All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

Yeah, we’re at that point in the cycle where you will be told about all the wonderful opportunities provided by levered private REITS.

For your IRA.

Because of all this craaaazy volatility in the stock market.

That and the President’s Cheif Economic Advisur tells us why “Dow 36,000” is just the tip of the iceberg.

ET contributor David Salem is back with five core tenets for achieving 5+% real returns over the next few decades.

It’s all a must-read, but I’m gonna highlight #4: “Favor equity investments in companies employing or serving primarily people with abundance as distinct from scarcity mindsets.”

This is the foundation for behavioral economics on a macro scale.

What is the only true superpower? The power to name things.

We name Milken and Boesky as junk-bond kings. We name their actions as a spree. We name their outcomes as devastation. We name their instrument as debt.

Today we name it balance sheet expansion.

Every man a king!

Say what you will about @jack, but he understands the necessary and sufficient condition for being a successful CEO today: create a Wall Street-supported non-GAAP Narrative to describe your company’s financial results.

Tired: MAUs

Wired: mDAUs

All this, plus Russell Wilson continues surfing the Zeitgeist like no one else.

In which Ben and Rusty discuss financialization, the incentivizes of low interest rate policy, the ‘financialization’ of education and the meaning of both for us…

China’s Belt and Road Initiative is back, baby! Just needed a little narrative happy face of “respect for global debt goals” and “promotion of green growth”. That plus multi-billion dollar non-recourse loans at 2% for a high-speed rail to nowhere.

Plus more on Walmart robots, ESG, and of course Free College!

Just another day of you can’t make it up, fresh from the ET Zeitgeist.

The Monday Zeitgeist today is about companies actually being allowed to go bankrupt, the usual DB/CBK chatter, money flow cartoons, great moments in bad metagame, and a decent little personal finance column.

This Weekend Edition is a bit of a downer, but the Zeitgeist is what it is. And the non-financial markets Zeitgeist right now? It’s all about poverty, the spirit of poverty and how people transform our concerns about both into political power.

We know what Fiat News is: the presentation of opinion as fact. We also know what fiat news looks like: pop on over to Vox and skim a few stories.

But how does fiat news WORK?

New from ET contributor Demonetized, a clear-eyed look at wolf traps and sales funnels.

What Herman Cain would bring to the Fed, what Socrates brings to the MMT debate, what Pinterest and Zoom bring to the IPO market, and what work European PMs bring home when the markets are closed.

All in a day’s work for a Good Friday Zeitgeist.

Turns out that we may not be on the precipice of a global recession after all, that AOC may be pretty good at this politics game, and that parasitic companies enjoy Insane Clown Posse more than most. Also, Bob Pisani reveals CNBC’s noble mission.

Capitalist productivity has become capitalist financialization.

Wall Street gets something to sell, management gets stock-based comp, and the White House gets re-election.

What do YOU get out of financialization? You get to hold up a card that says “Yay, capitalism!”.

It’s the Wednesday Zeitgeist, chock full of belied recessions, a little bit of humility, a little bit of YOLO, an expensive investment sold on yield, a less expensive investment sold on yield, slow maybes and a peek into the Widening Gyre.

It’s not even a wall of worry any more. More like tiny little speed hurdles that we set up to clear by a mile. Just another day’s work for the Fiat News machine.

They’re not even pretending anymore.

Disney is making a play to return to Neverland, a land where valuations are based on establishing market share and dominance of an emerging industry, where the moment you start worrying about how much money you’re making is the moment the narrative breaks. For students of markets and narratives alike, it will be worth watching.

It’s the Monday Zeitgeist, where we keep the Star Wars image streak alive at 2, celebrate the return of a beloved phrase, laud the arrival of a very dumb phrase, listen to political predictions from economists, and hear a political proposal from a journalist.

It’s the Weekend Zeitgeist, where we try to forget about markets for a day or two to see what matters in the rest of the world. This week, it’s robots, the 1980s, self-made men, Star Wars (more than an ACTUAL black hole), Moroccan exceptionalism and the Power of Google.

My father owned a red Corvair almost exactly like this one. He loved that car. Almost died in it, too, when he was t-boned at an intersection on his way to work in Bessemer, Alabama. That was in 1966. I was two years old.

The Boeing 737 MAX is our generation’s Chevy Corvair.

Unsafe At Any Speed.

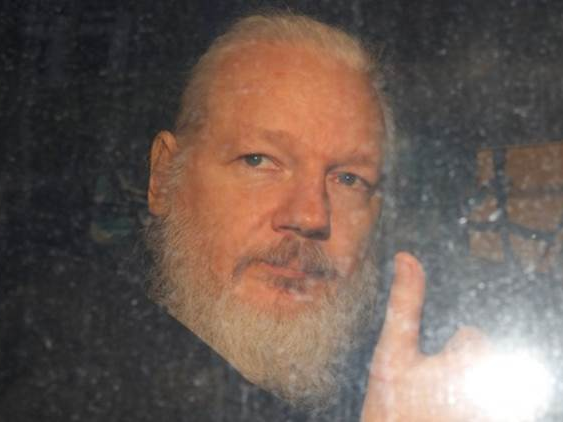

The arrest of Julian Assange presents one of the most fascinating, explainer-laden, Fiat News-driven narrative maps we have seen. Tread carefully in taking what you read about this one at face value, friends.

The gravity of political polarization is real, and the mass which lies at the base of its well are narratives of existential risk.