’s not about tax shelters or bond defaults or crappy local government or Trump idiocy or crypto bros? … an article that’s about entrepreneurship and the sort of small businesses that are the life blood of a vibrant local economy? What the hell, New York Times?

Not to worry, though, there’s plenty of Fiat News and the usual raccoonery here in the rest of the daily Zeitgeist.

Whether you’re a trader or a portfolio manager or a financial advisor or an allocator, ET Pro can help you identify both the inflection points and the trajectory of the market Zeitgeist – particularly the question that any long-term portfolio owner MUST get roughly right in order to succeed: are we in an inflationary or deflationary world, and how quickly (if at all) and in what ways is that world changing?

What fresh hell is this?

I know it’s originally a Dorothy Parker line, but Scream Queens made it their own. And it’s the only possible response to Forbes Brandvoice, where you, too, can “be an editor for your brand on Forbes.com”.

Just another day of fresh hell in Narrative-world, here on the Daily Zeitgeist.

Today’s Monday Zeitgeist is all about book report analyses, central bank Common Knowledge, a new form of home finance in which you make principal payments over time, multi-level-marketing surprises again, and believability.

When it comes to telling us how ‘the smart money’ and ‘the dumb money’ are playing it, there’s always someone who will tell us it’s Duck Season, and someone who will tell us it’s Rabbit Season. The reality is that it’s always Elmer Season. You and me? We’re Elmer in this cartoon.

It’s the weekend, which means it’s a (mostly) finance-free zone on The Zeitgeist. This week-in-review gives us a glimpse into purchases of fine art, the comedic stylings of David Brooks, the continued relevance of Marvin Gaye, a marketing word salad and a solemn hymn to solemn hymns.

March wage growth came in at 3.2% today, which is being described by everyone in financial media as “muted”.

Kinda like the Disney flacks telling us that Blue Will Smith is “fine”. It’s a different genie, but still.

As the immortal line in The Outlaw Josey Wales would have it, “Don’t piss down my back and tell me it’s raining.” Just another day in the Zeitgeist.

Jeff Skilling is back, baby!

And that takes me back 30+ years, when a kid fresh out of college had a ticket to Houston Hobby airport and an offer letter from McKinsey.

Our lives are defined by the roads we avoid as much as by the roads we take. And more often than not, sheer blind luck is responsible for the difference.

In which Fiddy does his part to jumpstart the Connecticut economy, Kendall Jenner shows us the way, and Chrissy Teigen shares the stage with … Jay Powell?

It’s all the news that’s fit to Nudge, here in the Daily Zeitgeist.

An interesting question with a straightforward answer. Put simply, if a fund manager tells you they’re selling, ignore the reason they give and replace it with “Big founder wants liquidity.”

Welcome! A few reminders as usual: We begin pretty promptly at 2PM. If you don’t see the video by 2:01 PM ET, try reloading the…

Maya Angelou not only knew what made the caged bird sing, but also what makes Fiat News tick.

People will forget what you said, people will forget what you did, but people will never forget how you made them FEEL.

You can make a lot of money collecting Golden Age comics. The Silver Age, though? Meh. The story arcs and narratives are a joke. The art is so-so at best. The publishers are just squeezing the installed base, and the creators are just mailing it in. They’re old, but so what?

Same with the Silver Age of Central Bankers. It’s hard to make money, particularly in Emerging Markets, when it’s every man for himself among DM central banks.

Today’s Zeitgeist is all about trust in the trustless (ugh), hope springing eternal in Value Added, benchmarking the unbenchmarkable, Fiat News through bad Googling, and why we can’t shake fat fingers.

It’s the most valuable lesson I’ve got for any smart, young Coyote embarking on a career in the Mob or in Wall Street: never ask for a cut on an existential trade idea.

Our Thing isn’t about the money. IT’S. ABOUT. THE. MONEY.

Except when it’s not.

The weekend Zeitgeist, in which we are reminded that we need Silicon Valley to tell us what art is, that we need Zucker and Murdoch to tell us what news is, and opposing politicians to tell us what we should be mad about.

ET contributor Demonetized takes a fresh look at the fable of the Ants and the Grasshopper. Or rather, it’s an Epsilon Theory look, with Clear Eyes and a Full Heart. Metastability, too.

Wells Fargo and Mastercard CEOs say blockchain has yet to live up to the hype, Bolsonaro has a post-election let-down in Brazil, you can increase profit margins by squeezing your suppliers, and other tales from Captain Obvious in today’s Zeitgeist.

As a recovering short seller, I have the same reaction to the activist news on Bed Bath and Beyond as I do to video of Lawrence Taylor breaking Joe Theisman’s leg … I just can’t watch. Gotta turn away.

Come to think of it, this is kinda my reaction to all financial and political news these days.