All Epsilon Theory Content

Everything we have published at Epsilon Theory since 2013, an archive of more than 1,000 evergreen notes.

In today’s Narrative-connected news, New Mexico makes a major shift in their portfolio allocation, away from broad equity indices and core fixed income, and towards real assets.

It’s a very Zeitgeist-aware portfolio shift, and boldly done. I love it!

Ben and Rusty update subscribers on the shift from cooperative to competitive games and our narrative research program, with a focus on the China Trade War and US electoral politics.

It’s the Weekend Zeitgeist! In which we get a flood of flood coverage, everybody is a contrarian, Bloomberg covers abortion, Time magazine does Time magazine things and Raleigh invites an unexpected guest or two to the 2019 Zeitgeist.

We spend a lot of time on our trade ideas, and do a lot of hand-waving at what we believe that everyone else believes. It’s a core problem for investors, and one that can’t be avoided.

The pecking order is a social system designed to preserve economic inequality: inequality of food for chickens, inequality of wealth for humans. We are trained and told by Team Elite that the pecking order is not a real and brutal thing in the human species, but this is a lie.

It’s like he’s a drunk dentist in Vegas for a convention, sitting down at the poker table and getting bored after three hands. So he decides that he can “impose his will” on the table by opening up out of position with rags and making a continuation bet all the way through the river. Like everyone else at the table doesn’t see him for EXACTLY who he is.

This isn’t a US thing. This isn’t a China thing. This isn’t a Trump thing. This isn’t a Xi thing.

This is a social animal thing.

The words are not lies. The words are not wrong. The conflict may be just.

But you are being played nonetheless.

I’m not sure that people who aren’t immersed in this world realize how crappy B3 debt is. Or how much of it is getting pushed into the market.

THIS is financialization.

How will you know that the US-China trade narrative is shifting towards a protracted game of Chicken?

When the narrative becomes dominated by national security language and clusters.

Rusty and I have been all over this for a year. More to the point, we have been right. If you want to know what’s happening with the Trade & Tariff narrative structure, you should subscribe to ET Professional. This is what we DO.

It’s easy to get waaaay too precious when it comes to professional kitchens, whether we’re talking about restaurants or a trading desk.

But credit default swaps are like chef knives. They’re not an affectation, but a necessary tool for so many tasks. Even if you don’t cook or trade a portfolio professionally, you’ll want to own a good knife and you’ll want to know the mechanics and the rationale of a CDS trade.

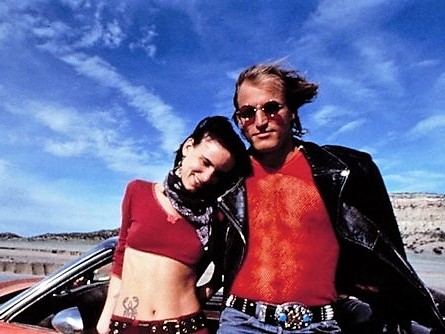

The word “spree” is so evocative in narrative-world, implying at a minimum some sort of wantonness and excess, some sort of moral bankruptcy.

How threadbare and slow-growing is the financial services world today? It’s a “hiring spree” just to open up a New York office. With 30 people. By 2022.

Facebook is a master at implementing price increases under the narrative of “optimization”, as if the company was doing you a favor by raising their ad prices so much. Now Amazon is reading from the same playbook in their advertising business.

Time to break up the trusts. Again.

It’s the best line in a movie full of great lines: You don’t run the same gag twice. You run the next gag.

Elon Musk is running the next gag.

We are the human animal.

We are non-linear.

We ARE a song of ice and fire.

It’s a song that has built cathedrals and fed billions and taken us to the moon. It’s a song that can do all of that and more … far, far more … if only we remember the tune.

The Pack remembers.

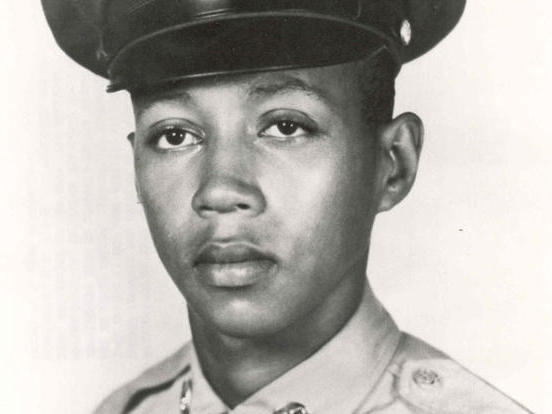

If Memorial Day is anything, it is a day for telling and re-telling stories about Full Hearts. Let me tell and re-tell you the story of Milton Lee Olive III.

It’s the Holiday Weekend Zeitgeist! In which we see an election season narrative make its way into other topics, hear the FDA’s plans to deal with expiring salt, hear from local man about local bear, hear from local man about local swimming hole, begin to doubt our judgment about the political import of impeachment proceedings, and read some perverse New York Times fanfic.

Huawei Founder Says U.S. Won’t Disrupt Business As Analysts Warn Of Sales Slowdown [Forbes]

The Fed Is Likely to Make an ‘Insurance’ Rate Cut [Bloomberg]

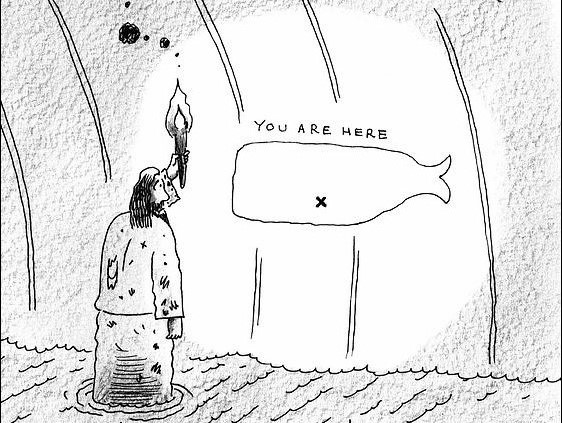

Retirement plan menus are ground zero for what is delightfully referred to as “choice architecture” … steering and Nudging you into making the “right” choice.

Ad men understand choice architecture. So do mob bosses. It’s all about creating a Hobson’s Choice … a choice that’s no choice at all.

It’s not a Wheel. It’s a Carousel.

“According to the Aspen Institute, close to 6 in 10 working-age Americans do not have a retirement account. Sadly, the Aspen Institute also warns that things are likely to get worse due to the changing nature of work.”

The American worker is the proverbial boiled frog. Or Milton from Office Space. Same thing.